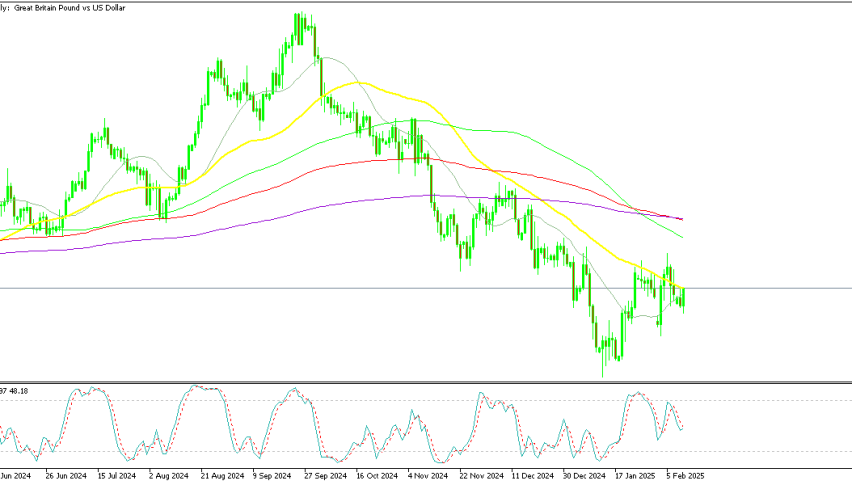

GBP/USD Exchange Rate Rises Following Strong UK Retail Sales Data

The surge in the GBP/USD pair above 1.2850 is due to a complex interaction of factors that includes encouraging UK economic data, expectations about the BoE’s future measures, and a weakening US dollar due to expected actions by the Federal Reserve.

To find out if the Pound can sustain its recent gains or whether it will encounter fresh downward pressure, the recently released UK Retail Sales numbers will be important.

Retail sales rose 0.5% in July 2024, following a revised fall of 0.9% in June

Department stores and sports equipment stores reported a boost following summer discounts and sporting events.

Read more ➡️ https://t.co/wqQfLrF1aq pic.twitter.com/SRe079pei7

— Office for National Statistics (ONS) (@ONS) August 16, 2024

The GBP/USD exchange rate increased above 1.2850 early on Friday, continuing its upward trend.

Recent economic news out of the UK and the US has made investors react positively, changing the market’s view of risk and raising the pound sterling’s value.

In the Asian trading session on Friday, it was noted that the GBP/USD pair was trading around 1.2870.

The Pound has been gaining for the second session in a row following July’s release of UK retail sales data.

Retail sales rose 0.5% in July 2024, following a revised fall of 0.9% in June. Department stores and sports equipment stores reported a boost following summer discounts and sporting events.

This indicates a stronger trend in UK consumer spending, which could mean additional gains for the Pound.

The Pound’s gains were partly attributed to the positive UK economic data released earlier in the week. The UK economy expanded by 0.6% quarter over quarter in the second quarter, as predicted.

In addition, Q2 GDP growth was reported to be 0.9% year over year, up from Q1’s 0.3% increase. These figures demonstrate the UK economy’s steady growth, which has helped the pound appreciate.

On the other side of the Atlantic, the expectation that the Federal Reserve may cut interest rates by 25 basis points in September has put pressure on the US dollar.

The estimate has already been heavily factored in by the market, leading to a depreciation of the US dollar.

An even larger rate cut of up to 50 basis points is still possible, however, it is thought to be less likely; the current odds are roughly 29.5%.

Even so, the US dollar gained some traction on Thursday after better-than-expected GDP data. US retail sales rose by 1.0% in July compared to June’s 0.2% decline, which was far better than the 0.3% increase that was anticipated.

In addition, initial jobless claims for the week ending August 9 were 227,000, below expectations, which helped to stabilize the dollar.

The latest UK Retail Sales report is a top concern for retailers. If retail sales continue to improve after the Bank of England (BoE) cuts interest rates by 25 basis points, it may opt to maintain its current monetary policy.

However, if the sales numbers had come in below forecasts, the BoE might have been under more pressure to consider more rate cuts, which would have been bad for the value of the pound.