Bitcoin ETFs Closing in on Satoshi Nakamoto’s Holdings as Price Rallies

In a remarkable development for the cryptocurrency market, spot Bitcoin exchange-traded funds (ETFs) in the United States are on track to collectively hold more Bitcoin than its enigmatic creator, Satoshi Nakamoto. This milestone underscores the growing mainstream adoption of the world’s largest cryptocurrency.

Bitcoin ETF Holdings Surge

According to data shared by Bloomberg ETF Analyst Eric Balchunas, the combined holdings of Bitcoin ETFs have reached 909,700 BTC, valued at approximately $55.1 billion at current prices. This figure is rapidly approaching Nakamoto’s estimated 1.1 million BTC stash, which has remained untouched for over 13 years.

At the current rate of accumulation, averaging 37,510 BTC per month, ETF holdings could surpass Nakamoto’s by January 2025. However, Balchunas suggests this milestone could be reached as early as October 2024.

BlackRock’s iShares Bitcoin Trust ETF (IBIT) has emerged as the frontrunner, accumulating $20.33 billion in Bitcoin as of August 12. Fidelity’s Wise Origin Bitcoin Fund (FBTC) follows with $9.72 billion in holdings.

BTC Mining Hashrate and Difficulty

On-chain data reveals a significant drop in Bitcoin’s mining hashrate, decreasing by more than 8% since reaching an all-time high in late July. This decline coincides with recent bearish momentum, impacting miner profitability. As a result, the next scheduled mining difficulty adjustment is expected to decrease by over 4%, potentially easing the burden on remaining miners.

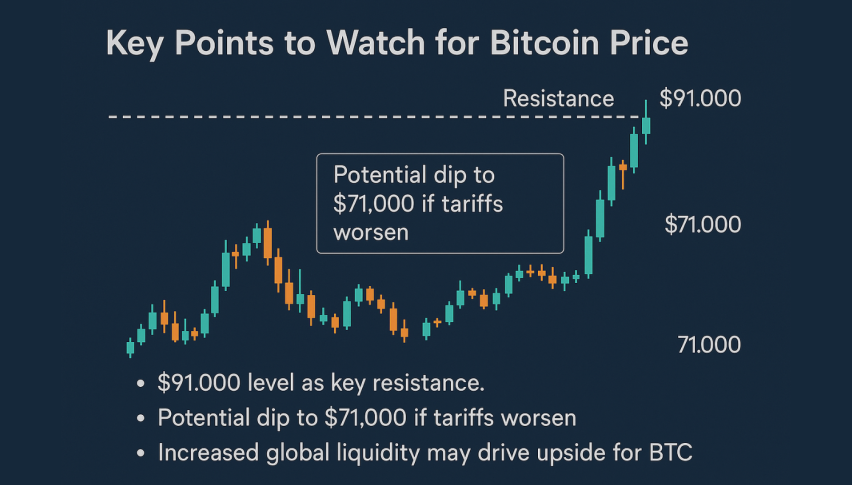

BTC/USD Technical Analysis

Bitcoin’s price has shown significant strength, recently soaring to an intraday high of $61,500 before consolidating around the $60,000 mark. This rally coincides with a 2.75% increase in Open Interest over the past 24 hours, indicating an influx of fresh capital into the market.

Cryptocurrency trader Rekt Capital noted positive momentum, stating, “Buy-side volume has come in. But even more volume needs to come in for Bitcoin to eclipse its local highs from a few days ago.” The trader added that a daily close above $61,700 would further boost bullish sentiment.

Another trader, Seth, predicted that a lower-than-expected CPI report could potentially drive Bitcoin to $68,000. However, the market sentiment remains cautious, with the Cryptocurrency Fear & Greed Index still indicating “Fear.”

Bitcoin Price Predictions and Market Outlook

Looking ahead to 2025, price predictions based on historical trends suggest Bitcoin could reach a minimum price of approximately $100,655, with a maximum potential of $121,030. The average trading price is projected to be $104,243, according to data from Changelly blog.

In the derivatives market, trading volume has risen by 12.43% to $68.24 billion, while open interest has decreased by 3.00% to $28.45 billion. Options volume has seen a notable decline of 20.74%, now at $1.05 billion, while options open interest has grown slightly by 1.10% to $20.67 billion.

Global Financial Impact

Bitcoin’s recent ascent to become the sixth largest monetary asset globally is a significant milestone. With a market value of $1.19 trillion, Bitcoin now outpaces traditional currencies such as the British Pound and the Swiss Franc, standing just behind Japan’s monetary assets. This achievement highlights Bitcoin’s increasing acceptance as a credible store of value, drawing comparisons to gold and major fiat currencies.

As Bitcoin ETFs continue to accumulate holdings at this pace, they are poised to become significant players in the cryptocurrency ecosystem, potentially rivaling even the holdings of Bitcoin’s mysterious creator. The rapid growth of these ETFs, combined with Bitcoin’s strong price performance, signals increasing institutional interest and could herald a new era for the world’s leading cryptocurrency.