NIKKEI225 Steady as 3-Day Selloff Slows

Stock markets on a firmer ground today after a volatile week, the Japanese stock market settles on a major support level.

Stock markets on a firmer ground today after a volatile week, the Japanese stock market settles on a major support level.

The week’s selloff in global stocks led by a string of unconvincing earnings seems to have halted today. The NIKKEI225 has benefitted from the reduced volatility and some positive data on inflation.

The market has been gearing up on the idea that there is a strong chance the BoJ may hike rates again at the next policy meeting on July 30-31. Rising inflation and a weakening yen were the central bank’s main concerns.

Inflation data for the city of Tokyo showed YoY CPI fell slightly from 2.3% to 2.2%. And CPI excluding energy and food came in lower at 1.1% compared to last month’s 1.4%. Analysts had forecast a slight increase in both.

However, I believe the concerns of a weak yen far outweigh any small decline in inflation. Various government officials have made calls for the BoJ to step in and curb the decline in their currency.

Yesterday’s data on foreign stock investment showed a decline of ¥49 billion, the first decline after 3 straight months of positive inflows for foreign investors.

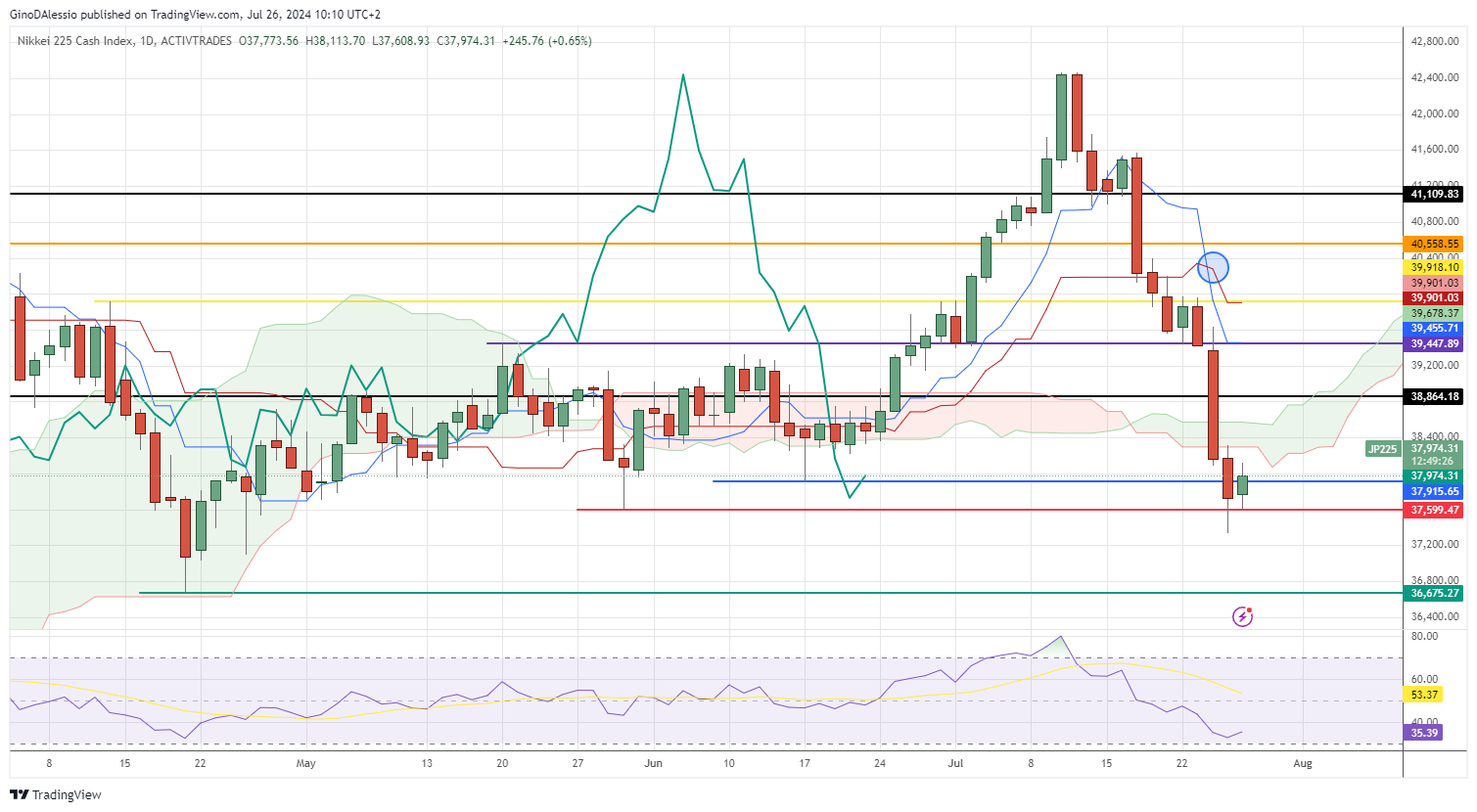

Technical View

The day chart below for the NIKKEI225 shows a market that is technically in a bear trend. The previous 2 candles broke below the Ichimoku cloud, and yesterday’s candle confirmed the bear trend with the cross over of the Ichimoku moving averages (blue circle).

The market has found support at the previous dip of 37,599 (red line), and further support will be found at the previous low of 36,675 (green line). While the market will find resistance at cloud, around 38,260 and the higher up at 38,864 (black line).

A break above the cloud cannot be considered complete until the lagging line has also crossed above the cloud. So, to consider the bull trend as back in place, we would need to see the market close above the black line.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account