Forex Signals Brief October 24: Services and Mfg. PMI Day

Yesterday the economic calendar was light in the Asian and European session, however the UD continued to push higher. Gold was also bullish early in the day, printing a new record high at $2,758, but then made a sudden reverse lower, perhaps on comments that Blinken could broker a deal between Iran and Israel. As a result, Gold price dived $50 lower, but remained above $2,700.

The Bank of Canada (BOC) has maintained its balance sheet normalization program while lowering its policy rate by 50 basis points to 3.75%. BOC Governor Tiff Macklem emphasized that there was a “clear consensus” on the rate cut, and noted that core inflation is declining as expected. He also suggested that if the economy performs as anticipated, further rate reductions may follow, with a focus on monitoring inflation and growth indicators.

In the U.S., September’s existing home sales came in at an annual rate of 3.84 million, slightly below the 3.86 million forecast. This marks the lowest level since October 2010. On a monthly basis, sales were down 1.0%, an improvement from the revised -2.0% decline last month, while year-over-year sales fell by 3.5%.

Crude oil futures saw a drop from above $72, ending the day down $1 or -1.5%, settling around $71 after U.S. Secretary of State Antony Blinken promised to mediate a potential agreement between Israel and Iran. Meanwhile, U.S. equities had a challenging day:

- Dow Industrial Average: Down 410 points (-0.1%) to 42,515.

- NASDAQ Index: Fell nearly 300 points (-1.70%) to 18,276.

- S&P 500 Index: Dropped 54 points (-0.92%) to 5,797.

Today’s Market Expectations

Today is a manufacturing and services day, with many PMI reports to be released throughout the day. It started with the numbers from Australia early this morning.

During the day, we will get the Flash PMIs Day for many major economies with the Eurozone, UK and US PMIs being the main highlights:

- Eurozone Manufacturing PMI: 45.3 points expected vs. 45.0 v prior.

- Eurozone Services PMI: 51.6 points expected vs. 51.4 points prior.

- UK Manufacturing PMI: 51.4 points expected vs. 51.5 points prior.

- UK Services PMI: 52.4 points expected vs. 52.4 points prior.

- US Manufacturing PMI: 47.5 points expected vs. 47.3 points prior.

- US Services PMI: 55.0 points expected vs. 55.2 points prior.

The U.S. Jobless Claims report is due to be released later today. Initial claims have consistently stayed within the 200K–260K range since 2022, reflecting stability in that metric. However, continuing claims, which had improved over the past two months, have recently surged to cycle highs, largely due to distortions caused by hurricanes and strikes. Last week, continuing claims rose to 1.867 million, up from 1.858 million previously, and there is no clear consensus for this week’s figure. For initial claims, expectations are set at 247K, slightly higher than last week’s 241K. The labor market outlook remains uncertain as external factors continue to influence these numbers.

Yesterday the USD continued to push higher again and we embarked long on the Buck, resulting in a good trading strategy, booking us 5 winning forex signals in total, while three trades ended up in loss, we se had 8 trading signals in total. Gold retreated in a massive crash, which caught us on the wrong side as we were trying to buy the pullback.

Gold Gets Closer to $2,800

Gold also reached a new record high today, hitting $2,758 as investors continued to buy early in the day. Although there was a $50 drop during the U.S. session, gold remains in a strong bullish trend for 2024, with prices up around 30% this year. The price consolidated above $2,700 after the decline.

XAU/USD – H1 Chart

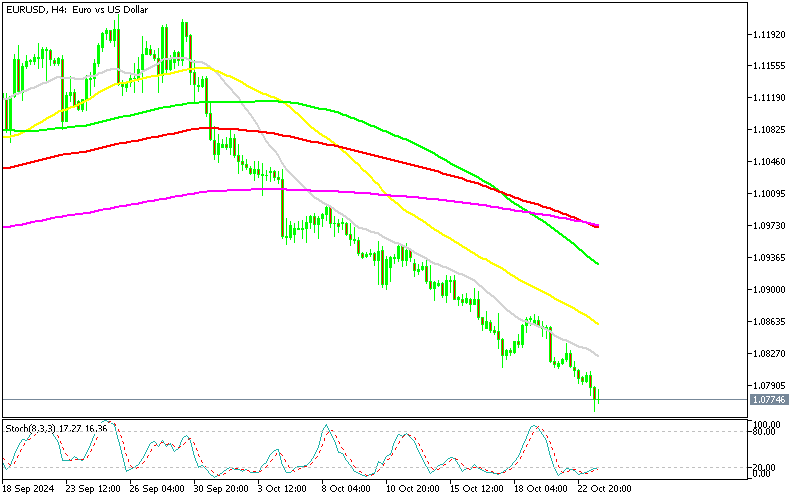

EUR/USD Keeps Sliding Lower Toward 1.07

The EUR/USD currency pair has struggled to rise above the 1.08 mark. Although intraday traders tried to manage the correction, sellers continued to apply pressure, keeping the exchange rate below this key level. Dovish comments from the European Central Bank (ECB) have contributed to this weakness, causing the pair to fall below the 200-week SMA. With strong demand for the U.S. dollar, sellers are now pushing for the 1.07 level as the next target for EUR/USD.

EUR/USD – H4 Chart

Cryptocurrency Update

Bitcoin Consolidtes after the Retreat on Monday

Bitcoin, which had been trading in a declining channel since April, saw its price fall from around $70,000 to below $50,000 by August. However, after the Federal Reserve lowered interest rates in September, Bitcoin began to rise again. Earlier this week, it nearly reached $70,000, but buyers couldn’t push it past that level. Yesterday, the price dropped to $65,000. Despite this, the top of the previous channel held as support, indicating that Bitcoin may now trade above its previous range.

BTC/USD – Daily chart

Ethereum Returns to the the 100 Daily SMA

Ethereum has experienced similar buying pressure. In October, it reached $2,700, and this week, ETH buyers managed to break through the resistance at the 100-day simple moving average (SMA). However, yesterday, Ethereum’s price dipped again, but it found support at the 50-day SMA and stabilized above $2,500.

ETH/USD – Daily chart