BNB Chain Sees Mixed Results in Q2, but Staking and DEX Trading Remain Strong

The Binance Smart Chain (BSC) experienced a mixed performance in the second quarter (Q2) of the year, according to a recent report by market intelligence platform Messari. While the network’s native token, BNB, remained relatively stable, down 5% quarter-over-quarter (QoQ), key metrics showed both positive and negative trends.

BNB Chain’s Revenue Decline Amidst Network Activity Slowdown

The chain’s revenue, which measures the total fees collected, plunged 28% QoQ to $48.1 million in Q2. This decline was primarily attributed to the decrease in BNB’s price and a slowdown in network activity. Average daily transactions dropped 10% QoQ to 3.7 million, and average daily active addresses fell 18% QoQ to 1.1 million.

Despite the overall decline, the report highlighted a shift in user preferences within the BSC ecosystem. While PancakeSwap, once a dominant decentralized exchange (DEX), saw a 46% QoQ decrease in daily transactions, Uniswap experienced a significant surge of 630% QoQ.

BNB Staking Surges While TVL Dips

On a positive note, the total BNB staked increased 30% QoQ to 30.4 million BNB, with the total dollar value of staked funds rising 24% to $17.7 billion. This positioned the Binance Smart Chain as the third-highest Proof-of-Stake (PoS) network by staked value.

However, the BSC’s decentralized finance (DeFi) ecosystem saw a decline in total value locked (TVL), down 24% QoQ to $5.5 billion. This was primarily driven by a 41% QoQ drop in borrowing on the DeFi protocol, Venus Finance.

BNB Price Consolidates Amidst Market Volatility

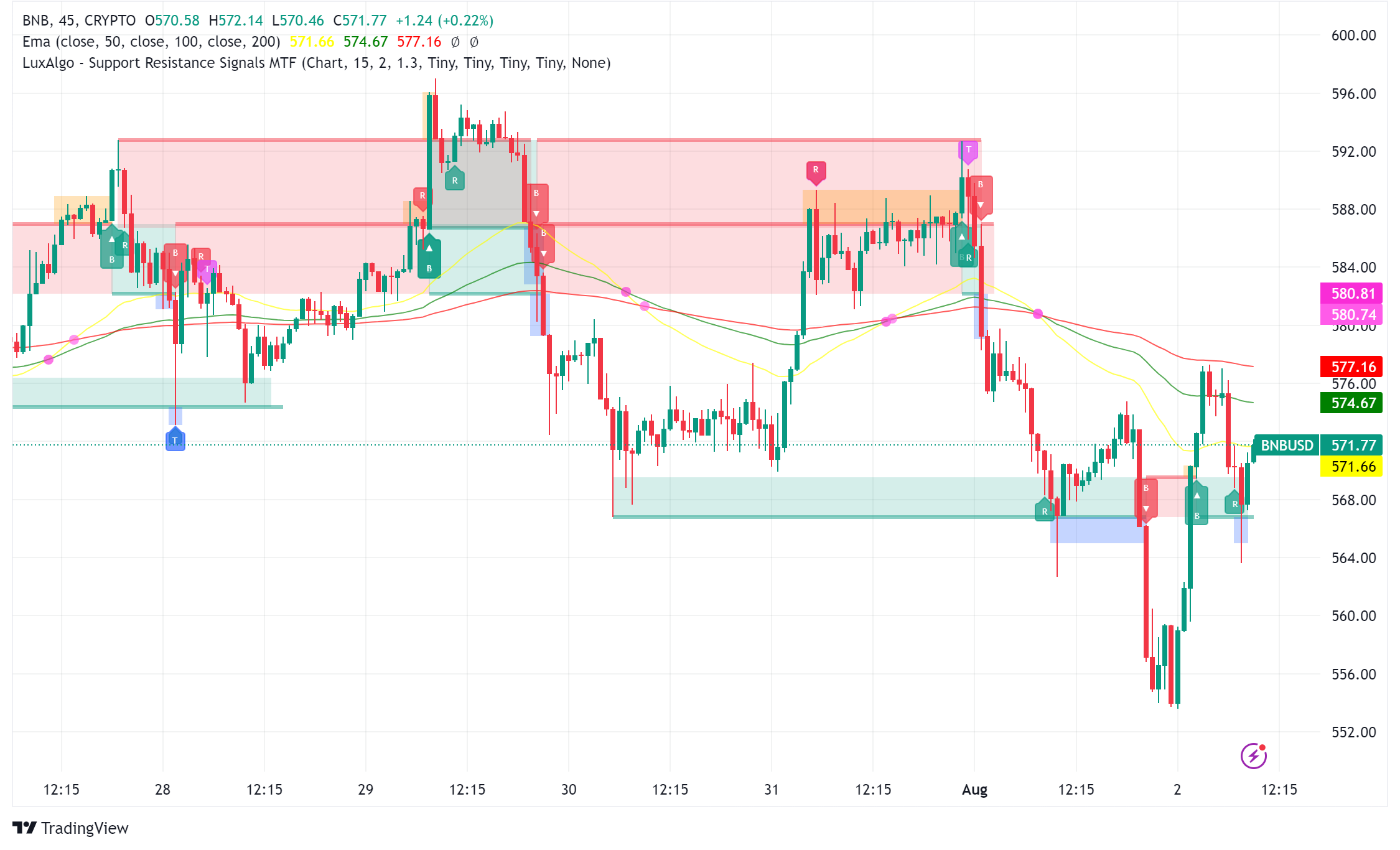

BNB’s recent surge and its proximity to the $600 resistance level have sparked optimism among investors. Analysts predict that a successful breakout could propel the token towards $650, while a failure to sustain above $590 could lead to a corrective phase.

At the time of writing, BNB was trading at $586, up over 2% in the last 24 hours. While the token has shown resilience amidst a broader cryptocurrency market downturn, it has been consolidating between $570 and its current trading price.

Analysts are watching the 200-day exponential moving average (EMA) as a potential support level for BNB, which could prevent further declines.

Binance Legal Developments Boost BNB Sentiment

Recent developments involving Binance and the U.S. Securities and Exchange Commission (SEC) have positively impacted BNB’s market performance. The SEC’s reassessment of its case has led to increased investor confidence, contributing to BNB’s recent gains.

BNB Chain Expands Grant Program to Foster Innovation

In other BNB Chain news, the platform has announced the latest winners of its grant program, aimed at supporting innovative projects that advance the blockchain ecosystem. The program offers funding up to USD 200K per project, along with marketing exposure, technical support, and ecosystem connections.

Binance Integrates DeFi BNB Assets into Web3 Wallet

Binance has integrated DeFi BNB assets into its Web3 Wallet to enhance user interaction and reward potential. This move aims to bridge the gap between the centralized Binance Exchange and the decentralized finance (DeFi) space. The platform plans to expand support to include additional DeFi BNB assets in the future.