Bitcoin Price Dips Below $56,000 as Market Sentiment Shifts to “Extreme Fear”

Bitcoin (BTC) has experienced a significant price drop, briefly falling below $56,000 and sparking concerns among investors. The leading cryptocurrency is currently trading at $56,500, marking a less than 1% increase over the past 24 hours, according to data from CoinMarketCap.

The recent price decline has had a profound impact on market sentiment, with the Crypto Fear & Greed Index plummeting to a score of 22 on September 6. This score indicates “extreme fear” in the market, representing a seven-point drop from the previous day and the lowest level since August 8.

Bitcoin’s Bearish Predictions and Economic Concerns

Arthur Hayes, co-founder of BitMEX, has added fuel to the bearish fire by predicting a further 12% drop in Bitcoin’s price. Hayes stated on X (formerly Twitter), “BTC is heavy. I’m gunning for sub $50k this weekend. I took a cheeky short.” His prediction aligns with growing concerns about a sluggish U.S. economy and disappointing jobs data, which have raised questions about the Federal Reserve’s anticipated interest rate cuts.

BTC Liquidations and Market Impact

The price dip has led to significant liquidations in the crypto market, with $94.26 million worth of positions liquidated in the last 24 hours. Long positions accounted for the majority of these liquidations, with $36.71 million in Bitcoin longs and $17.36 million in Ethereum longs being wiped out.

Analyst Predictions and Potential Recovery

Despite the current downturn, some analysts see potential for recovery. Crypto analyst Kaz The Shadow suggests that Bitcoin might experience a short-term bounce before potentially dropping to the $47,000-$44,000 range. He views this level as a critical support zone that could precede a strong rebound towards new all-time highs.

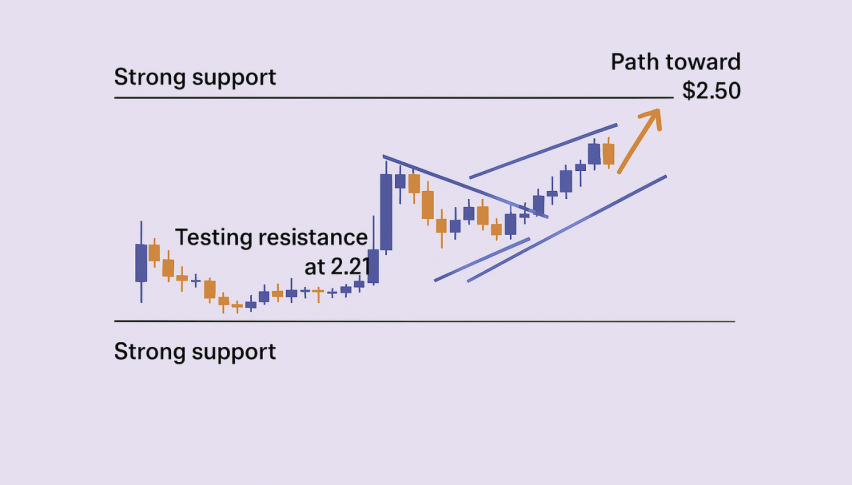

BTC/USD Technical Analysis and Key Levels

Technical analysis indicates that Bitcoin is currently facing resistance near the $57,000 level, with a bearish trend line forming at $57,050 on the hourly chart. The next key resistance is expected around $57,750, with a potential upside target of $60,000 if this level is breached.

On the flip side, if Bitcoin fails to overcome these resistance levels, it could face further decline. Support levels to watch include $56,000 and $55,600, with a potential drop to $53,500 if bearish momentum continues.