XRP Poised for Potential Breakout as Ripple Expands Blockchain Research Initiatives

In a significant move for the cryptocurrency space, Ripple, the leading provider of digital asset infrastructure, has renewed its strategic partnership with NYU Abu Dhabi through its University Blockchain Research Initiative (UBRI). This extension, which brings the total funding for NYU Abu Dhabi’s research projects and student initiatives to over $1 million, underscores Ripple’s commitment to advancing blockchain research and fostering innovation in the region.

Reece Merrick, Ripple’s Managing Director for the Middle East and Africa, emphasized the shared vision between Ripple and NYU Abu Dhabi in unlocking the full potential of blockchain research and innovation. The UBRI program, which has allocated over $60 million since its launch in 2018, supports blockchain research at more than 58 universities globally.

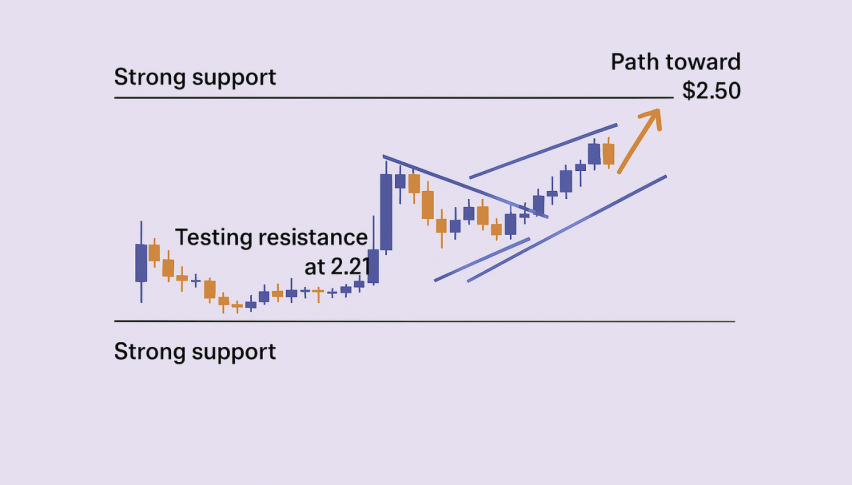

XRP/USD Technical Analysis: Symmetrical Triangle Formation

As Ripple continues to deepen its engagement in the UAE and the Middle East, the cryptocurrency XRP, closely associated with Ripple, is showing signs of potential price movement. Brett, a well-known Bitrue ambassador and influential figure in the crypto world, recently shared an analysis highlighting a symmetrical triangle pattern within an ascending channel for XRP. According to Brett’s insights, a confirmed breakout could potentially target a price as high as $24, representing a significant jump from current levels.

Current Market Position and Key Levels

The current XRP price stands at $0.5344, up 1.03% in recent trading. Technical analysis suggests that XRP is facing resistance at the $0.60 level, with support levels crucial at $0.52 to $0.53. The symmetrical triangle formation observed in the charts often indicates a consolidation phase, which could lead to a sharp breakout in either direction.

Bullish Indicators: Declining Exchange Supply

Adding to the bullish sentiment, data from Santiment shows that the XRP supply on exchanges has dropped to its lowest point in approximately seven months. This declining supply typically hints at reduced immediate selling pressure, as more investors opt for self-custody methods.

Regulatory Considerations: Ongoing Ripple vs. SEC Case

However, it’s important to note that the ongoing legal battle between Ripple and the SEC could impact XRP’s price. Both parties have until early October to contend with the recent ruling, which ordered Ripple to pay a $125 million fine for violating certain securities laws.