USDCAD Marches Toward 1.38 As Canada Retail Sales Tumble

The USD regained some momentum after two weeks of declines, with the USDCAD climbing about 100 pips from this week’s lows, as the support zone around 1.36 held firm. Last week, Federal Reserve Chairman Jerome Powell’s remarks before the US Congress triggered a 200-point price surge; however, the price had been trending downward over the past five weeks. This downward movement was arrested around the 1.36 support level, leading to a bullish rise this week that propelled the pair one cent higher. This rise followed the formation of a bullish reversal signal, characterized by a hammer daily candlestick.

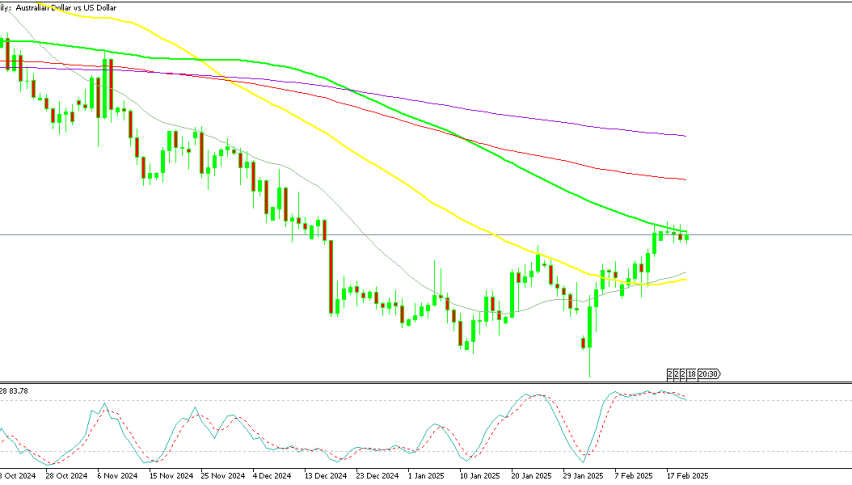

USD/CAD Chart Weekly – The 20 SMA Held as Support

During the North American session, the USD/CAD pair climbed to around 1.3748. The Loonie weakened as disappointing Canadian Retail Sales data for May added to expectations of future rate cuts by the Bank of Canada (BoC), while the US Dollar (USD) gained strength on hopes of Donald Trump winning the US presidential elections. Monthly retail sales dropped faster than anticipated, by 0.8%. April’s retail receipts were revised down from an increase of 0.7% to 0.6%. Retail sales excluding vehicles significantly declined by 1.3%.

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC | USD 100 | Visit Broker |

| 🥈 |  | Read Review | FSCA, FSC, ASIC, CySEC, DFSA | USD 5 | Visit Broker |

| 🥉 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker |

| 5 |  | Read Review | ASIC, FCA, CySEC, SCB | USD 100 | Visit Broker |

| 6 |  | Read Review | FCA, FSCA, FSC, CMA | USD 200 | Visit Broker |

| 7 |  | Read Review | BVI FSC | USD 1 | Visit Broker |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker |

Canadian Retail Sales Report for May

- Canada’s retail sales for May: -0.8% vs. -0.6% expected

- Prior was +0.7% (revised to +0.6%)

- Excluding autos: -1.3% vs. -0.5% expected

- Prior ex-autos: +1.8% (revised to +1.7%)

- Excluding autos and gasoline: -1.4% vs. +1.4% prior

- Largest decrease in sales at food and beverage retailers: -1.9%

- Lower sales also at building material and garden equipment and supplies dealers: -2.7% and general merchandise retailers: -1.0%

- Preliminary June data: -0.3% m/m

- Full report

Traders had priced in a 96% probability of a BOC rate cut prior to the data release, and now it seems almost certain, with the likelihood of additional cuts in the September meeting increasing. Canadian consumers are retreating. A second report, the Scotiabank Canadian Spending Tracker, ended Q2/24 on a bleak note, showing June’s year-over-year growth at +2.6%, the lowest since early 2021 during the pandemic.