Gold Prices Surge to $2,710 Amid Central Bank Rate Cuts and Geopolitical Tensions

Gold prices continue their upward trend, reaching a fresh high of $2,710 per ounce as investors seek safety amidst rising geopolitical tensions and economic uncertainty.

The prospect of further interest rate cuts by major central banks, along with a weakening U.S. dollar, has spurred demand for gold. Here’s a detailed look at what’s driving the rally and what to expect next.

Central Bank Rate Cuts Bolster Gold Demand

Gold’s recent surge can largely be attributed to expectations that major central banks will continue to cut interest rates. This week, the European Central Bank (ECB) cut rates for the third time this year, marking its first consecutive reductions in over a decade.

Analysts expect further cuts as the eurozone grapples with a bleak economic outlook. Meanwhile, the U.S. Federal Reserve is also expected to maintain its easing policies, especially following September’s significant rate cut.

Gold prices benefiting from the boost in safe-haven demand. On the one hand, there are only a few weeks left before the US presidential election, and on the other hand, the interest rate cut by the European Central Bank has also played a boosting role.#techfx pic.twitter.com/RCer2qxRxd

— TechFX Global (@TechFXGlobal) October 18, 2024

On the U.S. front, key economic data has supported this outlook. Retail sales increased by 0.4% in September, surpassing the 0.3% forecast, and initial jobless claims dropped to 241,000, lower than the expected 260,000. Additionally, the Philadelphia Federal Reserve reported a sharp increase in its business conditions index from 1.7 to 10.3 in October. This economic backdrop reinforces the belief that the Fed will continue to cut rates cautiously, which, in turn, supports the upward momentum of gold.

Weakening Dollar Adds Momentum

The U.S. dollar has been another key factor in gold’s rally. After reaching its highest point since August, the dollar has since weakened, making gold more affordable for international buyers. “The pullback in the U.S. dollar, combined with expectations of a more dovish stance from the Fed, has been a significant tailwind for gold,” said a senior commodities strategist.

When the dollar weakens, gold becomes cheaper for foreign investors, further driving demand. With ongoing uncertainties around monetary policies and the dollar’s continued softness, many investors are turning to gold as a hedge against currency risk.

Geopolitical Risks and Election Uncertainty Boost Safe-Haven Demand

In addition to economic factors, global risks and political instability are pushing more investors towards gold. Escalating tensions in the Middle East, coupled with uncertainty surrounding the U.S. presidential election, are bolstering gold’s appeal as a safe-haven asset. The ongoing conflict involving Israel and Iran-backed Hezbollah, alongside the tight race between Donald Trump and Kamala Harris, has made markets more unpredictable, prompting investors to seek the relative safety of gold.

The geopolitical risks have overshadowed other global economic data, such as China’s better-than-expected third-quarter growth of 0.9%, which had little impact on market sentiment. Instead, concerns about global stability have taken precedence, further supporting gold’s bullish trajectory.

#Gold price climbs above $2,700, hitting a record high due to expected central bank rate cuts and ongoing geopolitical risks. Despite the US Dollar's recent strength, gold remains in demand as a safe-haven asset, poised for strong weekly gains.#niftycrash #btcusd #gold #dxy pic.twitter.com/TNka7AlDdN

