Bitcoin Interest Surges 49%: Google Trends Data Reveals Global Curiosity Shift

Bitcoin interest rises 49% after price surge. Discover Google Trends insights and regional hotspots driving renewed curiosity in BTC.

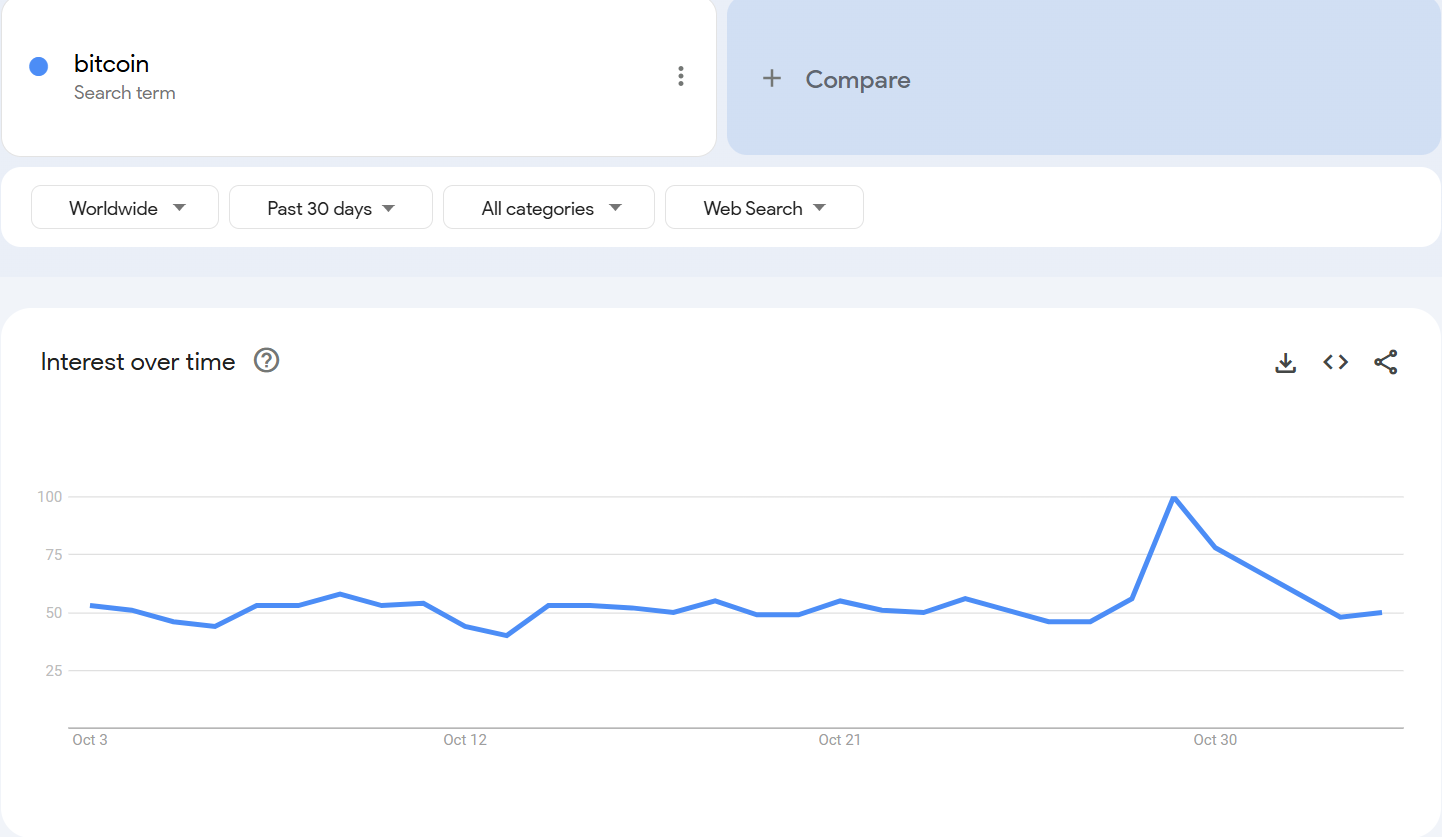

Google Trends shows a big spike in interest for “bitcoin” as of October 30 with a score of 51 out of 100. 0 is minimal and 100 is peak. The spike started around October 27 after a period of low interest.

In addition to global interest, Google Trends also shows the top regions. El Salvador where bitcoin is legal tender is #1, Nigeria is #2. Both are still high and reflects local interest and regional demand.

Google Trends Data: Short vs. Long-Term

Short term data shows rapid changes, “bitcoin” searches peaked at 100 on October 29. This is how fast Bitcoin’s price movements can trigger public interest especially in high interest regions like El Salvador and Nigeria. But long term data shows a more consistent trend.

Over the past 5 years, “bitcoin” interest hit a low of 17 in the week of October 20-26, 2024 and bounced back to 23 the following week.

El Salvador and Nigeria have been the top 2 in search volume for “bitcoin” for the past 5 years, Switzerland, Netherlands and Austria are 3-5.

This data shows that Bitcoin’s global interest is cyclical but specific regions have steady interest.

Top Bitcoin-Related Searches Reflect Broader Market Trends

Beyond “bitcoin”, related searches shows specific areas of interest. Over the past 60 months “bitcoin mining” has been a top search term. This shows public interest in how Bitcoin works. This could be due to energy costs or regulatory issues in regions where mining is not feasible.

Key Insights from Google Trends Data:

- Regional Leaders: El Salvador, Nigeria, Switzerland consistently lead in Bitcoin interest.

- Short-Term Peaks: Bitcoin reached peak search interest on October 29, driven by price action.

- Long-Term Trends: Bitcoin-related searches like “bitcoin mining” show sustained interest globally.

This recent surge in interest means people are curious about Bitcoin again, as digital assets are getting mainstream attention. Google Trends data shows the global story around Bitcoin, both speculative and adoption.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account