NZDUSD Rebounds Off MAs As Market Sentiment Turns Positive

The USD/NZD rate continues to show volatility, with NZD/USD climbing nearly 1 cent yesterday after a downward trend earlier this month.

The USD/NZD exchange rate continues to show volatility, with NZD/USD climbing nearly 1 cent yesterday after a downward trend earlier this month. Buyers managed to push the pair 4.5 cents higher, bringing it close to 0.63 and breaking through the 0.62 resistance level, marking a high for 2024. However, these gains were short-lived as buyers began to show signs of weakening.

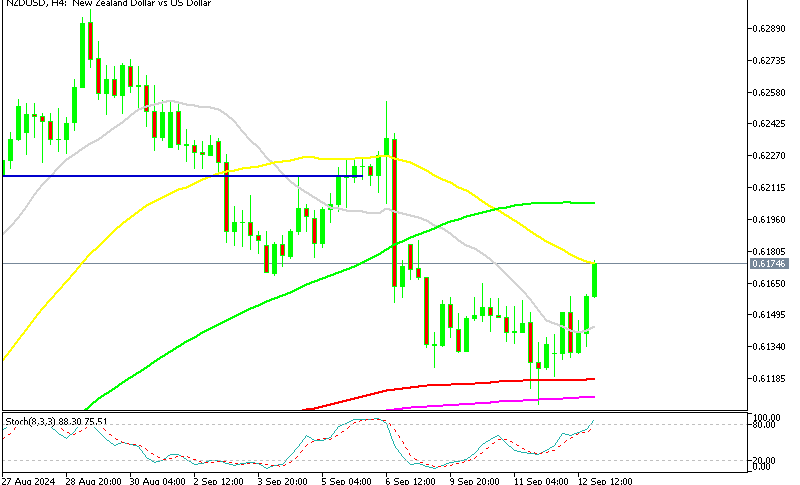

NZD/USD Chart H4 – Buyers Slowing ahead of the 100 SMA

On the H4 technical chart, we see that NZD/USD found support at the moving averages, where the price consolidated for a few days, showing that buyers weren’t letting go below 0.61. The price formed a doji candlestick which is a bullish reversing signal and the bullish move came, with NZD buyers pushing this forex pair to the 50 SMA (yellow).

NZD/USD Chart Daily – Buyers Slowing ahead of the 100 SMA

In September, the pair dipped again below resistance, touching the 100-day SMA (green) on the daily chart. This level became a key support point, sparking yesterday’s reversal and halting the decline. After forming a hammer candlestick on Wednesday, a bullish reversal was signaled, and the stochastic indicator on the daily chart approached oversold territory. Moving forward, resistance lies near 0.6170, and sellers will likely remain active if the price stays below this level. A move above 0.6170 could lead to a test of the previous resistance at 0.6220 on the upside.

BusinessNZ Manufacturing Index for August

New Zealand’s Manufacturing PMI for August came in at 45.8, up from the previous 44.4 (revised from 44.0). Despite the slight improvement, the PMI remains below the long-term average of 52.6, indicating the sector has been contracting for 18 straight months.

Key insights:

- Sub-index improvements: Production (46.3) and New Orders (46.8) saw their highest levels in several months, hinting at some stabilization.

- BusinessNZ’s Director, Catherine Beard: The recent uptick in these sub-indices is a positive sign, but overall, conditions remain tough for manufacturing.

- BNZ’s Senior Economist, Doug Steel: While indicators like business confidence and building consents have shown potential for improvement over the next year, the PMI reflects that current conditions in the sector are still difficult.

NZD/USD Live Chart

NZD/USD- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account