eur-usd

EURUSD Fails at 1.12 Again as European Inflation Keeps Slowing

Skerdian Meta•Monday, September 30, 2024•2 min read

EURUSD continues to test the 1.12 resistance zone but it keeps failing, today being the last example, with the price climbing above 1.12 twice but reversing back down and ending up 50 pips lower now. The lower CPI inflation reading from European countries today led to some dovish comments from the ECB president Christine Lagarde, which are weighing on the Euro at the moment.

The European economy is contracting, making it difficult for the EUR/USD to maintain gains above the 1.12 level. Despite this, the pair has shown resilience, repeatedly testing the 1.12 resistance zone but failing to break through. While Chinese monetary and fiscal stimulus has supported risk sentiment, the Euro hasn’t fully benefited from it. As the Euro weakened, the EUR/GBP pair also declined, with commodity currencies experiencing losses against the USD.

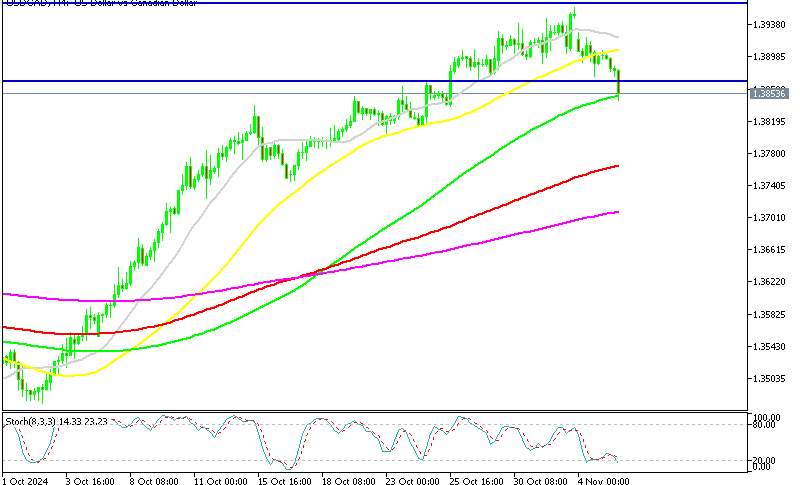

EUR/USD Chart H4 – Sellers Trying to Break Out of the Triangle

German and Italian September Preliminary CPI Inflation Report – 30 September 2024

Germany: CPI (Year-over-Year) by Destatis:

- September: +1.6% (vs. +1.7% expected)

- October: +1.9%

- This marks a slight slowdown in the inflation rate compared to both expectations and the previous month.

- HICP (Year-over-Year):

- September: +1.8% (vs. +1.9% expected)

- Prior: +2.0%

- The Harmonized Index of Consumer Prices (HICP) also showed a decrease, indicating cooling inflation pressures.

Italy CPI (Year-over-Year) by Istat:

- September: +0.7% (vs. +0.8% expected)

- Prior: +1.1%

- Italy’s inflation rate continues to soften, falling below both expectations and the prior month’s reading.

- HICP (Year-over-Year):

- September: +0.8% (vs. +1.0% expected)

- Prior: +1.2%

- The HICP in Italy also eased further, reflecting the broader trend of declining inflation across Europe.

These reports suggest that inflation continues to decelerate in both Germany and Italy, reflecting weaker price pressures heading into the final quarter of 2024, with other sectors of the economy also weakening further. Today’s numbers from Germany and Italy, coupled with dovish comments from ECB President Christine Lagarde come in the wake of lower-than-expected inflation from France and Spain last week, reinforcing growing calls for the ECB to cut interest rates in October.

EUR/USD Live Chart

EUR/USD

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.

2 hours ago

Save

Save

2 hours ago

Save

Save

5 hours ago

Save

Save