Bitcoin Price Prediction: BTC Eyes $72,500 as ETF Inflows and U.S. Election Hopes Drive Rally

Despite facing significant volatility due to escalating tensions in the Middle East, Bitcoin (BTC), the oldest and most prominent

Despite facing significant volatility due to escalating tensions in the Middle East, Bitcoin (BTC), the oldest and most prominent cryptocurrency, has maintained its upward momentum, recently gaining traction around the $71,500 level.

This rally is largely fueled by $3 billion in ETF inflows this October. Moreover, the upticks in BTC were further bolstered by the upcoming U.S. presidential election. Many in the crypto community view a potential Trump victory as a bullish sign for the crypto market.

#Bitcoin breaking above $69k! 📈 pic.twitter.com/VmtqH4jU9q

— Snazzy | 8g.btc (@Snazzy_888) October 28, 2024

In fact, Trump has proposed appointing Elon Musk to lead a new Department of Government Efficiency (D.O.G.E.) if elected, which could renew interest in Dogecoin, Musk’s favored cryptocurrency.

Thus, this combination of robust ETF investments and positive political developments set an optimistic stage for Bitcoin and other digital assets in the days ahead.

Surge in Bitcoin ETF Demand Fuels Market Optimism and Price Stability

On the positive side, October has been a strong month for U.S. spot Bitcoin ETFs, with more than $3 billion in net inflows, marking a six-month high in demand.

Over the past week alone, inflows into the 12 Bitcoin ETFs neared $1 billion, with BlackRock’s IBIT leading the pack, nearing $24 billion in total inflows since its launch.

October 21 kicked off a seven-day inflow streak, briefly pausing on October 22 before resuming with a peak inflow of $402 million on October 25.

BlackRock’s IBIT, along with Fidelity’s FBTC and ARK 21Shares’ ARKB, saw some of the highest inflows among these ETFs.

#catnews #cryptonews Bitcoin ETF inflows surpass $3b in October, demand hits six-month high https://t.co/P4JeQ0F4e5 pic.twitter.com/2VeYfVTZUH

— DTM (@DerekTMcKinney) October 26, 2024

Moreover, the demand for Bitcoin ETFs is reaching new heights, as retail investors largely drive this trend.

According to CryptoQuant’s Ki Young Ju, the 30-day momentum indicator for Bitcoin ETF demand has hit a six-month peak.

Currently, the total Bitcoin held in these ETFs is close to surpassing 1 million BTC, which would make them a significant player in the market.

As of now, Bitcoin is trading at $67,007, down 1.3%, with a market cap of $1.32 billion, reflecting the ongoing interest and activity surrounding this digital asset.

Therefore, the surge in Bitcoin ETF demand and inflows has provided strong upward pressure on BTC’s price, enhancing market optimism and potentially sustaining price levels near $67,000, despite minor dips, as investor interest and institutional involvement continue to grow.

Bitcoin Surges Past $70,000, Aiming for $72,500 and Beyond

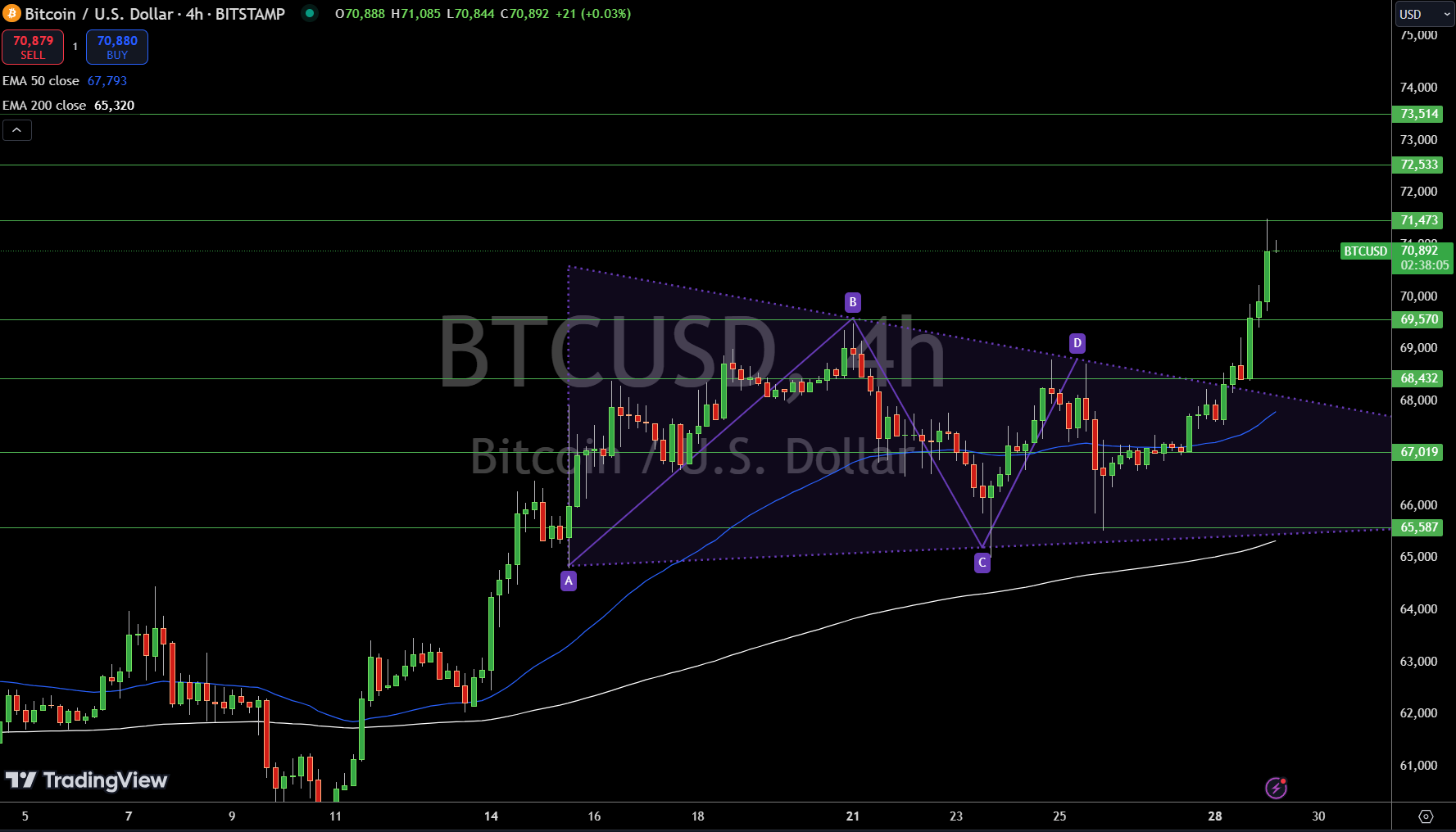

Bitcoin has confidently moved past the $70,000 mark, breaking out of a key technical pattern that points to strong upward momentum.

Currently trading around $71,050, this move signals potential for further gains, with the next target set at $71,500, and possibly $72,830 if the rally holds.

However, if selling pressure builds, Bitcoin has immediate support at $70,240, with additional backup at $68,190.

The Relative Strength Index (RSI) sits at 85, indicating an overbought condition, which could mean a short-term dip is possible.

The 50-day EMA at $68,190 adds a solid foundation to Bitcoin’s recent rise, reinforcing the bullish trend.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account