Ethereum’s Resilient Rally Faces Headwinds: DApp Decline and ETF Tepidity Test Investor Sentiment

Ethereum (ETH) has demonstrated price resilience in recent days, but concerns linger about declining network activity and lackluster demand for ETH exchange-traded funds (ETFs). As the second-largest cryptocurrency by market cap navigates a complex landscape, investors are closely watching key metrics for signs of future price movement.

Recent Price Action and Market Performance

Ethereum’s price surged 9.4% between October 10-15, reaching a two-week high of $2,687. However, this recent rally comes after a challenging period for the cryptocurrency:

- ETH remains down 25% over the past three months

- The broader crypto market (excluding stablecoins) declined only 2% in the same period

- Ethereum’s price dropped from $3,450 to $2,590 in 90 days

This divergence suggests a potential shift in investor sentiment towards Ethereum’s growth prospects.

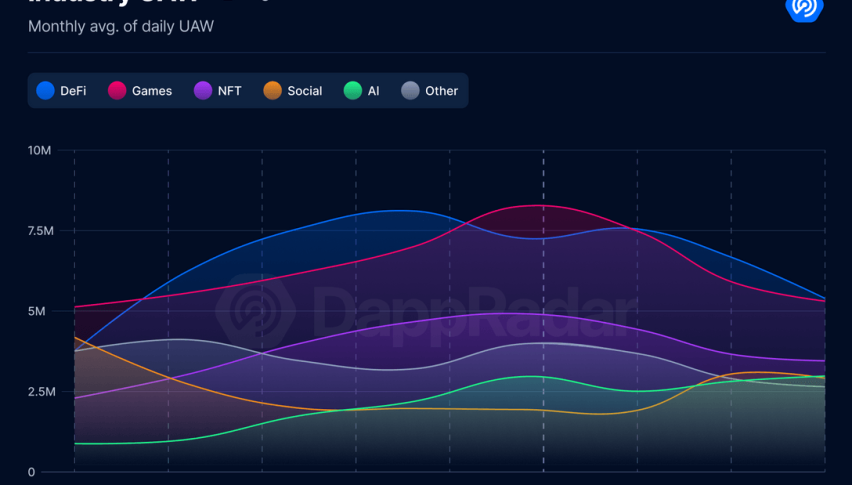

Declining DApp Activity on Ethereum Raises Concerns

A 23% drop in Ethereum decentralized application (DApp) volumes over the past week has sparked debate about potential price implications:

- Ethereum’s 7-day DApp volumes fell to $21.5 billion

- Key protocols like Uniswap (-16%), Balancer (-54%), CoW Swap (-18%), and 1inch Network (-23%) saw significant declines

- Competing blockchains like BNB Chain (-33%) and Solana (-26%) experienced similar volume drops

While the decline appears to be part of a broader trend across major blockchain networks, it has nonetheless raised concerns among some Ethereum investors.

Ethereum ETF Demand and Supply Dynamics

The launch of spot Ethereum ETFs in the United States has not generated the level of enthusiasm some had anticipated:

- Ether ETFs have seen net outflows of $6 million in October

- In contrast, Bitcoin ETFs recorded $810 million in net inflows from October 11-14

- Ethereum’s supply continues to increase despite high network usage

Vitalik Buterin, Ethereum’s co-founder, has acknowledged these concerns and suggested that improving transaction finality times could help address efficiency issues on the network.

Layer-2 Impact on ETH Economics

The increased adoption of layer-2 scaling solutions has had an unexpected impact on Ethereum’s tokenomics:

- Layer-2 adoption has reduced the ETH supply burn rate

- This trend accelerated following the EIP-4844 upgrade in April 2023

- Lower fees on layer-2 networks have decreased overall ETH burned through transactions

While beneficial for scalability, this shift has potentially contributed to Ethereum’s recent price underperformance relative to the broader crypto market.