Ethereum Struggles to Find Footing in the Growing Crypto Market

Ethereum (ETH), the world’s second-largest cryptocurrency by market cap, faces a multitude of challenges as it attempts to maintain its dominance in the ever-changing digital asset landscape.

Ethereum’s Market Share Slips on Decentralized Exchanges (DEXs):

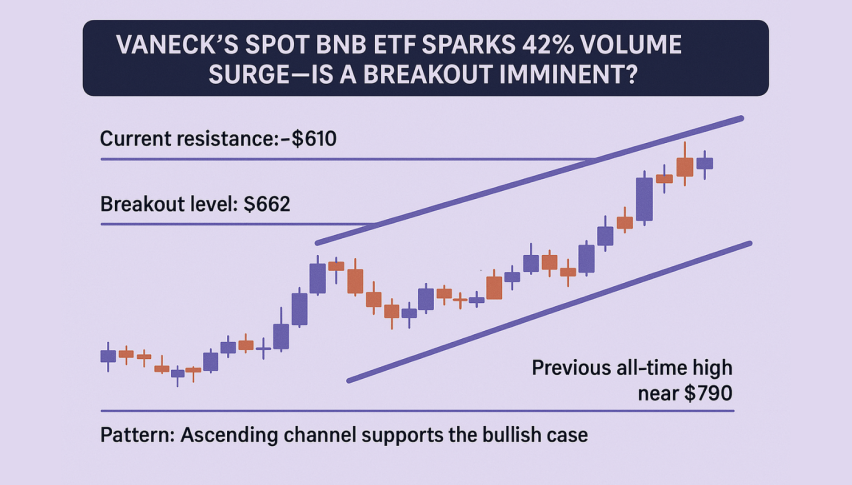

A recent report by VanEck highlights a decline in Ethereum’s DEX trading volume share, dropping from 42% in 2022 to 29% in 2024. This decrease is attributed to competition from faster blockchains like Solana, Sui, and Aptos, which are attracting users and developers due to their higher transaction processing speeds.

Ethereum’s congested network and high gas fees are driving developers towards alternative platforms for building new tokens. Despite the Dencun upgrade in March 2024 aimed at lowering fees, the influx of layer-2 solutions may have overshot the current demand, leading to a sharp drop in network fees.

Ethereum Lags Behind in Price Performance

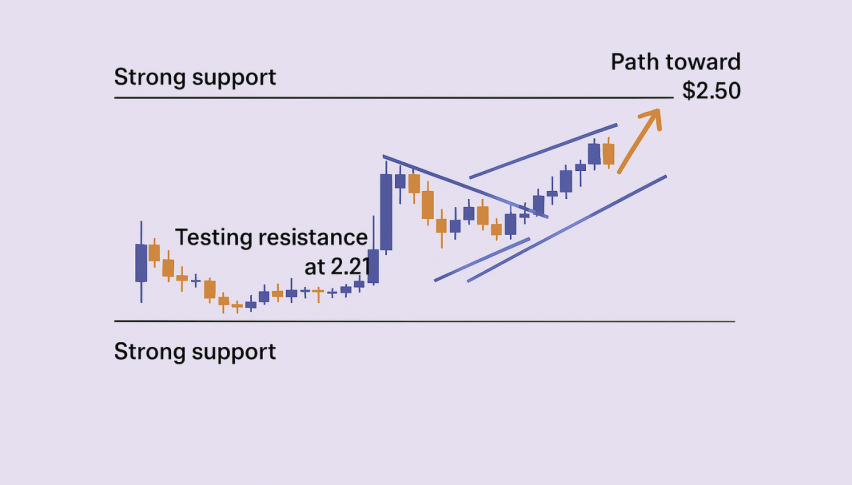

Analysts at CryptoQuant reveal a concerning trend: Ethereum’s price performance has fallen behind Bitcoin by a significant margin (up to 44%) since the “Merge” to proof-of-stake two years ago. Even the approval of Ethereum spot ETFs in July failed to spark a rally, with the ETH/BTC ratio currently at its lowest point since April 2021.

CryptoQuant analysts warn of further downside for Ethereum relative to Bitcoin. Ether could potentially lose another 50% against Bitcoin to reach an “undervaluation zone.” This underperformance is linked to Ethereum’s weaker network activity metrics compared to Bitcoin, with transaction count reaching one of its lowest points since 2020 when measured against Bitcoin.

The Future of Ethereum

Ethereum’s ability to navigate these challenges will be crucial in determining its future. Addressing network scalability, attracting developers back to its ecosystem, and improving overall network activity are essential steps for Ethereum to reclaim its lost ground.