Gold Price Forecast: Near Record High at $2,790 Amid U.S. Election and Inflation Risks

Gold prices have climbed to unprecedented levels, driven by safe-haven demand as the U.S. presidential election intensifies. As of Thursday, gold was trading at $2,783, close to its resistance level at $2,790, as investors prepared for market volatility and potential policy shifts.

The tight race between Republican former President Donald Trump and Democratic Vice President Kamala Harris has heightened demand for gold, traditionally seen as a hedge against economic uncertainty and potential deficit spending.

Gold Price Soars to All-Time High Ahead of Election pic.twitter.com/spW0xLeCzp

— GENERAL OF THE U.S. ARMY TOM S. GATES ★ 🦅🇺🇸🇺🇸 (@GENTomSGates83) October 31, 2024

Kyle Rodda, a financial market analyst at The future of trading , noted, “The rise in gold looks a lot like one of the Trump trades, or effectively a hedge against greater deficit spending in the United States.” Investors remain wary of potential fiscal policy changes and are seeking refuge in gold to mitigate risks in this high-stakes environment.

Inflation Data and Fed Rate Outlook in Focus

Beyond election uncertainties, the market is closely watching the U.S. inflation report for further insight into the Federal Reserve’s monetary policy. The core Personal Consumption Expenditures (PCE) index, scheduled for release later today, is expected to show a 0.3% increase for September, up from August’s 0.1% rise. Analysts predict that if PCE inflation falls below 0.2% month-over-month, it could strengthen the upward momentum in gold prices.

Matt Simpson, senior analyst at City Index, remarked, “Traders want to buy gold whether it rises or falls, and that has kept retracements small and consolidations tight.” Simpson added that a lower-than-expected inflation figure could propel gold further as investors continue to hedge against potential policy shifts.

The U.S. weekly jobless claims and Friday’s non-farm payrolls report are also on the radar. These indicators will offer additional context on the economy’s health and labor market stability. With a 96% chance of a Federal Reserve rate cut expected next week, a low-interest environment could continue to bolster gold’s appeal, as bullion tends to thrive when borrowing costs decline.

GOLD AT RECORD HIGH AS GLOBAL POLITICAL UNCERTAINTY BOOSTS SAFE-HAVEN DEMAND (Reuters)

Gold prices rose to a record high on Wednesday as uncertainty over the U.S. presidential election boosted safe-haven demand, with traders also awaiting economic data for cues on the Federal… pic.twitter.com/tcl5XBO0cu

— FXHedge (@Fxhedgers) October 30, 2024

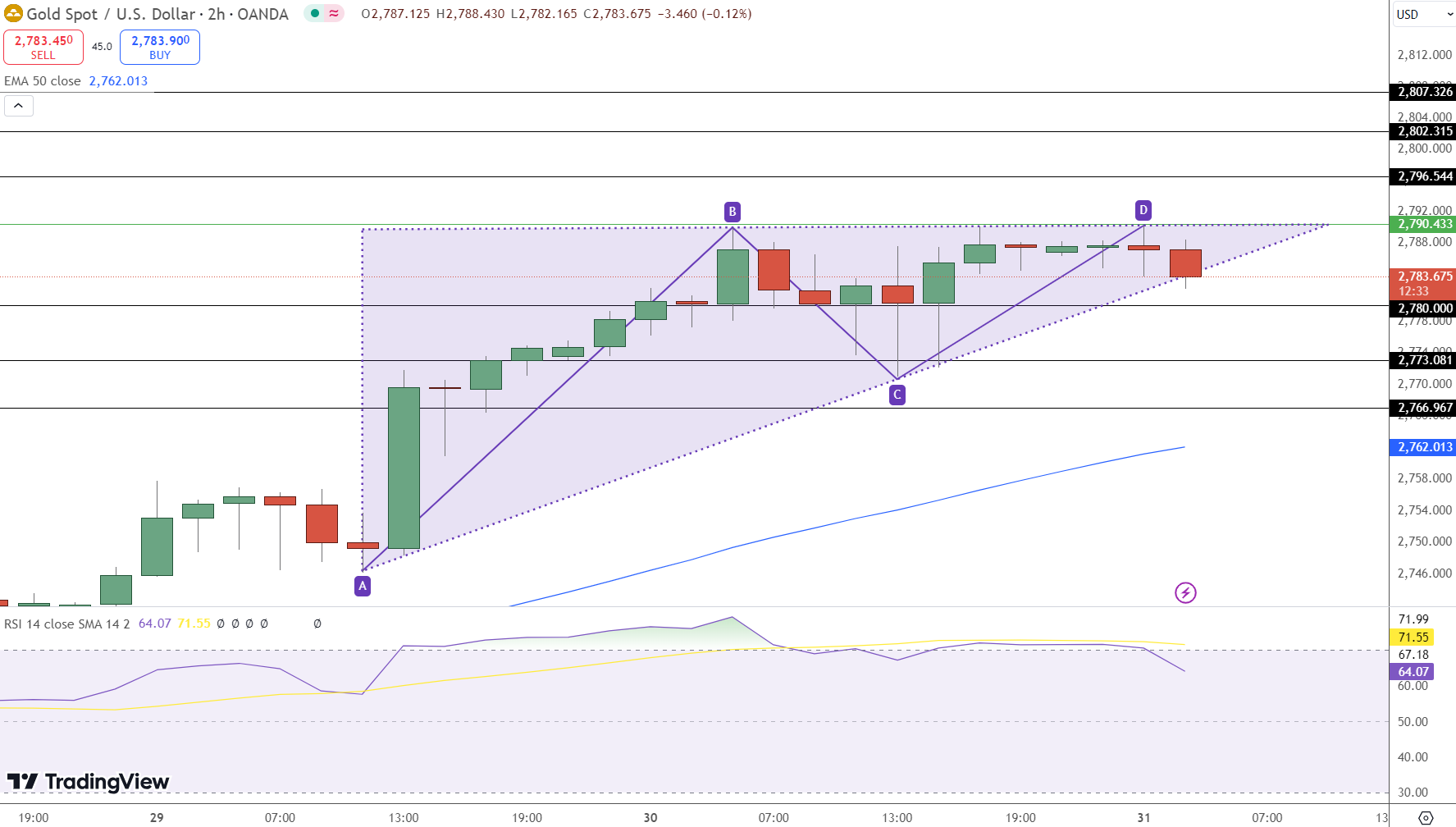

Technical Outlook: Key Levels to Watch

Gold’s current position at $2,783 places it near a pivotal resistance point at $2,790. If prices manage to break above this, further resistance targets are at $2,796 and $2,803. However, if the price fails to maintain support at $2,783, immediate downside risks could bring it to $2,780 and subsequently $2,773.

The 50-day Exponential Moving Average (EMA) at $2,762 is acting as a significant support level, reinforcing gold’s bullish stance. Additionally, the Relative Strength Index (RSI) is currently at 64, indicating moderate strength but staying below the overbought threshold. This RSI level suggests that bullish momentum may be limited, with resistance levels likely to pose significant barriers unless a major catalyst spurs further buying interest.

Key Technical Insights:

Resistance Levels: Immediate resistance at $2,790, with further targets at $2,796 and $2,803 if bullish momentum continues.

Support Levels: Key support at $2,780, followed by $2,773, which could indicate a shift in sentiment if breached.

RSI Trend: At 64, RSI shows moderate bullish strength but indicates caution near resistance levels.

In summary, gold’s price action appears delicately balanced between bullish and bearish pressures. As markets brace for both the U.S. election outcome and crucial economic data, the $2,790 resistance level remains a key point to watch in the near term.

🏆 7 Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |