USDJPY Drops further Amid BOJ Intervention and Economic Data

On Friday, the USDJPY fell by 0.65%, hitting a 3-week low. The yen gained support as signs emerged of the Bank of Japan (BOJ) intervening in the forex market on Thursday to bolster the yen. Additionally, Japan’s May industrial production was revised up to +3.6% m/m from the initial +2.8% m/m, further strengthening the yen.

BOJ Intervention and Yen’s Surge

On Thursday, the yen surged by up to 2.6%, reaching 157.41 per dollar. This spike was driven by exceptional trading volumes, suggesting possible intervention by the Ministry of Finance after the yen hit 38-year lows earlier in the week. The increased trading volume coincided with daily data showing a ¥31.7 trillion drain on Japan’s current account, equating to over $20 billion in forex purchases. Bloomberg’s analysis indicated that the BOJ spent approximately 3.5 trillion yen ($22 billion) during Thursday’s intervention to support the yen.

Currency diplomat Masato Kanda did not confirm the government’s involvement in the yen’s rise. Investors are now anticipating the BOJ’s policy meeting at the end of July, where officials are expected to discuss reducing bond purchases and potentially raising interest rates.

Wage Growth and BOJ Policy

Indicators of wage growth have started to reflect significant increases agreed upon during this year’s spring wage negotiations, aligning with the BOJ’s stance on continued monetary policy normalization. Japan’s largest trade union federation announced an average wage increase of 5.1% for its members this fiscal year, the highest in over 30 years.

Before the release of May’s earnings data, these pay rises were not significantly evident in monthly earnings figures. However, May’s data showed that regular payrolls for full-time workers increased by 2.7% y/y, surpassing the consensus expectation of 2.2%. Rising wage growth and the potential for a wage-price cycle are key factors behind the BOJ’s monetary policy normalization.

Despite these developments, BOJ officials are expected to adopt a cautious approach to monetary policy adjustments. It is anticipated that the BOJ will wait until its October meeting to raise its policy rate, with further normalization possible by early 2025.

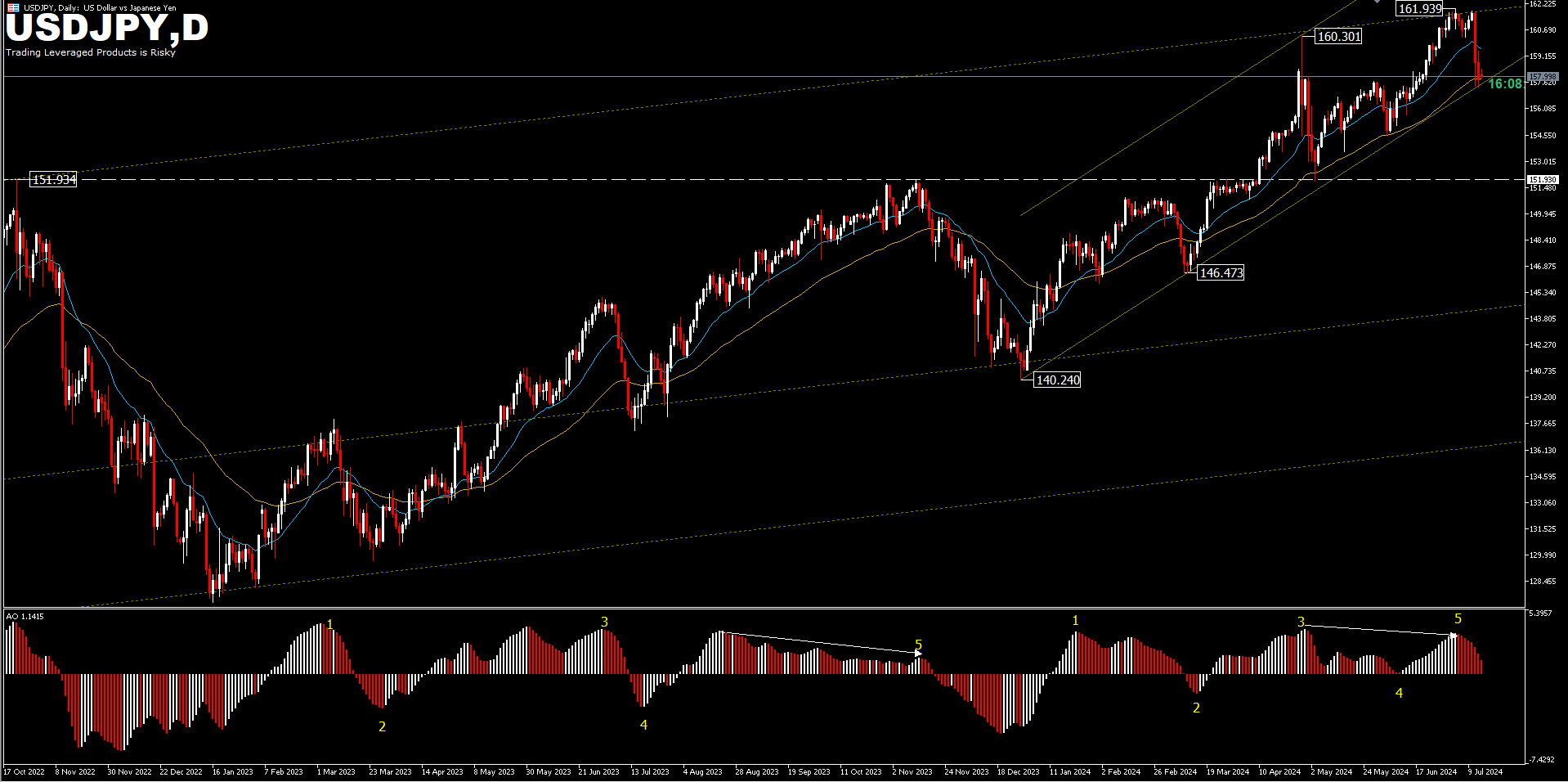

USDJPY Technical Analysis

The Japanese yen stabilized around 158.00 in quiet trade on Monday, a Japanese holiday. Investors are looking forward to the BOJ policy meeting at the end of July, where plans to reduce bond purchases and potentially raise interest rates may be announced. Externally, the yen faced pressure from a rising dollar, which gained safe-haven bids following the assassination attempt on former US President Trump.

From a technical standpoint, USDJPY faced resistance at 161.93 at the beginning of the month. The downside remains limited by the bullish trendline from the 140.24 – 146.47 drawdown. A break below this trendline could lead to further declines towards the support level at 151.93 (October 2022 peak), potentially prompting a rebound. The long-term uptrend could continue up to 161.93 depending on the depth of the current correction from 161.93. However, a sustained break below 151.93 would suggest a larger-scale correction or trend reversal.

Additionally, the price is currently stuck at the EMA50 bar. The correction wave could extend following a trendline break and a move below the 50-bar EMA.

Last week’s sharp decline confirmed a short-term top at 161.93. Given the bearish daily divergence conditions, the decline from 161.93 is likely a correction of the overall five-wave rally from 140.24. Risk remains on the downside as long as the 159.43 resistance holds. A sustained break of the bullish trendline will confirm the bearish scenario, with the next projections being the 38.2% and 50.0% retracement levels of the 140.25 – 161.94 pullback, at 153.64 and 151.08, respectively.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account