USDJPY Approaches the 50% Fibo Resistance after 7 Cent Surge

USDJPY crashed more than 22 cents during summer as the carry trade unwound, but it is facing the 50% fibo, after a 7 cent surge this week.

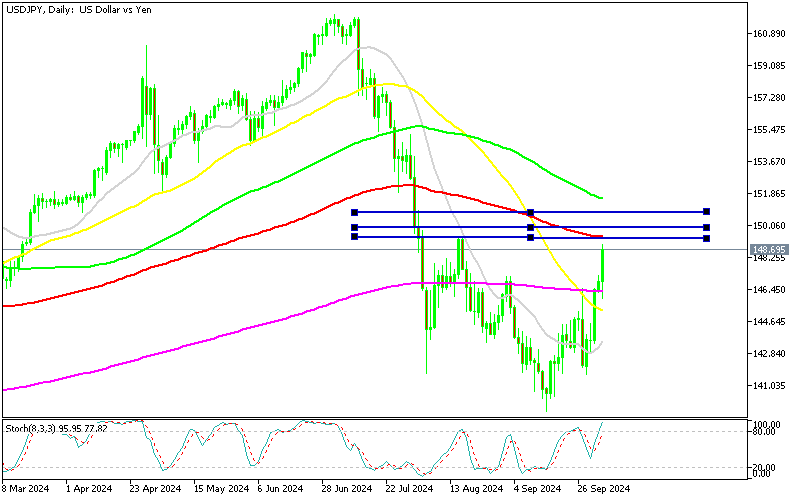

USDJPY crashed more than 22 cents lower during summer as the carry trade unwound, but after a 7-cent surge this week, it is facing the 50% Fibonacci retracement level from the 162-139.50 decline level above 150. That level comes at 151.80, so we will see if buyers have enough strength to push above this level, with the Bank of Japan and the new governor on the watch.

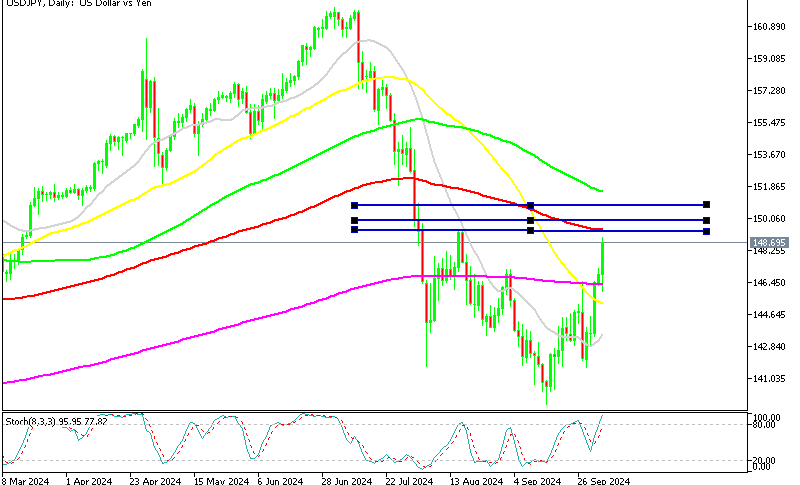

USD/JPY Chart Daily – Several Obstacles for Buyers to Overcome

Strong NFP Report Supports US Labor Market

The Non-Farm Payroll (NFP) report for September showed a significant rise in jobs, reversing recent slowing trends and confirming that the US labor market remains healthy. This follows a week of positive employment data, including strong ADP numbers and a surge in JOLTS Job Openings. These indicators have further reduced the odds of a 50 basis point rate cut by the Federal Reserve.

Key NFP Highlights

- Unemployment rate dropped close to 4.0%.

- Non-Farm Employment Change surged above 250K.

- Average Hourly Earnings increased for both September and August.

Strong USD/JPY Bullish Impact

The USD strengthened as a result of the positive data, pushing USD/JPY up by 2 cents on Friday and 7 cents over the week. USD buyers dominated, breaking out of a falling wedge pattern and testing August’s high of 149.37.

EUR/USD dropped below 1.1000 after being stuck around 1.1200 for over a month, contributing to the USD rally. However, the rise in USD/JPY was also influenced by the Japanese Prime Minister’s comments downplaying the likelihood of further rate hikes. Although USD/JPY retraced about 40% of its previous bearish move, the 151-152 resistance zone, which was crucial in 2022 and 2023, remains an important level to watch.

USD/JPY Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account