USD to NZD Rate Returns Below 0.60 After RBNZ Comments

The USD to NZD rate continues to be on a one-way lane, continuing the decline after the failed attempt to return above the major 0.60 level.

The USD to NZD rate continues to be on a one-way lane, continuing the decline after the failed attempt to return above the major level at 0.60. The pair opened with a 50 pip bullish gap after polls showed a more balanced outcome from the US elections, but that didn’t last long and the price reversed back down.

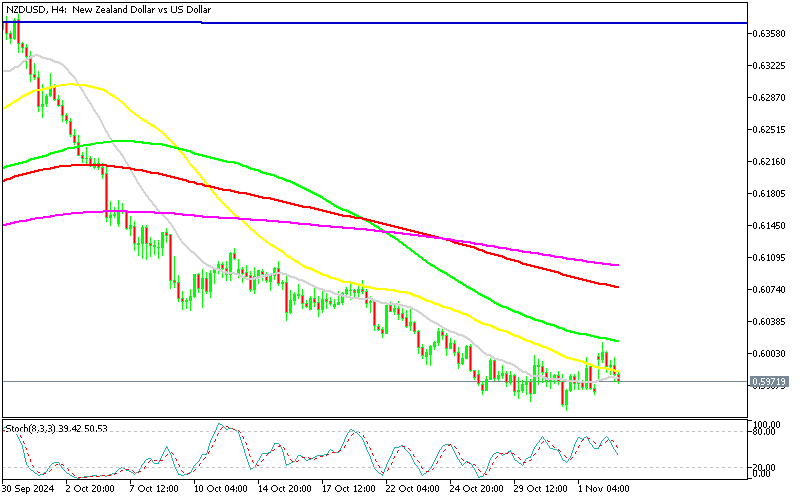

USD/NZD Chart H4 – Persistent Selling Pressure

In late October, the NZD/USD exchange rate dipped below the key 0.60 level, and despite a brief attempt to reclaim it amid a USD pullback, the level held as resistance. This suggests the potential for further losses in the pair, as the fundamental outlook for commodity-linked currencies, particularly the New Zealand dollar, has turned bearish.

After gaining 5 cents in the previous two months, NZD/USD saw a sharp drop at the start of October, falling from 0.6378 to 0.5939—a drop of 4.5 cents. Since then, the downward trend has persisted, with lower highs confirming a bearish outlook. The H4 chart shows temporary retracements met with resistance from smaller moving averages, signaling that rallies remain short-lived.

Influence of the Chinese Economy on the NZD and Technical Resistance

The Chinese economy has exerted pressure on this pair since early October, with ongoing selling activity pushing highs lower. Following yesterday’s retracement, the 100 SMA on the H4 chart acted as strong resistance, as buyers struggled to breach the critical 0.60 level. This resistance reinforces the downward momentum, with the bearish trend likely to continue if fundamentals remain unfavorable.

RBNZ Financial Stability Report

- Real economy is lagging reduction in interest rates, that’s a concern

- Economic conditions remain challenging, business is doing it tough

- Geopolitical tensions do really matter, key risk for the economy

ANZ Commodity Price Report Highlights

- Commodity Price Index: +1.4% month-over-month (prior: +1.8%)

- Gains recorded across most sectors, except for meat and fiber.

- NZD-Adjusted Terms:

- +3.4% month-over-month as the NZD Trade Weighted Index dropped by 1.3%.

Global Shipping Price Observations

- Baltic Dry Index: Decreased by 32% over the month, reaching an 8-month low, reflecting volatility in global shipping rates.

- China Containerized Index: Fell by 16%, indicating reduced costs for shipping to and from China.

- Seasonal Impact: Shipping demand typically declines after the annual peak, impacting shipping costs globally.

New Zealand Export and Import Trends

- Export Growth: Rising export volumes, especially in dairy, as global demand strengthens.

- Import Demand: Increasing import volumes as retailers stock up in preparation for the Christmas season.

NZD/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account