Italy to Raise Bitcoin Capital Gains Tax to 42% Amid Crypto Market Strength

In a significant move that could reshape Italy's cryptocurrency landscape, Deputy Finance Minister Maurizio Leo announced plans to increase

In a significant move that could reshape Italy’s cryptocurrency landscape, Deputy Finance Minister Maurizio Leo announced plans to increase the capital gains tax on Bitcoin and other cryptocurrencies from 26% to 42%. The decision, revealed during a conference outlining Italy’s 2025 budget on Wednesday, comes as Bitcoin trades near $67,300, showing resilience despite the tax news.

The substantial tax hike is part of Italy’s broader strategy to generate additional revenue, with the government citing the growing adoption of cryptocurrencies as a key factor. “The phenomenon is spreading,” Leo noted during a press conference at Palazzo Chigi, highlighting the government’s increasing focus on digital assets.

The measure is included in Italy’s newly approved €30 billion ($33 billion) budget for 2025, which awaits final parliamentary approval by year’s end. The budget also includes significant changes to Italy’s Digital Services Tax (DST), removing the previous minimum revenue requirements of 750 million euros for global revenue and 5.5 million euros for Italian digital services revenue.

Prime Minister Giorgia Meloni assured citizens that the new measures wouldn’t introduce broader tax increases. “As we promised, there will be no new taxes for citizens,” Meloni stated on social media, emphasizing that raised capital would support healthcare and vulnerable populations.

Market Impact and Investor Response

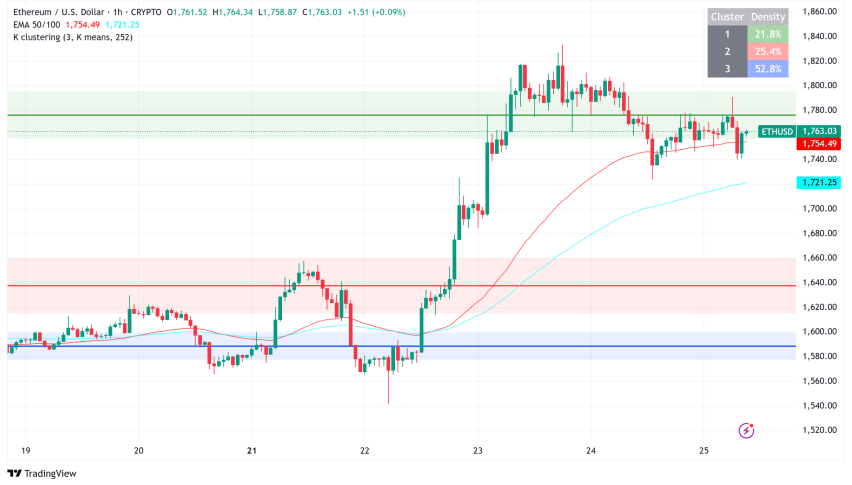

Despite concerns about potential negative market impact, Bitcoin has remained notably resilient. The cryptocurrency is currently trading above $67,000, marking a more than 12% increase week-over-week and reaching levels not seen since late July.

However, industry observers worry the steep tax increase could drive investors to seek alternatives or move operations offshore, similar to patterns seen in other jurisdictions with aggressive crypto taxation. The new rate would position Italy among the countries with the highest cryptocurrency tax rates globally.

Broader Economic Context

The tax revision comes as Italy grapples with broader economic challenges. The country’s inflation rate recently dropped below 1% in September, and the government is working to shore up revenues while maintaining public services. The budget measures are expected to raise approximately 4 billion euros ($4.35 billion) by 2025, representing about 0.2% of Italy’s GDP.

The move also coincides with the European Union’s preparation to implement the Markets in Crypto-Assets Regulation (MiCA), suggesting a broader trend toward increased cryptocurrency regulation and taxation across Europe.

The tax increase will mark a significant shift from Italy’s current system, which taxes crypto capital gains exceeding €2,000 at 26%. The new policy is expected to take effect as part of the 2025 budget implementation, pending parliamentary approval.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account