Nvidia Stock Bullish Breakout: Key Resistance Levels to Watch

The upcoming earnings report holds the potential to be a pivotal catalyst for the Nvidia stock's movement which is facing support.

Konstantin Kaiser•Tuesday, October 8, 2024•2 min read

Despite a downtrend since June, Nvidia (NVDA) has recently signaled a potential shift in momentum as the stock has broken out bullishly. This breakout suggests that a possible reversal is on the horizon, offering new opportunities for upward movement. Traders should closely watch key levels and indicators to confirm this bullish turn.

Nvidia (NVDA) has successfully broken the golden ratio resistance at $123, initiating a bullish breakout from the symmetrical triangle pattern. This move sets the stage for a potential surge toward the recent high of approximately $141. The daily chart’s technical indicators further support this bullish outlook.

Technical Indicators and Trends (Daily Chart)

- MACD (Moving Average Convergence Divergence): The MACD lines have crossed bullishly, with the histogram rising steadily over the past four days, signaling growing momentum.

- RSI (Relative Strength Index): The RSI is approaching overbought territory but remains in neutral regions, allowing for further upward movement.

- EMA (Exponential Moving Average): The golden crossover of the EMAs confirms a short- to medium-term bullish trend, reinforcing the positive trajectory for NVDA.

Despite the broader market correction, Nvidia appears poised for a serious attempt at breaching the last all-time high (ATH) near $141.

More Upside For The Nvidia (NVDA) Stock

Currently, Nvidia (NVDA) stock has an upside potential of approximately 6%, aiming for the recent high at $141. However, if an unexpected correction occurs, the next significant Fibonacci support levels are at $117 and $106. The 4-hour chart’s indicators continue to signal bullish momentum in the short term.

Technical Indicators and Trends (4H Chart)

- MACD (Moving Average Convergence Divergence): The MACD remains in a bullish crossover and the histogram is trending higher, supporting a short-term bullish outlook.

- RSI (Relative Strength Index): The RSI is approaching overbought levels, suggesting the possibility of a pullback near the previous high at $141.

- EMA (Exponential Moving Average): The golden crossover of the EMAs confirms a short-term bullish trend, reinforcing a generally positive outlook for the stock.

NVIDIA

NVIDIA

Nvidia (NVDA) Sees Strong Bullish Momentum Over the Last Six Weeks

Over the past six weeks, Nvidia (NVDA) stock has surged by more than 32%. If Nvidia manages to break its all-time high (ATH) of $141, it could target the Fibonacci projection level near $172, offering an additional upside potential of approximately 28.4% from the current price.

Technical Indicators and Trends (Weekly Chart)

- MACD (Moving Average Convergence Divergence): The MACD lines are approaching a potential bullish crossover, with the histogram trending higher for the last five weeks, signaling increasing momentum.

- RSI (Relative Strength Index): The RSI remains in neutral territory, providing no immediate directional bias but leaving room for further gains.

- EMA (Exponential Moving Average): The golden crossover of the EMAs reinforces a bullish trend in the short-to-mid term, suggesting a positive outlook despite recent market fluctuations.

