Forex Signals Brief November 4: US Elections, FED and BOE Rate Cut Highlight the Week

This week the economic calendar is light apart from the Bank of England meeting, but the US presidential elections will likely make up for it with volatility. Last week started with the general elections in Japan, which produced no clear winner, and offered some volatility for the Yen.

The CPI inflation report from Australia came weaker than expected, leaving the AUD weak throughout the week. We also had several jobs reports from the US. The employment reports were mixed, but that’s due to the hurricane and the worker’s strike in September. Jolts job openings came pretty weak while the ADP and the Unemployment Claims came in on the strong side. However, the NFP report on Friday showed the lowest level of new jobs since 2020, however it didn’t move markets too much.

This Week’s Market Expectations

Today the calendar is light, apart from the final Manufacturing PMI numbers form Europe. The Reserve Bank of Australia meeting is tomorrow but they’re not expect to start cutting interest rates yet, while the Bank of England will deliver the second cut later in the week. However, the highlight of the week will be US presidential elections.

Here’s the upcoming economic calendar with major events by day:

Monday

- Japan: National Holiday (Markets closed)

Tuesday

- China: Caixin Services PMI

- Australia: RBA Policy Decision

- Canada: Services PMI

- US: ISM Services PMI, US Presidential Election

- New Zealand: Labour Market Report

Wednesday

- Eurozone: Producer Price Index (PPI)

Thursday

- Japan: Average Cash Earnings

- Eurozone: Retail Sales

- UK: BoE Policy Decision

- US: Jobless Claims, FOMC Policy Decision

Friday

- Canada: Labour Market Report

- US: University of Michigan Consumer Sentiment

Last week the USD started the week bullish, continuing the momentum from previous weeks, however the volatility picked up and we saw several reversals throughout the week as employment reports from the US came in mixed. We opened 39 trading signals in total, ending it with 23 winning forex signals and 13 losing ones.

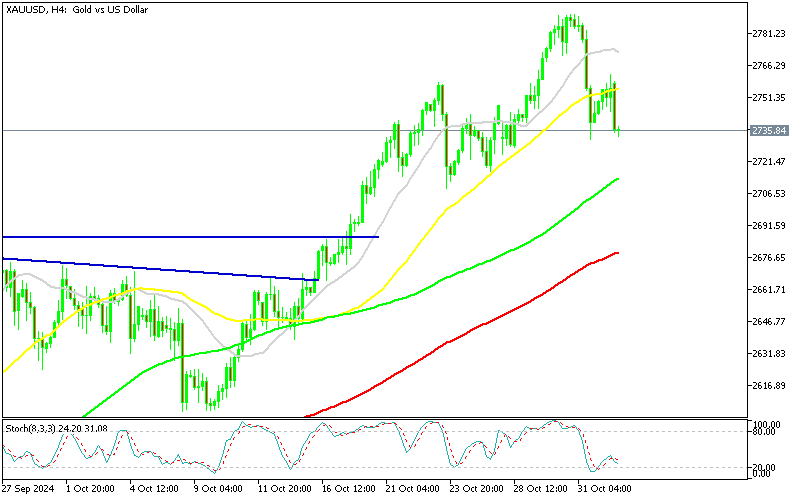

The 50 SMA Turned into Resistance for Gold

Gold prices have experienced high volatility this year, climbing over 40% from January’s opening price of $2,000 amid geopolitical tensions and economic uncertainties. Last week, gold reached a record high of $2,790 as anticipation grew for the upcoming US presidential election. Consistent buying pressure had been supported by the 50 SMA (yellow) on the H4 chart. However, a significant drop by week’s end was triggered by unexpectedly low unemployment claims and robust PCE inflation data for September, pushing gold briefly below the 50 SMA on Thursday for the first time in three weeks.

XAU/USD – H4 Chart

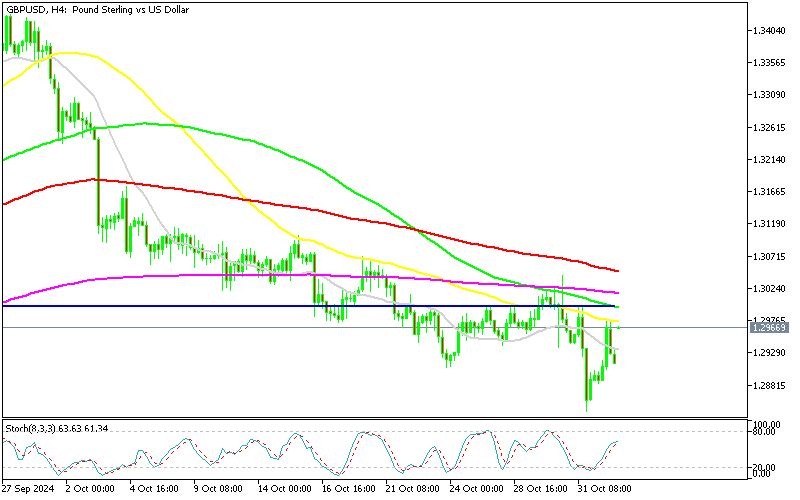

The 50 SMA Keeps Pushing GBP/USD Down

The UK’s economic conditions worsened in October, driving GBP/USD into a bearish trend. The pound fell by over 5 cents, reaching 1.2907 mid-week. When the UK government announced a new budget with a substantial £40 billion tax hike on Thursday, GBP declined further to the 1.2840s, while the USD strengthened. Moving averages (MAs) continue to serve as resistance for GBP/USD, keeping the pair’s negative outlook intact.

GBP/USD – Weekly Chart

Cryptocurrency Update

Bitcoin Returns to $70K Again

Following the Federal Reserve’s September rate cut, Bitcoin rebounded from $65,000 to over $70,000 after dropping from over $70,000 to around $50,000 since April. It almost hit new highs before slightly pulling back below $70,000, hinting at a potential breakout from its current trading range. The retrace continued yesterday, with the BTC price falling to $67.500, but buyers returned late in the day and pushed the price toward 70k again.

BTC/USD – Daily chart

Ethereum Falls Below $2,500

Ethereum showed some buying momentum in October, surpassing the 100-day SMA and reaching $2,700. After a brief dip, Ethereum found support above its 50-day SMA, remaining over $2,500 and reinforcing its upward trend. However, the price reversed lower over the weekend, so the price fell below $2,500 again.

ETH/USD – Daily chart