Tether holds about $100 Billion in US treasuries

Ardoino claims that Tether has around $100 billion in US Treasury securities, 48 tons of gold, and over 82,000 Bitcoin

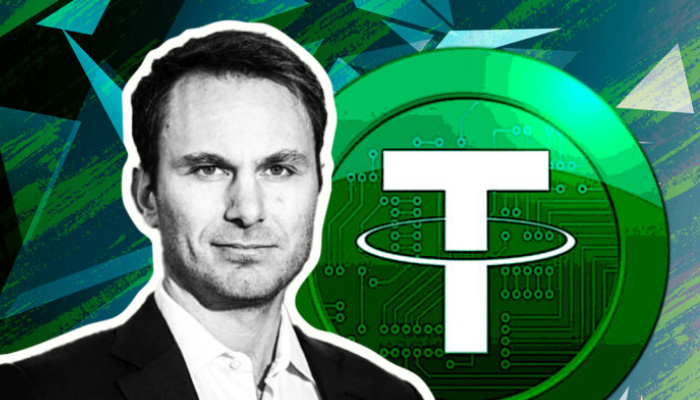

Tether CEO Paolo Ardoino took the stage at Lugano’s PlanB event in Switzerland to provide a breakdown of the reserve assets underpinning the company’s Tether-USD stablecoin USDT after rumors circulated that the US Department of Justice and the Treasury were looking into the company.

Ardoino claims that Tether has around $100 billion in US Treasury securities, 48 tons of gold, and over 82,000 Bitcoin, valued at roughly $5.5 billion at current market prices.

The CEO of Tether highlighted the asset reserves amid the fear, skepticism, and uncertainty caused by a recent Wall Street Journal article that said US authorities were investigating the company for allegedly violating US sanctions and anti-money laundering regulations.

The stablecoin company claims that since 2014, Tether has assisted law enforcement in recovering almost $109 million that was utilized in illegal activities like fraud, sanctions evasion, and cybercrime.

Additionally, Ardoino recently attacked the United States crypto regulatory policy for lagging behind other nations. This has led to the departure of numerous innovative digital asset enterprises from the US to more advantageous locations. The CEO of Tether did, however, also convey optimism that things will change after the US presidential election in 2024.

In October 2024, Tether’s USDT reached an incredible market valuation of $120 billion. Investors and speculators interpret this as a positive indication for the cryptocurrency markets, which might lead to greater prices in the upcoming weeks and months.

Tether recently gained attention after the Wall Street Journal (WSJ) reported that the stablecoin issuer was the subject of an ongoing investigation by the US government, according to anonymous sources. Paolo Ardoino, the CEO of Tether, was quick to refute the allegations, adamantly declaring that the “WSJ is rephrasing old noise.” Tether was equally unreserved in his criticism of the study, calling it “woefully irresponsible” and filled with “reckless allegations.”

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account