USDCAD has jumped 1.4 cents higher today on Trump winning the US presidency, while the data from Canada is not helping the CAD either. The Ivey PMI showed a slowdown in October, despite other soft economic releases, which will keep the Bank of Canada on an easing path, with more interest rate cuts to follow, after the last 50 bps rate cut.

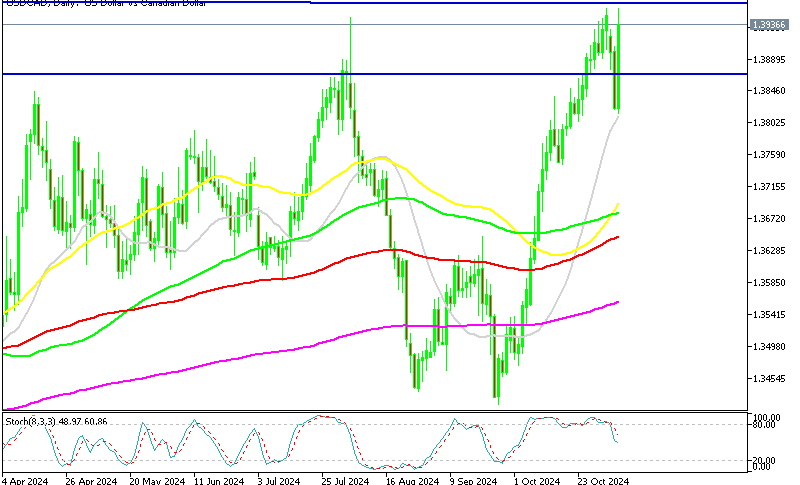

USD/CAD Chart H4 – The 100 SMA Holding for Now

Despite ongoing weakness in Canada’s economy, as seen in today’s data, USDCAD has maintained an upward trend since late September, climbing over 5 cents. This week, however, it briefly dropped to 1.38. Support held firm around the 20 SMA on the daily chart, likely influenced by positioning and anticipation ahead of the U.S. elections. With the election now concluded, the U.S. dollar saw a boost as Donald Trump and the Republican Party achieved victory, reviving the so-called “Trump trade” and lifting USD across markets.

Canada’s economic outlook, in contrast, remains challenging. The Bank of Canada (BoC) has been aggressively easing policy, with two 50-basis-point rate cuts implemented recently. This dovish stance comes as Canada’s manufacturing sector shows signs of slowing. The October Ivey PMI for Canada came in at 52.0 points, below the expected 54.0 points and down from 53.1 points in September. The non-seasonally adjusted PMI also declined, from 54.5 points in September to 52.0 points in October, signaling softer manufacturing conditions overall.

Canada Manufacturing Survey from Ivey PMI

- Reported PMI: 52.0 (below the expected 54.0), indicating slower growth in the manufacturing sector.

- Previous Month (September) PMI: 53.1, showing a slight decrease in manufacturing activity.

- Non-Seasonally Adjusted PMI: 52.0 in October, down from 54.5 in September, suggesting weaker-than-anticipated manufacturing conditions even without seasonal adjustments.

The decline in PMI points to cooling demand and heightened caution among manufacturers amid economic uncertainties. If this trend persists, it could weigh on Canada’s economic forecasts for Q4. While the Ivey PMI is a lower-tier indicator, its implications are relevant for the Canadian dollar, which is trading near a four-year low. Tariffs present additional risk, but the loonie’s trajectory will be closely tied to these economic conditions

USD/CAD Live Chart

USD/CAD