Russia to Launch Crypto Exchange Trials on September 1 Amid Sanctions

Russia is set to begin trials for cryptocurrency exchanges and cross-border transactions on September 1, aiming to address the growing

Russia is set to begin trials for cryptocurrency exchanges and cross-border transactions on September 1, aiming to address the growing challenges in international payments due to global sanctions.

This move is seen as a strategic effort by the country to bypass the economic hurdles imposed by over two years of international restrictions.

Russia to Test Crypto for Trade🚀

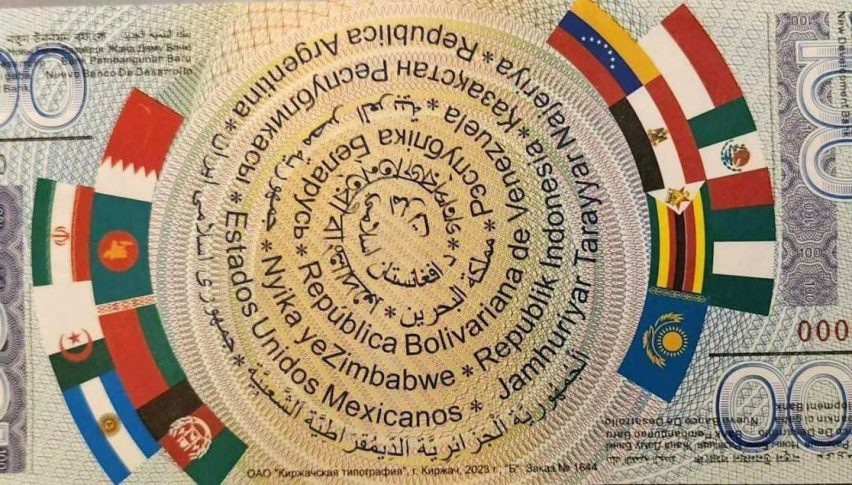

Russia to trial crypto for global trade on Sept 1, aiming to bypass U.S. sanctions and reduce dollar reliance.

Could this reshape international finance?🌐#Crypto #Russia #BRICS #Trading pic.twitter.com/VHO0t0ch5c

— Ashlay Joe (@AshlayJoe) August 27, 2024

New Legislation to Facilitate Crypto Payments

In July, Russian lawmakers passed legislation that legalized crypto mining and established a framework for testing digital tokens for cross-border payments. President Vladimir Putin signed these bills into law on August 8, marking a significant shift in the country’s stance on digital currencies.

The latest updates on cryptocurrency regulation includes

👇👇👇👇– Global Regulations

The International Organization of Securities Commissions has laid out 18 recommendations for global rules on managing crypto and digital assets. The World Economic Forum’s Pathways to the… pic.twitter.com/88cXPz7kO3— Nada (@Nada_D_Raw) August 27, 2024

The trials will involve the National Payment Card System, facilitating the exchange between rubles and cryptocurrencies, and providing a practical solution for Russian businesses struggling with foreign transactions.

Addressing International Payment Barriers

Russian companies have faced significant obstacles in paying foreign suppliers and receiving payments for exports, especially after the United States expanded the scope of sanctions against foreign banks dealing with Russia in June.

Choosing the wrong cross-border solution can be costly for your business.

The right solution must meet your current business needs and be flexible enough to accommodate your growth and future needs.

So, how do you find the right cross-border payment solution?

Find the… pic.twitter.com/ggOOnslx7X— Kora (@thekorahq) August 27, 2024

In response to these challenges, Russia’s central bank, which had previously considered a blanket ban on cryptocurrencies before the Ukraine invasion, is now actively supporting using digital assets to circumvent these restrictions.

The Role of Stablecoins in Streamlining Payments

Beyond Russia, the broader potential of cryptocurrencies, particularly stablecoins, in revolutionizing cross-border payments is gaining attention. Traditional international payment methods, such as wire transfers, are often slow, costly, and subject to various regulatory constraints.

Stablecoins, however, offer a faster and more cost-effective alternative, enabling near-instantaneous transactions with fewer intermediaries and lower fees.

Moreover, because stablecoins are pegged to stable assets like the U.S. dollar, they mitigate the risk of currency fluctuations, ensuring businesses receive or pay the intended amount.

Conclusion:

Russia’s upcoming trials of cryptocurrency exchanges reflect a growing global interest in digital currencies as a solution to payment challenges.

As these trials unfold, the impact on Russia’s economy and its ability to navigate around international sanctions will be closely watched by the global financial community.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account