Political Dynamics and BOE Overshadowing the Movement of Pound

GBPUSD strengthened to a price range of $1.2630 from a six-week low, as investors assessed the UK’s monetary policy and political future. Last week, the BOE kept interest rates unchanged, raising hopes of a rate cut in August following policymakers’ comments. In addition, the domestic inflation report showed headline inflation has fallen to the BoE’s target of 2%. The upcoming GDP figures will provide further economic insight, after Friday’s strong retail sales data dampened optimism from the BoE’s comments.

GBPUSD strengthened to a price range of $1.2630 from a six-week low, as investors assessed the UK’s monetary policy and political future. Last week, the BOE kept interest rates unchanged, raising hopes of a rate cut in August following policymakers’ comments. In addition, the domestic inflation report showed headline inflation has fallen to the BoE’s target of 2%. The upcoming GDP figures will provide further economic insight, after Friday’s strong retail sales data dampened optimism from the BoE’s comments.

Meanwhile, a scandal called “Gamble-gate,” involving Prime Minister Rishi Sunak’s aides betting on election dates, has caused significant political turmoil and threatens to overshadow the rest of the campaign, which the Labour Party is expected to win by a large margin.

On the other hand, the US Dollar is on a buying spree ahead of potential euro-centric risks dominated by the weekend elections in France which could prompt the European Central Bank to cut interest rates further in the coming days. Very strong Canadian and Australian inflation figures were reported this week, raising concerns that global inflation is about to pick up again, which has pushed bond yields higher.

Some Federal Reserve officials have warned that they will not rush to cut interest rates this year, which will add pressure in the bond market and ultimately favour the USD. The divergence in interest rate policy between the US “higher for longer” and the UK and Eurozone favours the Dollar.

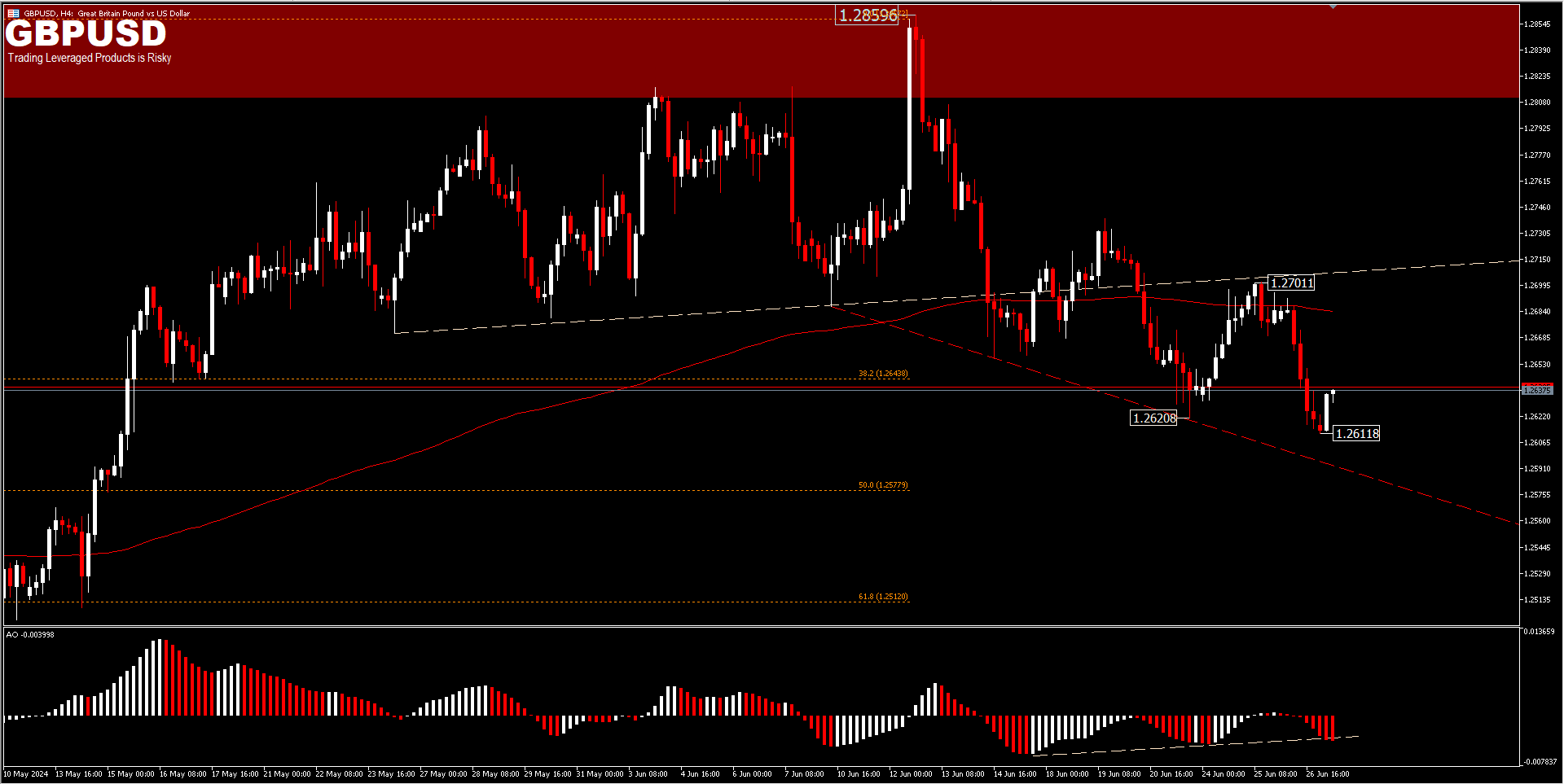

GBPUSD’s decline from 1.2859 attempted to resume the decline back through an interim low of 1.2620 and reached a low of 1.2611 in today’s Asian session trading. The short rebound is attempting to move higher above 1.2630 to recoup some of the previous day’s losses.

Intraday bias is neutral again. Sustained trading below 1.2611 low would confirm the downside wave for 50% or 61.8% retracement, at 1.2577 and 1.2512 from 1.2298 and 1.2859 pullbacks respectively. On the upside however, a strong break of the 1.2701 resistance would confirm that the pullback from 1.2859 is complete, and will instead retest those highs.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account