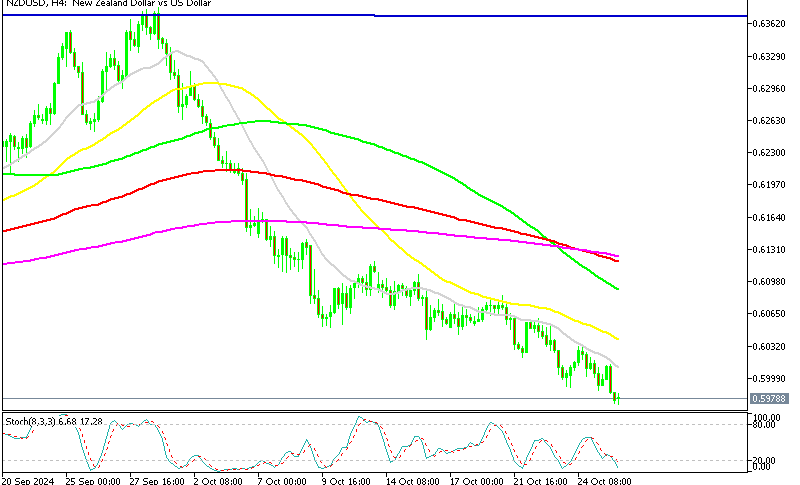

USD to NZD Rate Below 0.60 as Chinese Economy Disappoints

This month, the USD to NZD exchange rate reversed sharply, losing 3 cents and dropping below the 0.60 level after climbing by 5 cents over the previous two months. The pair has already fallen by 4 cents, with a steady decline since early October. Last week, temporary support emerged above 0.60, though the highs continued to drop, moving the pair closer to its initial 0.60 target, which was broken toward the end of the week.

NZD/USD Chart H4 – MAs Pushing the Price Down

Although buyers attempted to stabilize NZD/USD around the key 0.6050 support level, they were unable to lift it back above 0.61. On the H4 chart, the 50 Simple Moving Average (SMA) initially provided resistance, but as the week ended, the 20 SMA took over, reflecting sustained selling pressure on the pair. The market opened on a bearish note today following the release of China’s industrial profit data, which saw a significant drop in September and weighed on risk-sensitive currencies like the New Zealand dollar (Kiwi).

China’s National Bureau of Statistics (NBS) Industrial Profits Data

- Industrial Profits Decline: China’s industrial profits dropped significantly by 27.1% year-on-year in September, marking the largest monthly decline so far in 2024 (prior reading: -17.8% y/y in August). This decline underscores continued challenges within China’s industrial sector.

- Cumulative Earnings Performance: From January to September, industrial profits fell by 3.5%, reversing the slight 0.5% gain reported for the January-August period. This shift reflects weaker earnings momentum in the second half of the year.

- Primary Drivers for the Decline:

- Insufficient Demand: Weaker domestic and international demand has impacted revenue for industrial firms.

- Faster Decline in Producer Prices: Declining prices at the production level have further compressed profit margins across key industries.

- High Base Effect from August: A stronger base from previous months has exaggerated the year-on-year decline.

- NBS Optimistic Outlook: Despite the downturn, the National Bureau of Statistics expressed confidence that recent policy measures will create a more favorable environment for industrial production. These policies are intended to support recovery in industrial profits and encourage stability within the sector going forward.