USD Continues the Retreat Despite the Jump in ISM Services

Despite the positive ISM Services data, market activity has been subdued, showing a bearish trend against the USD. The lack of major economic reports during the European session has left investors in a holding pattern, awaiting the results of the U.S. election.

With the election outcome approaching, a cautious strategy may be to wait and assess the market’s reaction before making moves. Historically, a Trump win would likely support the dollar, while a Harris victory might exert downward pressure on it.

The October ISM Services PMI indicated strong activity in the services sector, reaching its highest level since September 2023, with notable improvements in employment and steady demand across various sectors. While new orders and prices showed minor easing, businesses remain resilient amid challenges like supply disruptions from recent hurricanes and port strikes.

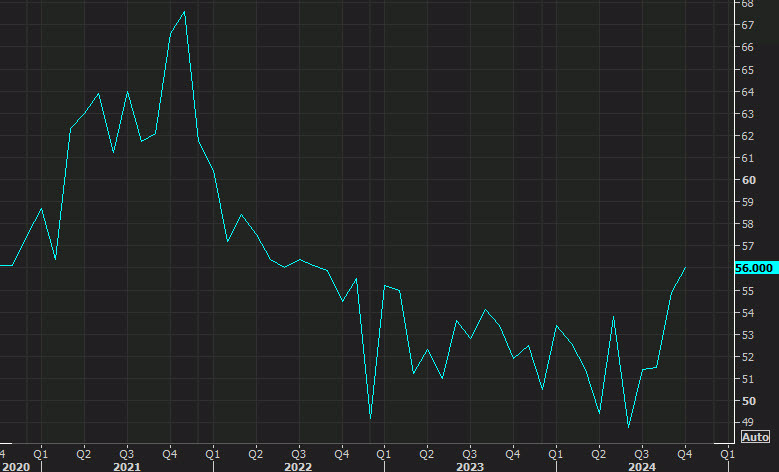

US October ISM Services PMI

US October ISM Services PMI Summary

- Overall ISM Services PMI: 56.0 points (vs. 53.8 points )

- September ISM services PMI was: 54.9 points

Key Indexes

- Business Activity: 57.2 points (vs. 59.9 points prior)

- Employment: 53.0 points (vs. 48.1 points prior)

- New Orders: 57.4 points (vs. 59.4 points prior)

- Prices Paid: 58.1 points (vs. 59.4 points prior)

- Supplier Deliveries: 56.4 points (vs. 52.1 points prior)

- Inventories: 57.2 points (vs. 58.1 points prior)

- Backlog of Orders: 47.7 points (vs. 48.3 points prior)

- New Export Orders: 51.7 points (vs. 56.7 points prior)

- Imports: 50.2 points (vs. 52.7 points prior)

- Inventory Sentiment: 53.0 points (vs. 54.0 points prior)

Sector-Specific Comments

- Accommodation & Food Services: Material availability and delivery improving; port strike diverted shipments, but cost impact minimal.

- Agriculture, Forestry, Fishing & Hunting: Closer inventory monitoring, fall and winter restocks at lower levels.

- Construction: Strong business activity with high demand in commercial construction and services.

- Health Care & Social Assistance: IV solution shortages due to hurricane damage, supply delays from port strikes, possible price increases, and longer wait times.

- Information: Hurricanes boost equipment sales/rentals; infrastructure spending remains strong.

- Professional, Scientific & Technical Services: Steady business with lengthened revenue cycles and stabilized commodity prices.

- Real Estate, Rental & Leasing: Supplier delivery delays due to hurricane impacts.

- Retail Trade: No supply chain issues from port strikes, with contingency plans confirmed.

- Utilities: High demand, slight price increases, steady growth.

- Wholesale Trade: Economic challenges affecting business and supplier operations.