EURUSD Holds Below 1.11 As Eurozone Inflation Falls

The EUR/USD has turned lower this week after showing strong buying momentum earlier in the month. Yesterday, German CPI inflation data came in soft, with a decline of -0.1% in August, further pressuring the Euro and pushing EUR/USD below 1.11. This followed a rise above 1.12 last Friday, driven by dovish comments from Federal Reserve Chairman Jerome Powell at Jackson Hole, which marked a breakout from a year-long trading range. However, dollar buyers returned, causing the pair to drop around 150 pips over two days.

On Wednesday, EUR/USD dropped by 80 pips, breaking below the key support level of 1.1100 during the US session. The pair faced multiple headwinds, including weak inflation data from Spain and Germany, indicating that price pressures continued to ease in August. This fueled speculation about an imminent interest rate cut by the European Central Bank (ECB), pushing EUR/USD below the 50 SMA (yellow) on the H4 chart during the European session. The decline continued in the US session as the upward revision in Q2 Gross Domestic Product (GDP) data added further downward pressure on the pair.

EUR/USD Chart H4 – The 50 SMA Has been Broken

The weaker inflation figures from Germany and Spain were a precursor to today’s Eurozone CPI inflation report. The expectation of a rate cut by the ECB in September has solidified, given the persistent downward pressure on Eurozone prices and the region’s bleak economic outlook.

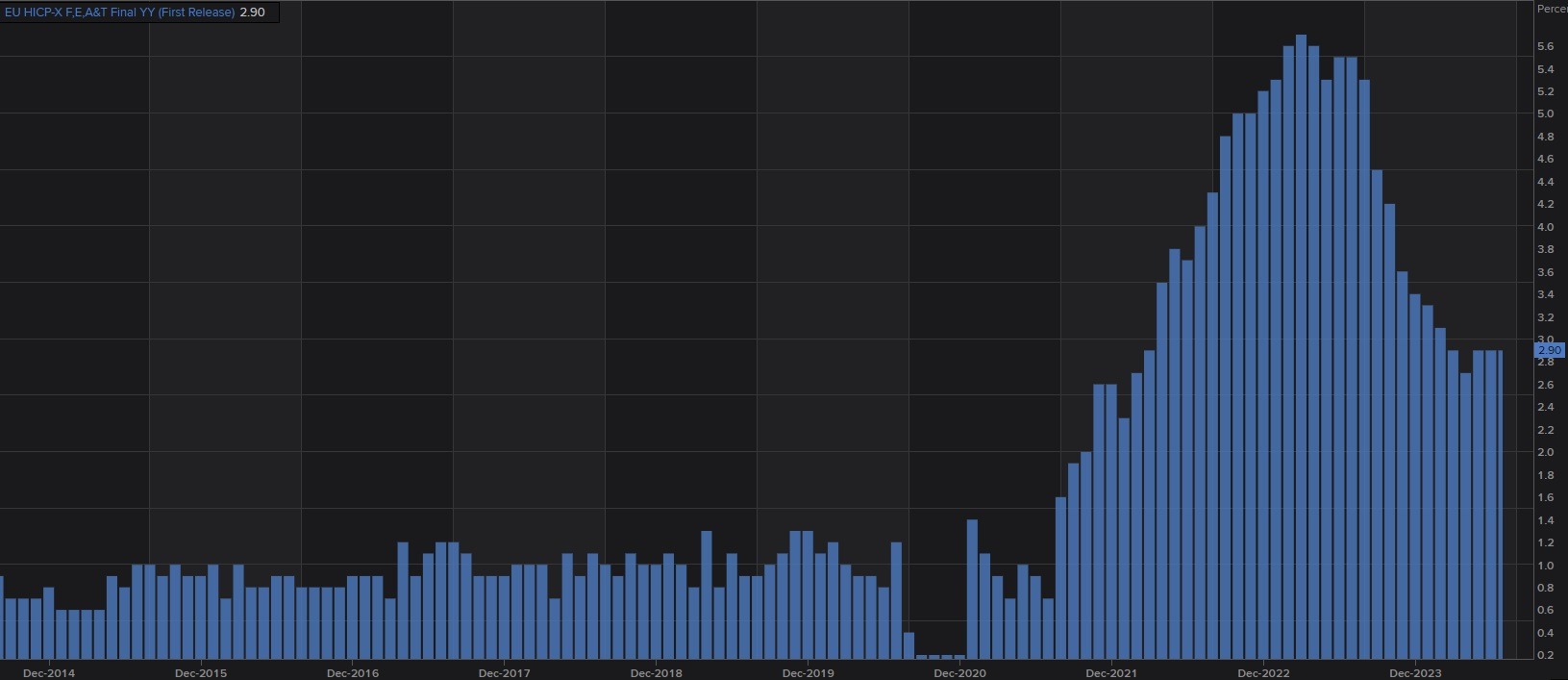

Eurozone August CPI Inflation Report

- Headline HICP Year-over-Year: 2.2%, matching expectations of 2.2%

- Core HICP (excluding Food, Energy, Alcohol, and Tobacco) Year-over-Year: 2.8%, in line with the forecast of 2.8%

- HICP excluding Food and Energy Year-over-Year: 2.7%, meeting the expected 2.7%

The Eurozone’s flash Harmonized Index of Consumer Prices (HICP) data for this month has come in precisely as forecasted across all key measures. The headline inflation rate remains steady at 2.2% year-over-year, indicating that overall price levels are increasing at a moderate pace. Meanwhile, core inflation, which excludes more volatile items such as food, energy, alcohol, and tobacco, also aligns with expectations at 2.8%.