GBPUSD Well Supported Despite “Painful” UK Budget

The European trading session was relatively quiet again with no significant data releases to move the markets, but GBPUSD remains supported.

The European trading session was relatively quiet again with no significant data releases to move the markets, but GBPUSD remains supported. The primary headline came from UK Prime Minister Keir Starmer, who warned of a “painful” budget to be unveiled in October, hinting at potential tax increases. However, he assured that there would be no tax hikes for workers, aiming to balance fiscal responsibility with economic sensitivity.

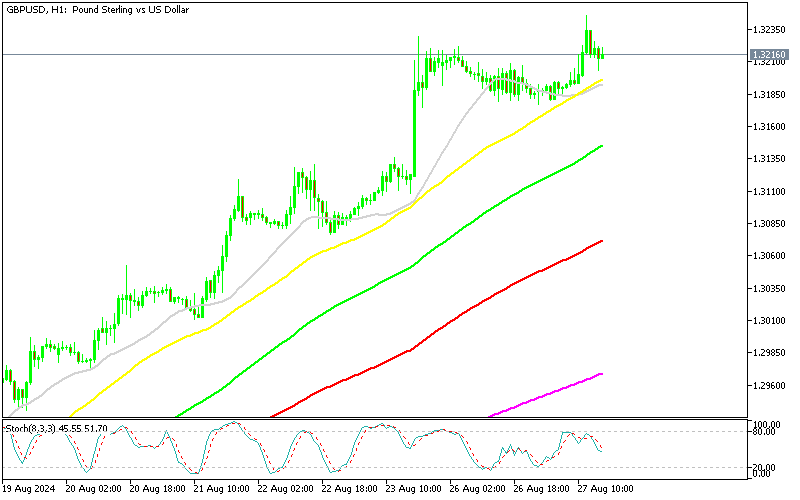

GBP/USD Chart H1 – MAs Keep Pushing the Lows Higher

Price Action in Markets and Bond Yields

Market movements were minimal overall, with the most noticeable changes occurring in the bond market. Long-term Treasury yields have been rising faster than short-term yields, suggesting a potential shift in investor sentiment. While this could simply be daily fluctuations, it is worth monitoring, especially as the Federal Reserve continues to navigate policy decisions amidst what remains a relatively resilient economy.

Focus Shifts to the US Trading Session

Attention is now turning to the American trading session, where the US Consumer Confidence report will be a key focus, particularly the labor market data embedded within it. The labor market indicators from this report could provide fresh insights into the economic outlook and influence market expectations about future Fed policy moves.

UBS Increases US Recession Probability

UBS Global Wealth Management has increased its estimate of the probability of a U.S. recession to 25%, up from the previous 20%. This adjustment reflects growing concerns about the economic outlook, which could keep the US dollar under pressure. Meanwhile, the British pound continues to gain strength, despite discussions around a stricter budget and rising tax revenues, such as VAT, which have increased due to higher prices. These developments underscore the complex balancing act facing policymakers as they manage economic growth and fiscal stability.

UK PM Starmer’s Budget Warning

UK Prime Minister Keir Starmer has issued a warning about the upcoming budget in October, describing it as “painful.” He emphasized that those with the “broadest shoulders” will be expected to bear the heaviest financial burden. Starmer acknowledged that he will need to make significant demands on the public, asking them to endure short-term pain for the sake of long-term benefits. This approach suggests that the government may introduce measures aimed at redistributing wealth or increasing taxes on higher-income earners to address fiscal challenges and invest in the country’s future.

GBP/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account