Dollar Firms Up With Rising Trump Bets

The U.S. Dollar extended gains against major currencies during the week ended October 18 amidst growing expectations of a Trump presidency, widely perceived as boosting the U.S. dollar.

The greenback has gained amidst perception that Trump’s tariff and tax policies would keep U.S. interest rates high. The greenback strengthened against the euro, the British pound, the Japanese yen, the Australian dollar, the Canadian Dollar, the Swedish Krona and the Swiss franc over the course of the week.

The Dollar Index, which measures the U.S. Dollar’s strength against a basket of 6 currencies gained 0.58 percent during the week ended October 18, recording the third week of gains. The Index had added 0.36 percent during the week ended October 11 and 2.13 percent during the week ended October 4.

Data released by the U.S. Census Bureau on Thursday showed month-on-month Retail Sales in the U.S. rising 0.4 percent in September versus market expectation of a rise of 0.3 percent. Retail sales had grown only 0.1 percent in August.

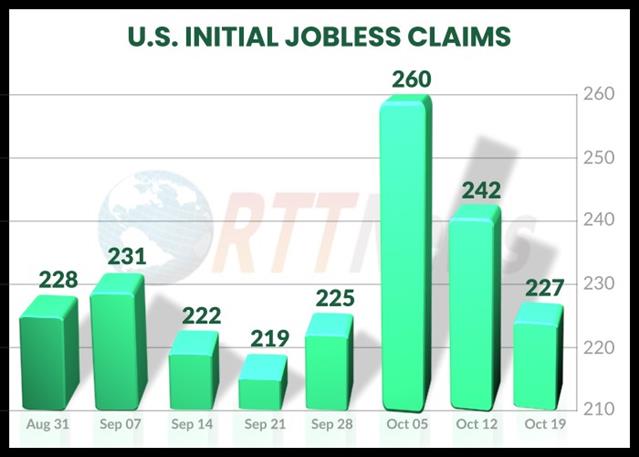

Also, data released on Thursday showed the number of people claiming unemployment benefits in the U.S. unexpectedly decreasing to 241 thousand in the week ended October 18 whereas markets had expected it to be at 260 thousand, the previous week’s level.

Amidst the strong economic data, the DXY touched a weekly low of 102.93 on Monday and climbed to a weekly high of 103.87 on Thursday, before slipping and eventually closing at 103.49 on Friday. The Index was at 102.89 a week before.

The euro slipped against the U.S. Dollar during the week ended October 18 amidst the ECB’s widely expected 25-basis points cut in interest rates on Thursday. The EUR/USD pair declined to 1.0866 on October 18, from 1.0937 a week earlier, recording a decrease of 0.65 percent as markets priced in increased likelihood of back-to-back rate cuts at the ECB’s upcoming meetings. The pair ranged between the high of 1.0936 recorded on Monday and the low of 1.0810 touched on Thursday.

The U.S. Dollar surged against the British pound also during the week ended October 18 amidst a higher-than-expected softening in inflation in the U.K. that triggered hopes of aggressive rate cuts by the Bank of England. The GBP/USD pair which had closed at 1.3066 on October 11, dropped to 1.3048 by October 18. The pair ranged between Tuesday’s high of 1.3102 and Thursday’s low of 1.2971. Data released on Wednesday showed annual inflation in the U.K. declining to 1.7 percent in September from 2.2 percent in the previous month and pleasantly surprising markets that had expected a level of 1.9 percent.

The Australian Dollar too plunged 0.65 percent against the U.S. Dollar during the week ended October 18, amidst diminishing expectations regarding stimulus measures from China, the toning down of aggressive rate cut prospects from the Federal Reserve as well as weakness in global commodity prices. The AUD/USD pair which had closed at 0.6750 on October 11 climbed to a high of 0.6746 on Monday before dropping to 0.6656 on Wednesday. The pair finally closed at 0.6706 on Friday.

The past week also saw the Japanese yen extending losses against the U.S. Dollar. The USD/JPY pair which was at 149.13 on October 11 climbed to 149.52 in a week’s time. The pair had touched a low of 148.84 on Tuesday and a more than 2-month high of 150.32 on Thursday. The yen’s weakness came amidst inflation in Japan declining to 2.5 percent in September from 3 percent in the previous month. The lowest reading since April cast doubts on the headroom available to Bank of Japan to hike rates aggressively.

With the U.S. presidential elections only two weeks away, political dimensions have again assumed preeminence and currency markets appear to be positioning for a Trump victory. Coupled with the lingering tensions in the Middle East that continues unabated, the six-currency Dollar Index has risen to 103.63 from 103.49 on Friday.

The EUR/USD pair has decreased to 1.0852 amidst weak PPI readings from Germany. Rate cut expectations have driven the GBP/USD pair to 1.3022. The AUD/USD pair has slipped to 0.6687. Ahead of Sunday’s general election in Japan, the USD/JPY pair has firmed up all the way to 149.95.