Forex Signals Brief August 23: Traders Looking at the Jackson Hole

Yesterday the USD found some support after declining for three weeks, but Powell might send it lower again during the Jackson Hole Symposium

Yesterday it was a services and manufacturing day, with European manufacturing weakening while services only held up due to the Paris Olympics. The UK saw some positive numbers all around, with services and manufacturing in expansion, beating expectations, which helped push the GBP higher before the US data.

We saw some positive Existing Home Sales and Unemployment Claims, backed by better Services PMI which showed that these sectors remain in decent shape, which helped the USD after a bearish month. The recent market pattern of a lower dollar and rising stocks took a turn yesterday, largely due to concerns over Fed Chair Powell’s potentially hawkish speech at the Jackson Hole Symposium. This shift was also supported by another round of U.S. economic data pointing to a sluggish economy.

Around midday, the U.S. dollar gained strength in a sharp, one-leg rise, which then moved sideways. Attempts to push the dollar higher, fueled by a weaker TIPS auction and declining stocks, were unsuccessful as the euro resisted falling below 1.11. In the gold market, the trend reversed as well. Gold initially faced selling pressure and triggered stop losses when it fell below $2,500 but found support and began climbing back towards $2,470.

Today’s Market Expectations

Today it kicked off with the CPI inflation report from Japan. The overall CPI rose by 2.8% year-over-year, which is slightly above the expected 2.7% and matches the prior figure of 2.8%. The Core CPI, which excludes fresh food, increased by 2.7% year-over-year, aligning with expectations and up from the previous 2.6%. Meanwhile, the Core-core CPI, which excludes both fresh food and energy, rose by 1.9% year-over-year, meeting expectations. This marks the first time it has fallen below 2% since September 2022, down from the previous 2.2%.

The U.S. New Home sales data is expected to show an increase from 617K to 628K. However, enthusiasm in the home-building sector is waning. June saw a 0.6% decline in new home sales, marking the second consecutive drop and leaving sales 7.4% below last year’s levels. Analysts from Wells Fargo note that a weaker job market and expectations of lower future mortgage rates are cooling demand, while builder incentives are becoming less effective. In June and July, 61% of builders offered incentives, the highest rate since January.

The main focus this week is Fed Chair Powell’s upcoming speech at the Jackson Hole Symposium, scheduled for 14:00 GMT. This event is crucial as it often serves as a platform for the Federal Reserve’s key policy announcements. Powell is expected to signal a rate cut in September, possibly indicating that “the time to ease policy has come.” Although the market has already anticipated at least three rate cuts by the end of the year, such a statement would still be a significant market-moving event. While Powell is likely to sidestep questions about a 50 basis point cut, any hint of openness to a larger reduction would be taken as a dovish move, which would force the USD to resume the downtrend.

Yesterday the USD made an attempt at a comeback, especially after the positive economic data from the US, which sent the USD popping higher, catching us on the wrong side with a couple of Gold signals, which dived around $45 lower. We opened six trading signals in total, ending up with one winning trade and two losing ones, while three forex signals carried onto today.

Gold Holds Above $2,500

Gold reached a new all-time high of $2,531 earlier this week but has since pulled back, dropping $40 today despite positive U.S. economic data. Home sales showed a surprising gain, reversing the downward trend of recent months, while the Services PMI surged past 55 points, signaling solid expansion in that sector. This data has strengthened the U.S. dollar, putting pressure on other assets, including gold (XA), which fell below $2,470 before finding some support.

XAU/USD – Daily chart

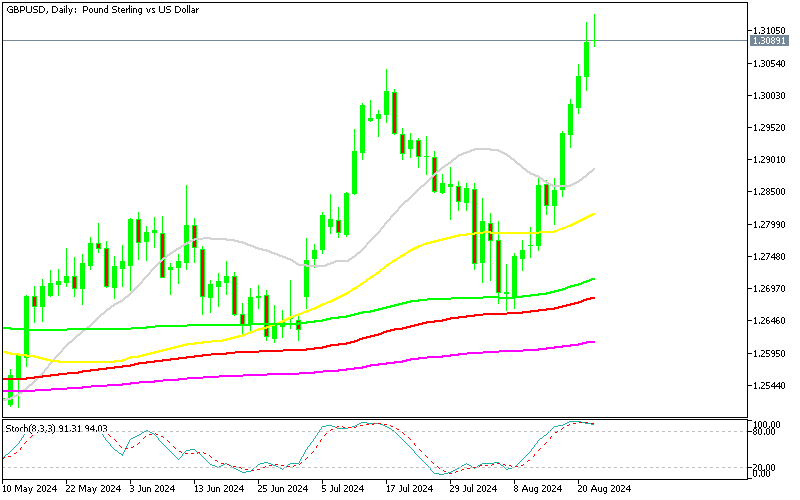

GBP/USD Closes the Day With A Doji

The GBP/USD pair has shown impressive strength, rebounding off the moving averages on the daily chart. Yesterday’s strong UK Services and Manufacturing PMI data drove the pair to 1.3130, although it later slipped below 1.31, where the 50-day SMA (yellow) provided support.

GBP/USD – Daily Chart

Cryptocurrency Update

Bitcoin Holds Above $60k but the 50 SMA Keeps It Down

In the cryptocurrency market, Bitcoin experienced a sharp drop midweek, losing nearly 3% to fall to $57,700, which dragged down the broader crypto market. Earlier in the week, Bitcoin briefly surged to $61,830, fueled by significant investments from well-known financial institutions like MicroStrategy and increased interest in Bitcoin ETFs. Despite these gains, Bitcoin’s price remains volatile, averaging around $60,000.

BTC/USD – Daily chart

Ethereum Remains Subdued by the 20 Daily SMA

Ethereum has been on a downward trajectory since March, with lower highs suggesting the potential for further declines in August. After dropping from $3,830 to below $3,000 in June, Ethereum briefly rallied above the 50-day SMA due to buying pressure, but new selling pressure led to another bearish reversal. The price fell below the 200-day SMA before bouncing back to over $2,600. Currently, buyers are testing the 20-day SMA (gray), setting the stage for a possible battle between bulls and bears.

ETH/USD – Daily chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account