The End of the Petrodollar Agreement: A New Era for Global Finance

The end of the petrodollar era, fueled by factors like the rise of renewable energy and the diversification of oil producers, could reshape

The petrodollar system, an economic pillar established in the 1970s, has long been a linchpin of the global financial order. By mandating that oil transactions be conducted in US dollars, it propelled the dollar to the status of the world’s primary reserve currency, offering both the US and Saudi Arabia significant economic and political leverage.

However, the recent refusal by Saudi Arabia to renew this decades-old agreement signals a potential seismic shift in global financial dynamics.

This move towards diversifying oil sales into various currencies, including the Chinese yuan, reflects broader trends in international trade and finance within the global economy.

The increasing use of local currencies for cross-border payments, particularly by BRICS nations and countries in the Middle East and Asia, is challenging the dollar’s dominance and paving the way for a potential new era in global finance.

The end of the petrodollar system could have far-reaching consequences, impacting the strength of the US dollar, global financial stability, and geopolitical power dynamics.

This article delves into the history of the petrodollar system, its far-reaching impacts, and the potential implications of its dissolution, providing a glimpse into a new and evolving landscape of global finance.

The expiration of the US-Saudi petrodollar deal could significantly affect the dollar’s dominance in the global financial order.

Understanding the Petrodollar System

The petrodollar system refers to the global practice of trading oil exclusively in US dollars, established in the 1970s through agreements between the United States and Saudi Arabia.

This system arose after the US abandoned the gold standard in 1971, leading to economic instability.

To address this, the US and Saudi Arabia struck a deal: Saudi Arabia would price its crude oil exports in US dollars, and in return, the US would provide military support.

Key Components of the Petrodollar System:

- Oil Sales in US Dollars: Saudi Arabia priced its oil exports exclusively in US dollars.

- Reinvestment in US Treasuries: Oil revenues were reinvested in US Treasury bonds.

This arrangement created a constant demand for US dollars, reinforcing the dollar’s position as the world’s primary reserve currency.

For the US, it provided a steady influx of capital, stabilizing the bond market and helping to finance government deficits at lower borrowing costs. Additionally, the petrodollar system helped manage the US national debt by providing a steady influx of capital.

For Saudi Arabia, the system guaranteed a stable market for its oil and secured US military and political support.

The petrodollar agreement fostered economic ties between the two nations and played a crucial role in maintaining global financial stability for decades.

However, the recent shift away from this system signals a significant change in the international financial landscape.

Historical Significance and Impact

The petrodollar system traces its origins to the 1944 Bretton Woods Agreement, which established the US dollar as the world’s reserve currency, backed by gold.

This framework facilitated post-war economic stability and international trade.

The Bretton Woods Agreement:

- Established in 1944: Made the US dollar the world’s primary reserve currency, pegged to gold.

- Facilitated Global Trade: Provided economic stability post-World War II.

However, in 1971, President Nixon’s decision to remove the dollar’s gold convertibility (the “Nixon Shock”) triggered currency volatility.

To re-stabilize the dollar, the US forged the petrodollar system with Saudi Arabia in 1973. Saudi Arabia agreed to price oil in US dollars, boosting demand for the currency and solidifying its dominance.

End of Gold Convertibility (1971):

- Nixon’s Decision: Ended the dollar’s convertibility to gold, leading to floating exchange rates.

- Increased Volatility: Created a need for a new system to stabilize currencies.

The petrodollar system offered mutual benefits. The US gained a stable currency and leverage in global finance, while Saudi Arabia received military protection and economic stability.

Petrodollars were often reinvested in US Treasury bonds, further strengthening the dollar’s status. This system reinforced the US dollar as the world’s reserve currency.

Economic and Political Benefits:

- For the US:

- Steady Capital Influx: Reinvestment of oil revenues into US Treasuries.

- Low Borrowing Costs: Stabilized bond market and low interest rates.

- For Saudi Arabia:

- Stable Oil Market: Guaranteed a secure market for oil exports.

- US Support: Military and political backing from the US.

Bolstering the US Dollar:

- Global Reserve Currency: Ensured continuous demand for the US dollar.

- Economic Influence: Reinforced the dollar’s dominance in international trade and finance.

This arrangement cemented the US dollar as the world’s reserve currency, facilitating international trade and financial transactions.

However, it also tied global economic stability to oil prices and US monetary policy, creating vulnerabilities and potential for geopolitical tensions.

Benefits and Drawbacks of Oil Prices

The petrodollar system has been a double-edged sword. It bolstered the US economy, kept interest rates low, and fueled consumer spending.

However, it also tied the US to a volatile region, fostered over-reliance on fossil fuels, and arguably contributed to global income inequality. The end of the petrodollar system could lead to higher oil prices, impacting the global economy and financial markets.

