USDJPY Falls Below 153 After BOJ Mentions Rate Hikes

USDJPY dipped below 153 this morning as the Bank of Japan left interest rates unchanged but mentioned interest rate hikes.

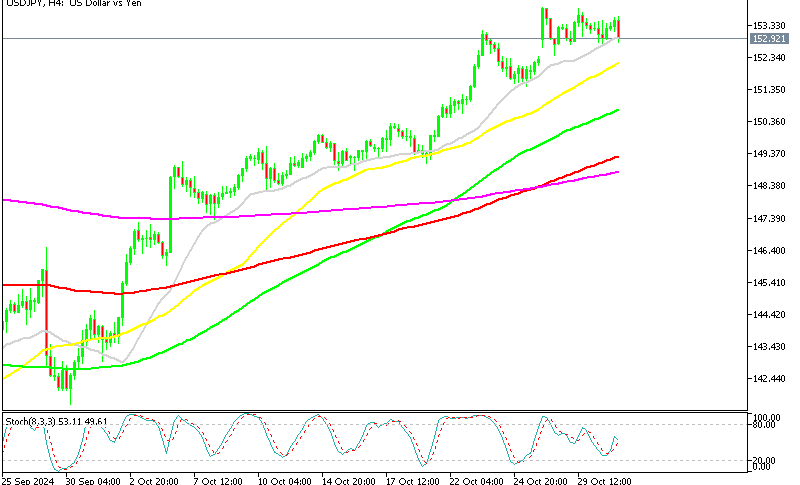

USDJPY dipped below 153 this morning as the Bank of Japan left interest rates unchanged but mentioned interest rate hikes. USD/JPY has been making some massive gains since the middle of September, being supported technically and fundamentally, with sellers nowhere to be seen. This week the price has been trading above 1562 and the lows keep getting higher, which points toward mid 155s, which was a support zone on the way down.

USD/JPY Chart H4 – MAs Keeping the Price Supported

Following a significant drop in USD/JPY in early August, the trend has since shifted bullishly, with recent volatility reflecting strong buying momentum. From mid-September to October, USD/JPY rebounded from below 140 to around 153, displaying a notable 12-cent gain. This week, the pair opened with a 50-pip bullish gap and continued upward to reach 154, where the 20 SMA on the H4 chart serves as a key support, indicating sustained buying pressure.

Despite Japan’s recent economic data—including September’s jobless rate, retail sales, and industrial production—offering limited support for a Bank of Japan rate hike, ongoing political uncertainties in Japan add to yen volatility. The recent Japanese general election did not yield a definitive result, creating additional ambiguity for yen stability. USD/JPY remains likely to trade above 152.50 and appears well-supported, though it may rise further past 154.00 before any potential pullback, as overbought conditions persist.

After a slight dip yesterday, USD/JPY attracted buyers during the U.S. session and ended the day flat. The 20-hour moving average at 152.80 is a key support level; if breached, traders might look toward the rising 50-day moving average at 152 for further support. To the upside, a break above the recent highs at 153.88 could clear the path for a potential move toward 154.50 to 155.

Bank of Japan statement, October 31 2024.

Bank of Japan Interest Rate Decision

- Maintains short-term interest rate target at 0.25%, as expected, with a unanimous decision.

CPI and GDP Forecasts

- Core CPI FY 2024 median forecast: +2.5% (unchanged from July)

- Core CPI FY 2025 median forecast: +1.9% (revised down from +2.1% in July)

- Core CPI FY 2026 median forecast: +1.9% (unchanged from July)

- Core-core CPI FY 2024 median forecast: +2.0% (up from +1.9% in July)

- Core-core CPI FY 2025 median forecast: +1.9% (unchanged from July)

- Core-core CPI FY 2026 median forecast: +2.1% (unchanged from July)

- Real GDP FY 2024 median forecast: +0.6% (unchanged from July)

- Real GDP FY 2025 median forecast: +1.1% (up from +1.0% in July)

- Real GDP FY 2026 median forecast: +1.0% (unchanged from July)

- Quarterly Report Highlights

- Real interest rates remain low; BOJ will consider raising policy rates if the economy and prices align with forecasts.

- Monetary policy will focus on sustainably achieving a 2% inflation target.

- Japan’s economy is recovering moderately, though some weaknesses persist.

- Underlying consumer inflation expected to align with the 2% target in the latter half of the forecast period (FY 2024–2026).

- Inflation likely to rise gradually, with upside risks for FY 2025.

- Uncertainty remains high regarding Japan’s economic and price outlook.

- Currency volatility impact on prices has grown as companies are more actively adjusting prices and wages.

USD/JPY Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account