XRP Flash Crashes: Ripple Tokenizing US Treasuries, Will $0.55 Hold?

XRP wasn’t spared the sell-off, looking at the formation in the daily chart. After the pin bar at the end of July, the follow-through on August 1 is putting brakes on optimistic bulls targeting $0.74. The wide-ranging bar of August 1, combined with the rising volume pushing prices below the local consolidation, might mean the short-term uptrend is over. Even so, buyers still have the upper hand from a top-down preview. If the downtrend is prevented today and trading volume rises as buyers slow down the selling momentum, XRP might resume the leg up.

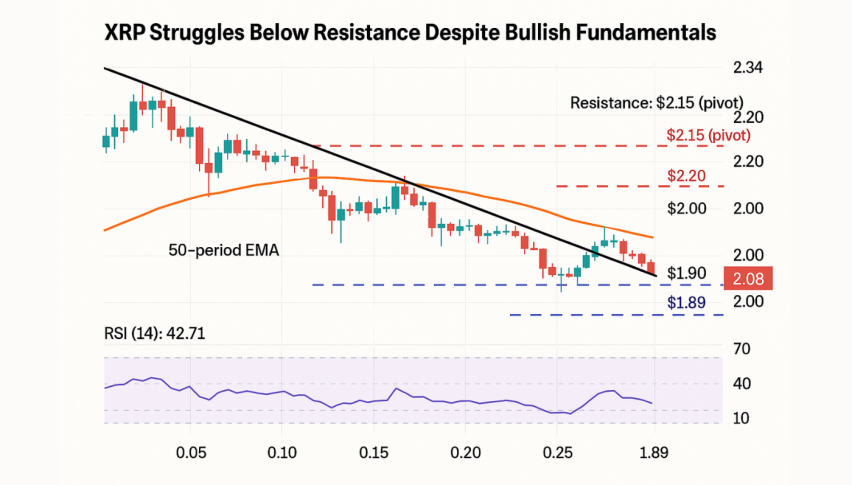

The XRP uptrend is facing intense resistance at around the $0.66 zone. The retest of this level on July 31 and yesterday’s drop could anchor aggressive sellers targeting $0.55 or lower. So far, the coin is down nearly 6% in 24 hours while shedding 5% in the previous week. The drop in XRP prices on August 1 was with rising volume, standing at $1.7 billion.

Traders are keeping an eye on the following trending XRP and Ripple news:

- Ripple, the blockchain company, said it is introducing a tokenized version of Treasuries on the XRP Ledger following its partnership with OpenEden. The product would allow investors to invest in a transparent and cheap platform. This is similar to what BlackRock offers on Ethereum.

- Despite XRP rising and Ripple striking key partners, traders are generally neutral, with some quarters fearful. Yesterday, the United States SEC canceled the closed-door meeting it had planned. Rumors are the regulator has closed its case against Ripple and will settle, not seeking the $2 billion penalty.

XRP Price Analysis

At spot rates, XRP/USD remains in an uptrend.

Even so, from the daily chart, the strong rejection of August 1 punctures the momentum.

The immediate support is at $0.55.

If there is a confirmation of yesterday’s losses, pushing prices below this level, XRP might dump to $0.50 in a correction.

Meanwhile, aggressive XRP traders can look to buy the dip, expecting prices to turn around and breach $0.62 in alignment with the recent dominant trend.

This preview holds if XRP remains above $0.55.

Risk-on traders can wait to see what happens next.

A strong rejection of recent losses, yanking prices above $0.62 could ignite demand.

Conversely, any sell-off below $0.55 might offer entries targeting $0.50 and even July 2024 lows.