Shifting Global Power Dynamics

The end of the petrodollar agreement is a symptom of broader shifts in global power dynamics. Key factors include:

- Rise of Alternative Energy Sources: The growing adoption of renewable energy (solar, wind, hydro) and natural gas is reducing global dependence on crude oil, thereby diminishing the petrodollar’s significance.

- Emergence of New Oil Producers: The rise of new oil-producing nations like Brazil and Canada, with Brazil’s expanding oil production and Canada’s oil sands, has diversified global oil supply, challenging the dominance of traditional producers.

- Increasing Use of Local Currencies: BRICS nations (Brazil, Russia, India, China, South Africa) are actively promoting the use of their currencies in international trade. This trend is also observed in the Middle East and Asia, reducing reliance on the US dollar.

Geopolitical Factors: Saudi Arabia’s strategy to diversify its alliances and strengthen ties with emerging powers like China reflects a desire for greater autonomy and a reduced dependence on the US.

This shift indicates a recalibration of global power relationships, with potential implications for the future of international trade and finance.

Additionally, Saudi Arabia’s decision to sell oil in multiple currencies, including Chinese RMB, Euros, Yen, INR, Yuan, and potentially digital currencies like Bitcoin, reflects broader trends in the global financial order.

Potential Impacts on the US Dollar as the Global Reserve Currency

The end of the petrodollar system could trigger a seismic shift in the global financial landscape, with significant ramifications for the US dollar and global oil trade.

As oil is increasingly priced in other currencies or a basket of currencies, the global demand for US dollars may decrease.

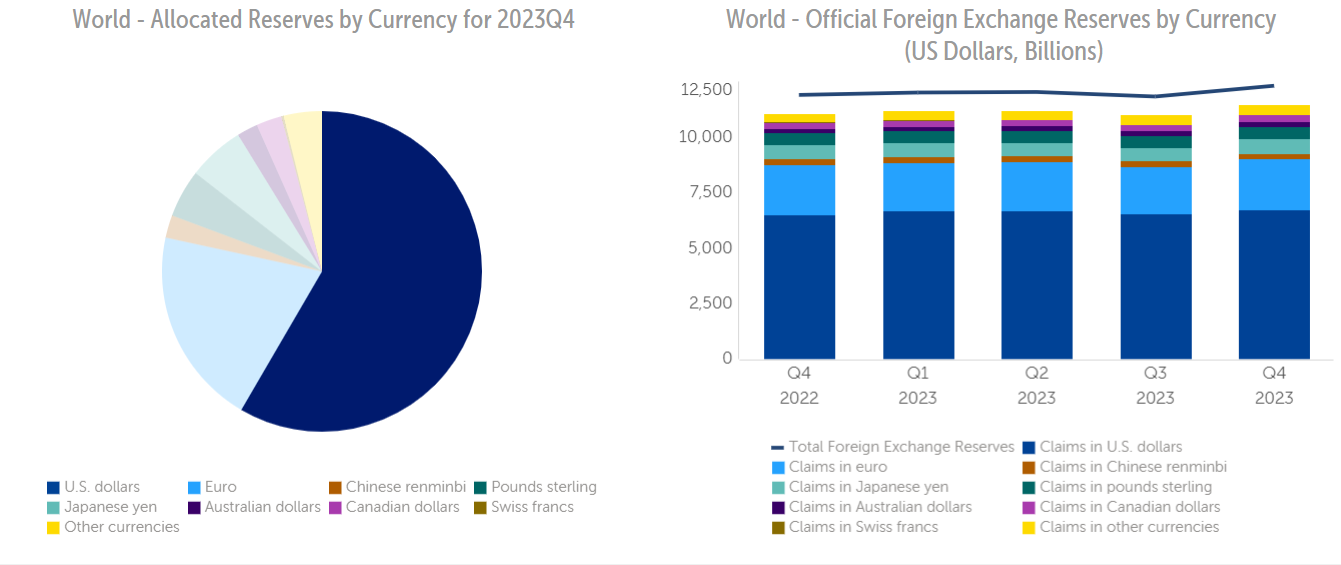

The US dollar’s share of global reserves has already experienced a notable decline, falling from 73% in 2001 to 58.4% in 2023, according to data from the International Monetary Fund (IMF).

This reduced demand could weaken the dollar, potentially sparking inflation within the US and forcing the Federal Reserve to raise interest rates in an attempt to stabilize the economy.

Furthermore, the diminished demand for US Treasury bonds, historically a safe haven for petrodollar surpluses, could disrupt financial markets.

If foreign governments hold fewer US bonds, it could increase borrowing costs for the US government, impacting government spending and potentially hindering economic growth.

