XRP Undervalued? Ripple Capped Below $0.66 amid Exploding Bitcoin and Ethereum Prices

XRP is in an uptrend but trailing the rest of the markets, per the development in the daily chart. Though Bitcoin and Ethereum pulled higher, breaking and retesting crucial liquidation lines, XRP is struggling for momentum. The only positive for now is that the coin is above $0.55. However, what’s needed is a convincing, high-volume close above $0.66 and July highs for buyers to confirm gains. Before then, the sideways chop might continue, sapping momentum and engagement.

The lull in XRP is evident in how prices have been performing. To put in the numbers, the coin is flat in the past day but up 4%. As things stand, engagement is also within average, at around $810 million. Unless there is a breach of $0.66 and July highs, momentum will continue to be low, and traders will be at bay. This state of affairs will remain until there is a trend definition.

Traders are bullish and closely monitoring the following trending XRP and Ripple news:

- Ripple, the blockchain firm, is now minting RLUSD on the XRP Ledger and Ethereum. The stablecoin will be pegged 1:1 versus the greenback, the United States treasuries, and other liquid cash equivalents. As the stablecoin scene heats up, how the Ripple product fares remains to be seen.

- The stagnation below $0.66 seen in XRP is partly due to the liquidation by whales. Cumulatively, whales sold over $26 million of multiple derivatives, including those of XRP.

XRP Price Analysis

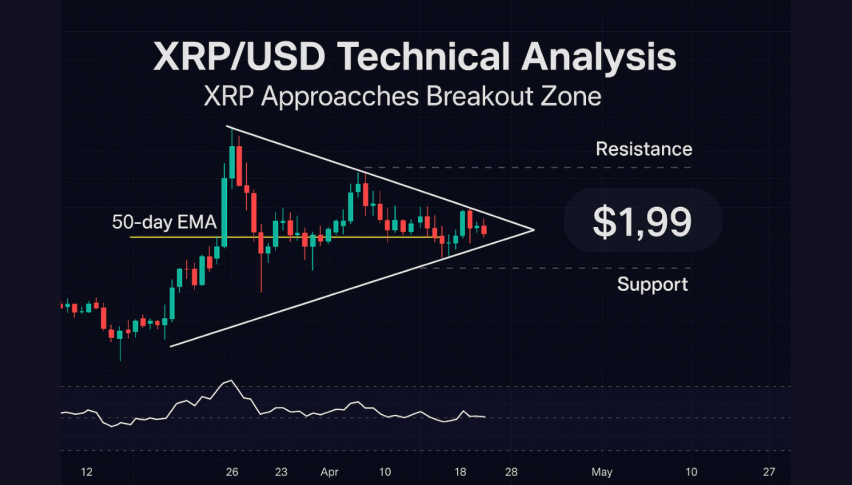

XRP/USD is firm at press time, and possible undervalued.

The immediate liquidation line is $0.66.

On the lower end, the primary support is $0.55.

Depending on the breakout direction, the current consolidation can either be accumulation or distribution.

As things stand, a breach of $0.66, at the back of expanding volume, can see XRP soar to $0.74.

It may present an opportunity for conservative traders to wait for the definition of trends.

Before then, since the uptrend is valid, despite the sideways movement, aggressive traders can load the dips above $0.55.

Any unexpected crash below $0.55 will nullify this outlook; slowing down the uptrend.