Bitcoin Slumps After Brief Foray Above $65,000

Bitcoin (BTC) has hit a rough patch this week, surrendering gains made after Federal Reserve Chair Jerome Powell’s dovish comments and the pro-crypto alliance between Donald Trump and RFK Jr.

Bitcoin’s Sharp Price Drop

Bitcoin plunged nearly 6% in a short timeframe on Tuesday, erasing all the progress from the previous week. The price briefly touched $58,200 before a small recovery, but it currently sits at $58,800, down 4.5% in 24 hours. The broader crypto market mirrored this decline, with the CoinDesk 20 Index falling by a similar amount.

Why Did Bitcoin Price Decline?

The downturn coincides with a broader sell-off in the U.S. stock market, led by a 1.3% drop in the tech-heavy Nasdaq. Disappointing earnings expectations from Nvidia, a major chipmaker, might be contributing to the market anxiety.

Some investors might be reassessing their optimism after initially interpreting Powell’s remarks as a sign of imminent interest rate cuts. The upcoming government jobs and inflation reports for August could influence the Fed’s decision on rate cuts in September.

BTC/USD Technical Analysis

Bitcoin’s volatility has been on the rise, leading to more frequent price swings. The annualized volatility recently surged above 65%, significantly higher than previous months. This volatility is particularly impactful on leveraged positions in Bitcoin futures markets.

The Bitcoin futures premium briefly dipped below the neutral level, indicating a decline in bullish sentiment. However, the impact on professional traders seems limited, with forced liquidations being relatively small compared to the Aug. 5 crash. Stablecoin demand in China, a gauge of retail interest, remains neutral, with no signs of renewed enthusiasm.

Bitcoin’s Future Outlook

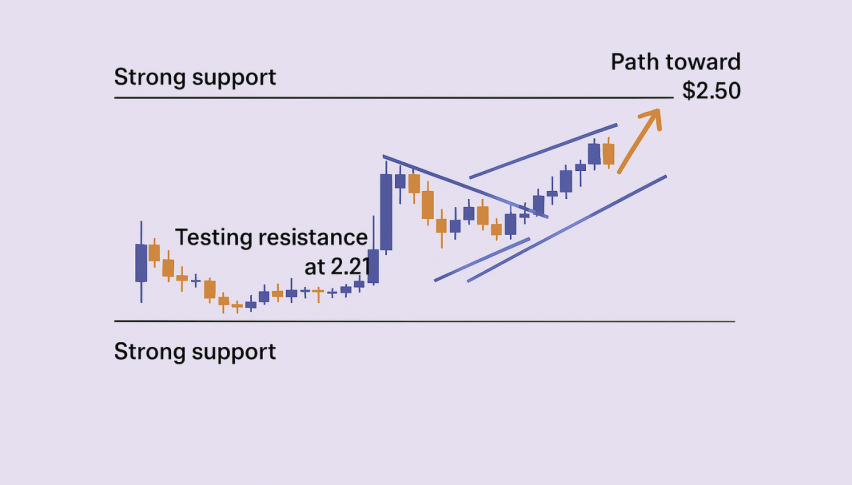

Bitcoin is currently consolidating around $58,500. A break above $60,500 is needed for a near-term recovery.

Resistance levels at $60,200 and $61,500 could hinder potential upward movement. Conversely, a failure to surpass $60,200 could lead to further price drops towards $57,650 or even $56,500.