Market Analysis – A Strengthening Dollar Pressures Gold!

– The best-performing currency of the day is the US Dollar, which has increased by 0.34% and continues to pressure gold.

– The US Dollar gains support from recent US economic data, leading investors to question if markets are pricing in a higher Core PCE Price Index.

– Gold prices have fallen to a long-term support level of $2,291.50.

– The market exhibits a strong risk-on sentiment, with global stocks rising and most safe-haven assets declining.

Gold prices are facing pressure due to increased risk appetite and a strengthening US Dollar. However, technical analysts note that the $2,291.50 support level has held firm on six occasions over the past three months. Despite trading near this support, traders seek a trend change signal. According to analysts, the higher the possibility of a Trump becoming president, the higher the probability of China continuing to de-dollarize and back their currency with Gold reserves.

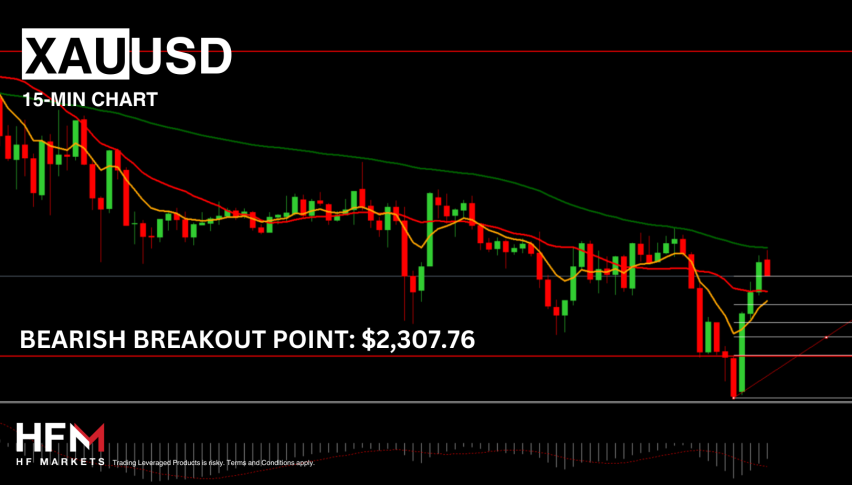

Currently, gold is below key indicators like the 75-Bar EMA and 100-Bar SMA. If the price rises above $2,318.05, it could indicate a correction up to $2,326.83, while a drop below $2,307.76 without a new high would trigger a sell signal.

Long-term, gold prices may remain high due to geopolitical risks, including conflicts in Ukraine and the Middle East and potential US-China tensions. A Bank of America survey found that 29% of portfolio managers view these risks as crucial for the global economy. In response, central banks are increasing their reserves, with the World Gold Council reporting a 290.0-ton increase in the first quarter, continuing last year’s positive trend.

Additionally, higher silver prices, which correlate with gold, support the metal’s value. Economic data driving the Dollar’s strength, like the recent higher-than-expected Consumer Confidence Index, influences gold’s performance. Investors are closely watching upcoming US New Home Sales, Pending Home Sales, and the Core PCE Price Index. For gold to rise, weaker economic data is needed to pressure the Dollar and shift investor focus to gold.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account