Looking for More Longs on CHF Pairs After Softer Swiss CPI

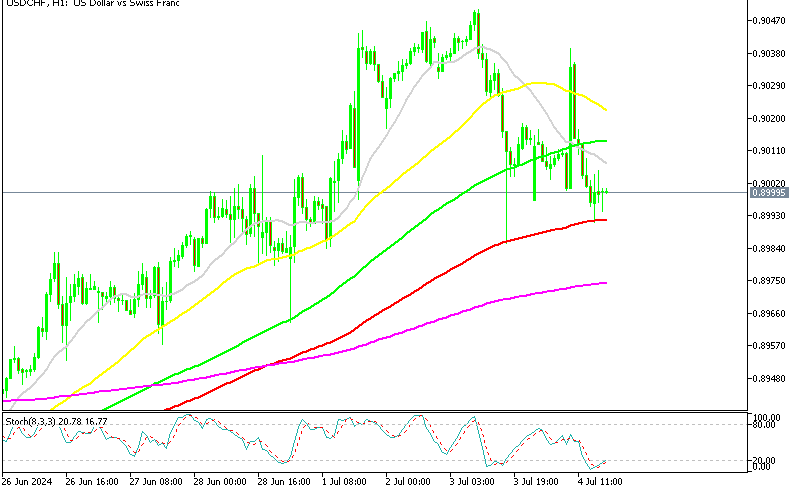

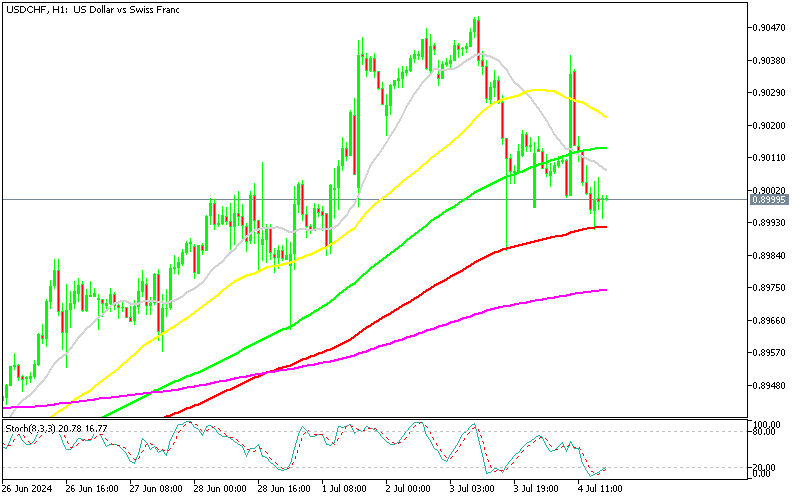

The CHF to USD rate is showing volatility, bouncing in a 50pip range after a strong trend in USD/CHF in the previous two weeks

The CHF to USD rate is showing volatility, after a strong trend in USD/CHF in the previous two weeks. The price has climbed above 0.90. US dollar dropped lower yesterday following the contraction in ISM services report, but swiftly bounced back after the soft Swiss CPI inflation data this morning.

USD/CHF Chat H1 – The Support at 0.90 Is Holding Again

USD/CHF climbed to a new one-month high, surpassing the 0.90 level for the first time since late May during the European session yesterday. This was driven by the continued weakness in the CHF following the second SNB rate cut in recent meetings. However, the pair saw a decline in the US session as the ISM services index indicated a contraction in activity for June. Despite this, the area around the 0.90 level acted as a strong support, prompting us to issue a buy forex signal for USD/CHF .

Simultaneously, we initiated a buy forex signal for EUR/CHF . Today, both pairs experienced a significant spike, each rising approximately 40 pips, allowing us to profit from these trades. Following the pullback, we have decided to open another buy signal for USD/CHF as the price finds support again around the 0.90 zone. This level has consistently provided a solid foundation for upward movement, reinforcing our bullish outlook on the pair.

Switzerland June CPI Released by the Federal Statistics Office – 4 July 2024

- Switzerland June CPI YoY +1.3% vs +1.4% expected

- May CPI YoY was +1.4%

- Core CPI YoY +1.1%

- Prior core CPI YoY was +1.2%

- CPI MoM for June came at 0.0% vs 0.1% expected

- Previous CPI MoM was 0.3%

Analysis of Swiss Inflation Trend

If the Swiss National Bank (SNB) needs a reason to consider further rate cuts, this report provides a strong justification. The June CPI came in lower than expected at 1.3% year-on-year, down from May’s 1.4%, while Core inflation, which strips out volatile items, also decreased to 1.1% from 1.2%, so both inflation measures are well below the 2% target by the SNB. The month-on-month CPI remained flat at 0.0%, below the anticipated 0.1% increase and a significant drop from the previous 0.3%.

Implications for the SNB Policy

This inflation trend aligns with the SNB’s shift from foreign exchange sales to purchases in the first quarter of this year, indicating a strategic adjustment to support price stability. The sustained cooling of core inflation below the key 2% threshold suggests that the SNB has the latitude to implement more accommodative monetary policies without risking inflationary pressures. Given the subdued inflation figures, the SNB could be prompted to cut interest rates further to bolster economic activity and prevent deflationary risks. This could also have implications for the Swiss franc, potentially weakening it to make Swiss exports more competitive.

Overall, these CPI figures highlight a subdued inflationary environment in Switzerland, providing the SNB with the necessary conditions to consider easing monetary policy further if deemed necessary.

USD/CHF Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account