Will We See $3,000 in Gold in 6 Months?

Gold has been on a steady upward trend since March when it was trading at $2,000, gaining $500, which suggest $3,000 for XAU by February.

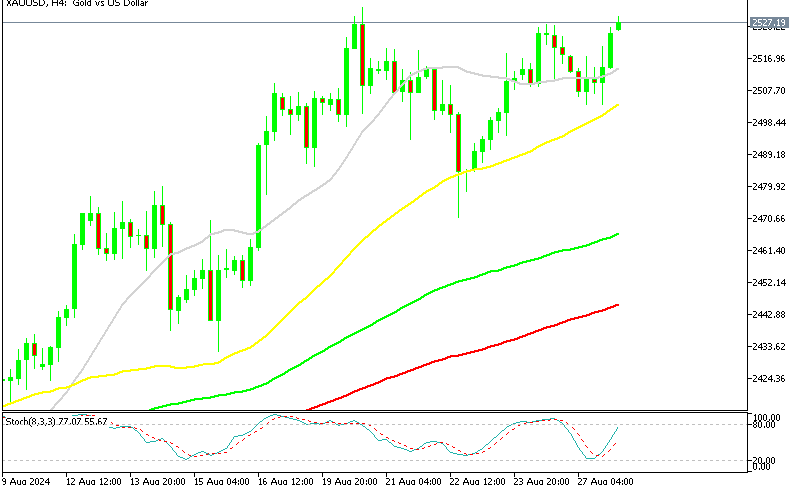

Gold has been on a steady upward trend since March when it was trading at $2,000, consistently reaching new highs. Recently, it has been approaching the all-time high of $2,531, set last week. After a sharp drop below $2,470 on Thursday, buyers quickly stepped in, and yesterday’s decline was relatively mild. The price has since recovered, pushing back above $2,525.

Gold Chart H4 – MAs Keeping XAU Supported on Dips

Impact of Federal Reserve Signals on the Gold Price

Federal Reserve Chairman Jerome Powell indicated that the monetary policy easing process has begun, which led to a decline in the USD and a boost in gold prices. Powell hinted at potential rate cuts in September, including the possibility of a 50 basis point reduction. This dovish stance has kept investor sentiment positive and benefited gold, especially as US Treasury yields have been falling.

Market Reactions and Economic Data

Despite stronger-than-expected US economic data, such as the CB Consumer Sentiment Index indicating increased optimism among American consumers in August, the USD remained weak. This weakness provided further support for gold prices. While buyers have maintained control, gold has struggled to break through the key resistance level of $2,530 since last Tuesday, with traders awaiting additional catalysts.

Looking Ahead: Key Events

Traders are now focused on Friday’s release of the core Personal Consumption Expenditures Price Index (PCE), the Fed’s preferred inflation measure. The technical outlook for gold remains positive, with moving averages offering support during price dips and the formation of higher lows. However, for gold to gain sustained upward momentum, it must settle above the $2,531 level.

Gold Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account