- Short-Term Impacts: While the immediate effects may be gradual, a weakening dollar could lead to higher import prices for US consumers and businesses, potentially contributing to inflation.

- Long-Term Impacts: A sustained decline in the dollar’s dominance could reshape global financial structures, impacting trade, investment, and geopolitical power dynamics.

The US economy’s resilience and adaptability will be crucial in navigating this evolving landscape and mitigating potential risks associated with the decline of the petrodollar system.

Global Financial Order and Emerging Trends

The end of the petrodollar era is ushering in a potential transformation of the global financial order. Emerging economies, with their growing economic clout, are playing an increasingly influential role in reshaping financial norms.

Countries like China, with its substantial trade volumes, are actively promoting the use of their own currency, the yuan (or renminbi), in international transactions.

According to the IMF’s latest data, the US dollar’s share of global reserves stood at 59.0% in Q4 2022, down from its peak of 71.5% in 2001.

- Rise of the Yuan: China’s Cross-Border Interbank Payment System (CIPS) is gaining traction as an alternative to the SWIFT system for cross-border transactions.

- Diversification of Reserves: Countries are increasingly exploring the diversification of their foreign exchange reserves to include currencies like the yuan.

This diversification could impact global trade, as countries may seek to bypass the dollar in bilateral agreements, potentially leading to a more fragmented but potentially more resilient financial system.

Strategic Responses and Future Outlook

As the petrodollar system’s influence diminishes, key players are adapting. The US may leverage monetary policy and trade agreements to maintain the dollar’s dominance, while exploring digital currencies.

Saudi Arabia, meanwhile, is strengthening ties with China, evident in their $116 billion bilateral trade in 2023, and diversifying its economy.

International institutions like the IMF and World Bank could play a stabilizing role, potentially promoting a diversified basket of currencies in global reserves.

The future of global finance remains uncertain, but potential scenarios include:

- A multipolar currency system with the euro, yuan, and a digital dollar sharing reserve currency status.

- Increased volatility as currencies compete for dominance.

- Emergence of innovative financial products and technologies to facilitate trade and investment in a multipolar world.

The path forward hinges on strategic economic choices, international cooperation, and financial innovation.

Conclusion

The conclusion of the petrodollar era represents a pivotal moment in global finance. The declining share of the US dollar in global reserves, dropping from 71.5% in 2001 to 59.0% in Q4 2022 (IMF data), underscores this shift.

Emerging economies like China, with its burgeoning $116 billion trade with Saudi Arabia in 2023, are reshaping financial norms.

The future is likely to see increased diversification of reserve currencies, potentially including the Chinese yuan, and the rise of alternative financial systems like China’s Cross-Border Interbank Payment System (CIPS).

This transition could lead to a more multipolar financial landscape, with potential implications for trade, investment, and geopolitical power dynamics.

While challenges like increased volatility may arise, this shift also presents opportunities for innovation and a more resilient global financial system.

The adaptability and strategic choices of major economies and international institutions will be crucial in navigating this new era of global finance.

FAQ: The Petrodollar and its Future

Did Saudi Arabia drop the petrodollar?

While Saudi Arabia hasn’t completely abandoned the petrodollar system, it’s actively diversifying its financial strategies. In March 2023, Saudi Aramco, the state-owned oil giant, sold oil to China priced in yuan for the first time.

This move, coupled with other instances of pricing oil in currencies like the UAE dirham and the Indian rupee, signals a gradual shift away from exclusive reliance on the US dollar.

Did the petrodollar expire?

News outlets have reported that a 1974 agreement between Saudi Arabia and the US, commonly known as the “petrodollar deal,” was not renewed and concluded on June 9, 2024.

What is the future of the petrodollar?

The future of the petrodollar is uncertain, given the growing adoption of renewable energy sources, the emergence of new oil producers like Brazil and Canada, and shifting geopolitical dynamics.

While the US dollar still dominates global oil markets, its share of global reserves has fallen from 71.5% in 2001 to 59.0% in Q4 2022, according to IMF data.

The rise of alternative currencies like the Chinese yuan and new payment mechanisms like CIPS are challenging the dollar’s dominance.

How does the petrodollar affect the US dollar?

Historically, the petrodollar system has strengthened the US dollar by creating constant global demand. However, as the petrodollar’s influence wanes, the dollar’s value could weaken. This might lead to higher inflation in the US, potentially requiring higher interest rates to maintain economic stability.

Additionally, the reduced demand for US Treasury bonds, often used to store petrodollar surpluses, could impact US borrowing costs and financial markets. The full extent of the impact will depend on how quickly and extensively the petrodollar system is replaced or diversified.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account