Solana (SOL) Faces Mixed Signals: FTX Wallet Movement and Market Resilience

In a recent development, a wallet associated with the defunct cryptocurrency exchange FTX and its sister company Alameda Research has unstaked 177,693 Solana (SOL) tokens, valued at approximately $23.75 million. This movement, reported by blockchain security firm PeckShield on September 12, has sparked discussions within the crypto community about a potential selloff.

The wallet in question, identified as H4y…gFZ on Solscan, still holds a substantial 7.057 million SOL tokens, worth around $954 million, which remain staked. This recent activity mirrors similar moves observed in November and December 2023, when the same address unstaked significant amounts of SOL and transferred them to Coinbase.

Market Speculation and Price Resilience

While some market participants speculate about a possible liquidation, as tokens are typically moved to centralized exchanges (CEXs) for selling after unstaking, analysts suggest the impact on SOL’s price may be limited. The unstaked amount represents a relatively small portion of the wallet’s total holdings, which account for 1.5% of SOL’s circulating supply.

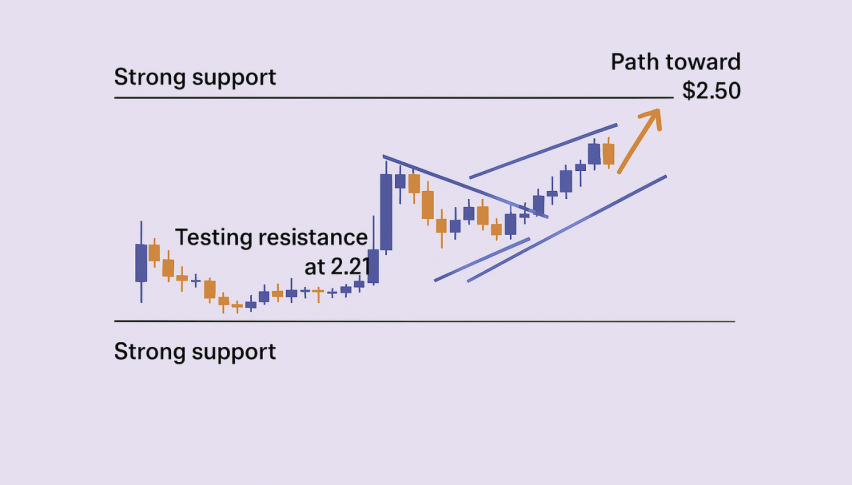

Despite these concerns, Solana’s price has shown resilience. As of September 13, 2024, SOL is trading near $135, marking a 5% increase over the past 24 hours. This stability comes in the wake of recent market volatility influenced by US inflation data and increased activity within the Solana ecosystem.

Solana Ecosystem Activity Surge

The Solana network has seen a surge in decentralized exchange (DEX) trading volumes, with a 7% increase since September 5, according to DefiLlama data. Additionally, the total value locked (TVL) in the Solana network has grown by 11% from the previous month, now standing at 36 million SOL.

Upcoming Solana Breakpoint Conference

Looking ahead, the crypto community is eagerly anticipating the Solana Breakpoint conference, set to begin on September 20 in Singapore. The event is expected to feature announcements of new projects and potential token airdrops, which could further impact SOL’s price trajectory.

Long-term Outlook and Potential Catalysts

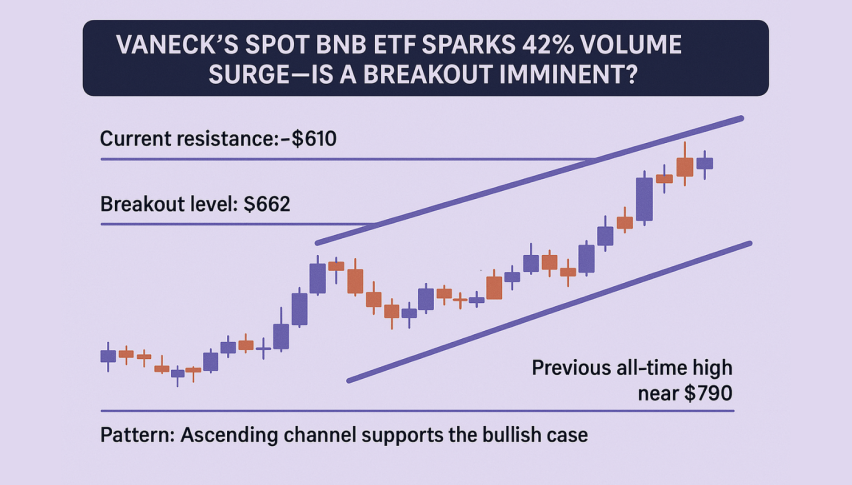

While Solana’s price has moderated since its March peak of $209, coinciding with Bitcoin’s new all-time high, market watchers remain optimistic about its long-term potential. Factors such as advancements in network technology, renewed interest in meme coins, increased institutional investments, and possible ETF launches could contribute to future price increases.