Bitcoin down 12% in August

Bitcoin price action showed vulnerability after the $60K support was breached later this week.

The digital asset experienced a more than 12 percent monthly decline, undoing the gains from July. Bitcoin’s value has dropped by more than 20 percent since reaching an all-time high of almost $73,500 in April, despite some encouraging signs such as increasing institutional adoption, a potentially more accommodative regulatory environment, and impending Federal Reserve rate cuts.

Coinglass data revealed the crypto market recorded over $321 million worth of liquidations on Wednesday after Bitcoin dropped below $60K for the first time in about a week.

Bitcoin hovers around $59.1K at the time of this publication. The most valuable crypto asset extends its value by nearly 1% on the day after suffering heavy losses the prior day.

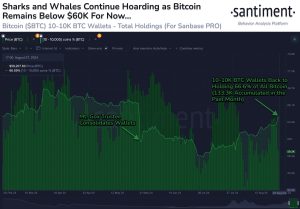

Santiment data revealed that the digital asset key support is now $58.9K. For the past month, BTC wallets holding between 10 and 10K BTC have added 133.3K coins, whereas the smaller ones remain with excess BTC and are in a rush to sell these to them

If Bitcoin fails to hold towards the support at $58K, its situation could worsen for the bulls because there’s no telling how low Bitcoin’s price could drop and whether these factors have already been fully priced in.

Funding rates are defined in this manner, they represent time-based payments made by and to traders of crypto derivatives contracts known as perpetual swaps based on the difference between the price of the index and the price of a futures contract.

During his speech, Federal Reserve (Fed) chief Jerome Powell suggested that there could be an interest rate cut for September to trigger the market to open long positions in Bitcoin and Ethereum. However, the latest liquidation shows that the market went the other way.

Jerome Powell’s comments are what Scout believes were the catalysts that the market desperately needed sparking positivity that more down rate is coming. However, he failed to give any concrete timing.

A key support level for Bitcoin in the months that followed the spot Bitcoin exchange-traded funds (ETF)’s approval in January was early presumed to be at $64K, However, this confidence changed recently in August. 5, the mood infamously known as “Crypto Black Monday” saw Bitcoin breaching the $50K support line.