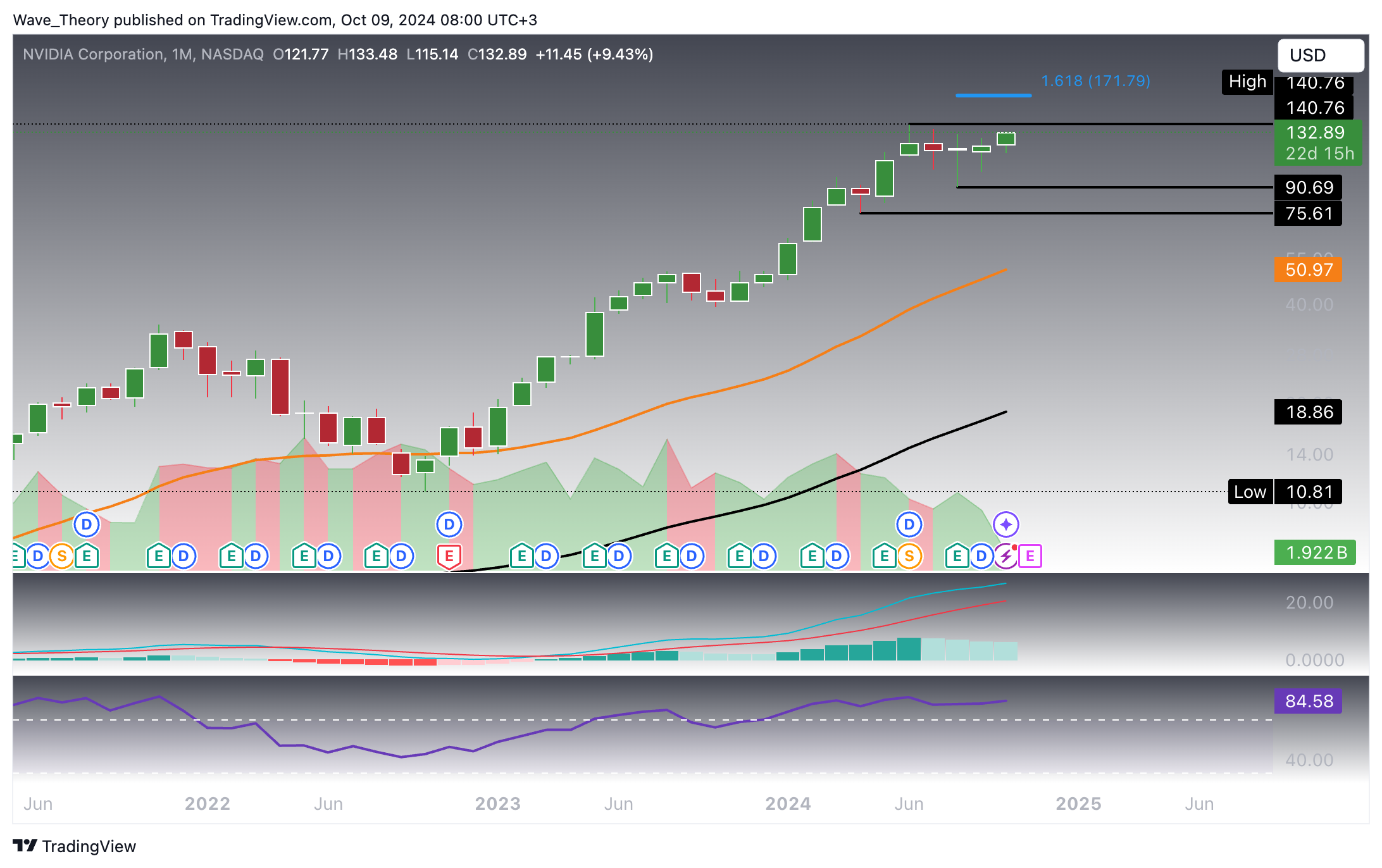

Nvidia (NVDA) Shows Bearish Signals in the Monthly Chart Despite Long-Term Bullish Trend

In the monthly chart, Nvidia’s MACD histogram has been ticking lower bearishly for the past four months, signaling weakening momentum. However, the MACD lines remain in a bullish crossover, while the RSI continues to linger in overbought regions, indicating potential for a pullback. On a broader scale, Nvidia finds significant support between $76 and $91, while major resistance lies at $141 and $172. Despite these challenges, the golden crossover of the EMAs confirms a long-term bullish trend, and Nvidia continues to be one of the top-performing stocks over the past two years.

Nvidia (NVDA) has shown strong long-term bullish momentum, despite recent bearish signals in the monthly MACD, with key support between $76 and $91 and resistance at $141 and $172, while remaining one of the top-performing stocks of the past two years.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Konstantin Kaiser

Financial Writer and Market Analyst

Konstantin Kaiser comes from a data science background and has significant experience in quantitative trading. His interest in technology took a notable turn in 2013 when he discovered Bitcoin and was instantly intrigued by the potential of this disruptive technology.

Related Articles

Comments

0

0

votes

Article Rating

Subscribe

Login

Please login to comment

0 Comments

Oldest

Newest

Most Voted

Inline Feedbacks

View all comments