US Dollar Weakens Amid Inflation Data Anticipation and Yen Surge

The dollar fell against the yen on Tuesday and against a basket of its rivals in calmer trade as markets awaited US inflation data that could signal the timing of Federal Reserve interest-rate reductions.

The dollar/yen fell as data revealed that US producer prices rose less than expected in July, with a rise in the cost of products offset by cheaper services, suggesting that inflation continued to subside.

Following the PPI news, Treasuries gained, pushing rates lower.

Traders Brace for CPI Report’s Influence on Fed Policy

The more carefully regarded consumer price index report on Wednesday will also influence the Fed’s interest rate policy.

🚨Just In: June US PPI annual inflation rises 2.2%, below expectations for 2.3%.

Core PPI inflation increased 2.4% Y/Y, compared to forecasts for a gain of 2.7%.

Looks like a September rate cut is coming. pic.twitter.com/MklYeZojVi

— Jesse Cohen (@JesseCohenInv) August 13, 2024

Helen Given, associate director of trading at Monex USA, stated that today’s PPI announcement was undoubtedly positive for markets. Traders are interpreting this as a prelude to tomorrow’s CPI, which markets have been gearing for as a potential volatility event after last month’s data revealed that prices had fallen.

Currency markets have been rattled by a rapid increase in the yen since July, which has caused – and has been fuelled by – an unravelling of a popular investment strategy known as the carry trade, contributing to a stock market decline.

However, with the dollar up 0.18% against the yen at 147.23, markets appeared to have passed the worst of the recent turmoil.

The yen fell to a 38-year low in July as investors poured into the carry trade, which involves borrowing yen in Japan at low interest rates and then selling it for other currencies to acquire higher-yielding assets elsewhere.

A combination of factors, including a surprise rate hike by the Bank of Japan and forecasts of rate reduction in the United States due to a sluggish labour market, have combined to reverse the carry trade stampede, sending the yen up nearly 8% since mid-July.

Japan’s Parliament to Address Central Bank’s Decision

Government sources told Reuters on Tuesday that Japan’s parliament will conduct a special session on 23 August to address the central bank’s decision to hike interest rates.

Japan's parliament to hold Aug 23 special session on BOJ rate hike, sources say https://t.co/o05CANNE18 pic.twitter.com/emmfD4JAF3

— Reuters (@Reuters) August 13, 2024

The market wants to see how much hunger there is for it to rise further. The reality is that the interest rate differential between the United States and Japan will remain wide.

The market became oversold swiftly, but it is currently attempting to return to neutral. I believe they are treading gingerly, dipping their toes back into the water and testing how the tide flows.

The dollar index declined 0.01% to 102.598, while the euro rose 0.11 per cent to $1.1005.

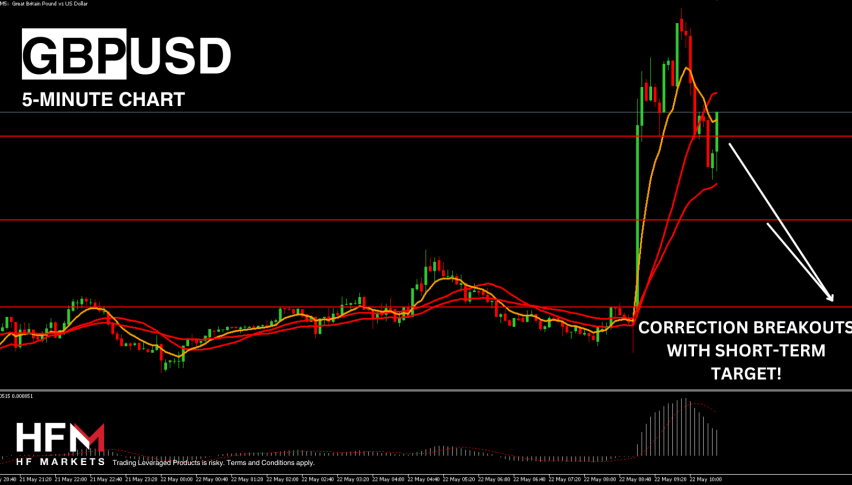

GBP Sterling Improves

Sterling is traded at $1.2841, a decrease of 0.16% from the previous day. Data earlier in the session showed the UK’s unemployment rate decreased to 4.2% in June from 4.4% in May, surprising economists’ predictions of a little increase. Job openings decreased as wage growth slowed.

Low survey response rates have lately prompted investors and economists to place less emphasis on British labour market data.

Given believes that last weekend’s concern over the possibility of a harsh landing was exaggerated and that markets appear to be returning to stability. Any negative surprise on CPI, like we saw on PPI this morning, is expected to have a stronger impact on USD, pushing the buck even lower.