EUR/USD Holds Above 1.08 As EZ Economy Shows Signs of Life

Following a four-week decline, EUR/USD rallied yesterday, climbing above 1.08, bolstered by positive data from Germany. The October PMI figures for services and manufacturing exceeded expectations, signaling that the downturn in both sectors may be over. Reports showed improvement in Germany and the Eurozone’s manufacturing sectors, setting a stronger tone for Q4.

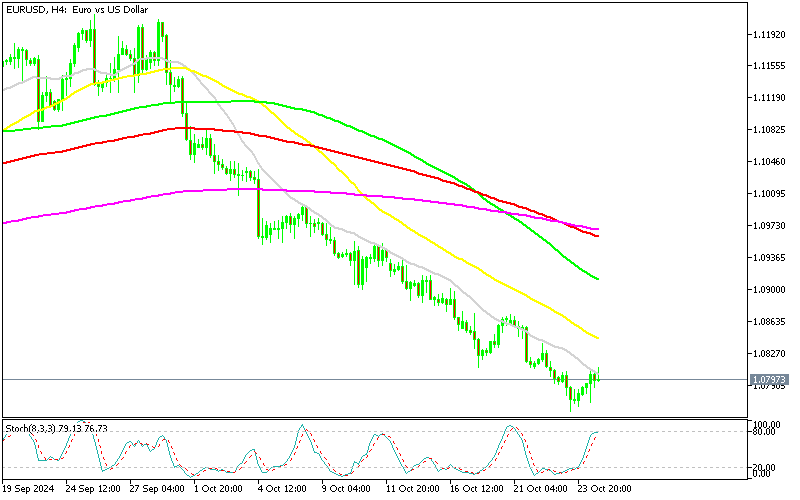

EUR/USD Chart – Consolidating at the 50 SMA

After a 0.3% contraction in 2023, the IMF forecasts the GDP for 2024 to fall flat at 0.0%. EUR/USD also made a technical breakout above the 20 SMA on the H4 chart, approaching the 50 SMA around 1.0830, signaling a potential upside if this level holds. Buyers could gain more control if sustained above that average.

Germany October Ifo Business Climate Index

- October Ifo Business Climate Index: 86.5 points (above the 85.6 points expected, prior was 85.4 points).

- Current Conditions: 85.7 points (better than the 84.4 points forecast, prior was 84.4 points).

- Business Expectations: 87.3 points (exceeding the 86.8 points forecast, previous was 86.3 points).

- Summary: The data reflects improved business sentiment in Germany, with all indices exceeding expectations, signaling a possible stabilization in economic outlook.

While the business outlook in Germany improved in October, signaling a lift in company morale, these positive sentiments need further support from concrete data to suggest a solid recovery next year. Despite stronger-than-expected PMI data recently, there are still limited signs of a near-term rebound for the struggling German manufacturing sector, which remains in recessionary territory.