— Gold Trades (@Forexevabk) October 18, 2024

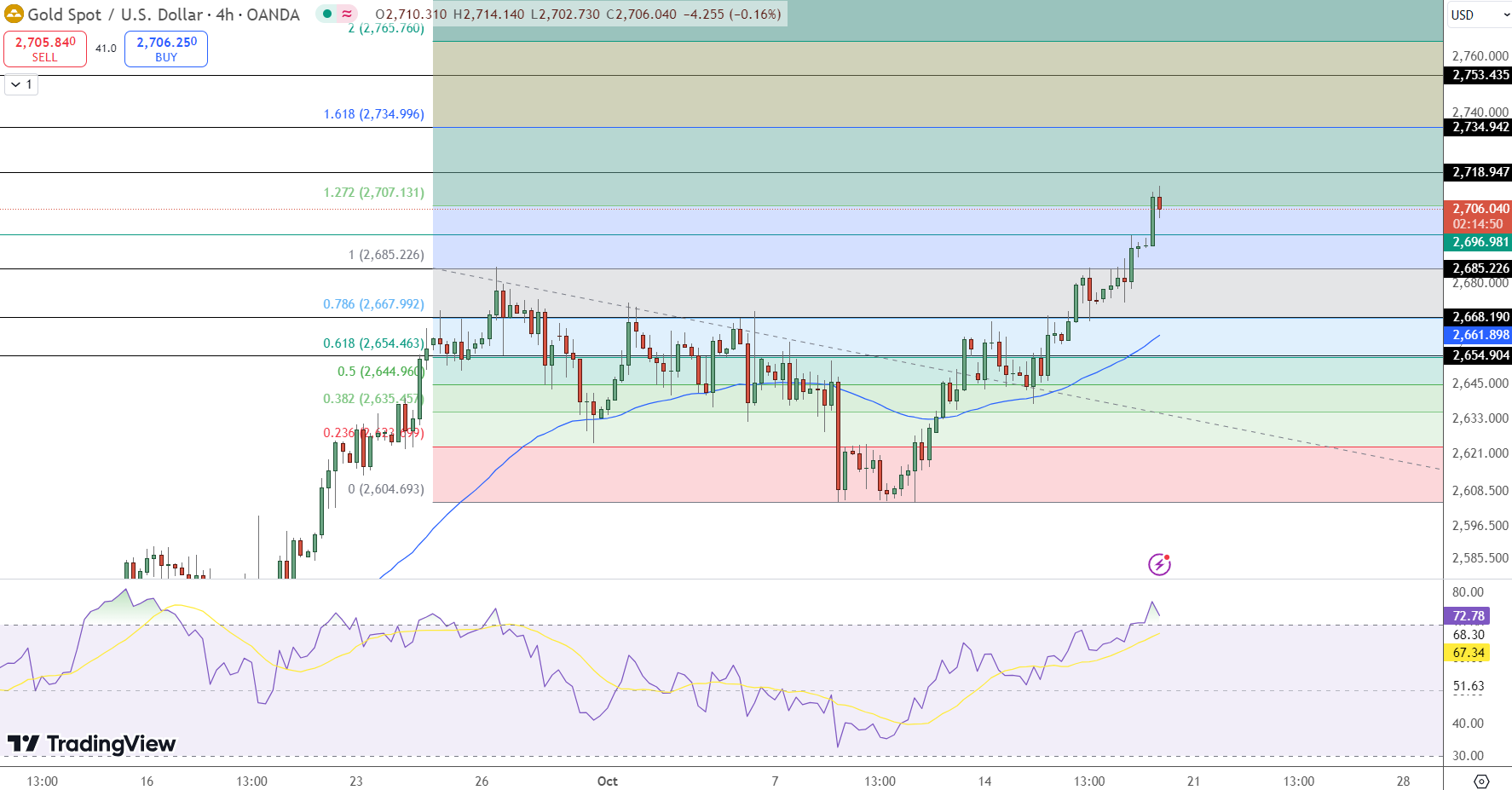

Technical Outlook: Key Price Levels to Watch

Gold is maintaining its strong upward momentum, with technical indicators pointing toward further gains. Currently priced at $2,706.04, gold remains above critical support levels, suggesting that the bullish trend will persist.

Key Resistance Levels: Immediate resistance lies at $2,718.95, with the next resistance levels at $2,734.99 and $2,753.43, supported by the 161.8% Fibonacci extension.

Support Levels: The first support level is at $2,685.23, followed by stronger support at $2,668.19.

Technical Indicators: The 50-day EMA stands at $2,661.89, offering a solid base for continued upward movement. Meanwhile, the RSI is at 72.78, indicating that gold is nearing overbought territory, but there is still room for further upside before a possible correction.

Key Takeaways:

Bullish momentum continues, supported by central bank rate cuts and a weakening U.S. dollar.

Gold prices could target the 161.8% Fibonacci extension at $2,734.99 in the short term.

Geopolitical risks and U.S. election uncertainty are driving safe-haven demand for gold.

Gold remains poised for further gains as global uncertainty and central bank policies support its appeal. With solid technical backing, investors can expect gold to maintain its upward trend in the near future.