Market Surprises: SNB Cuts Rates, BoE Holds Steady; Norges Bank Remains Hawkish

SNB Surprises with Consecutive Rate Cut

The Swiss National Bank (SNB) surprised markets once again by delivering a second consecutive 25 basis point cut. This move left the policy rate at 1.25%, defying market expectations. Despite recent inflation numbers and the Fed’s high-for-longer message, the SNB opted for this cut, citing decreased underlying inflationary pressure compared to the previous quarter. The statement highlighted that with this rate cut, the SNB aims to maintain appropriate monetary conditions.

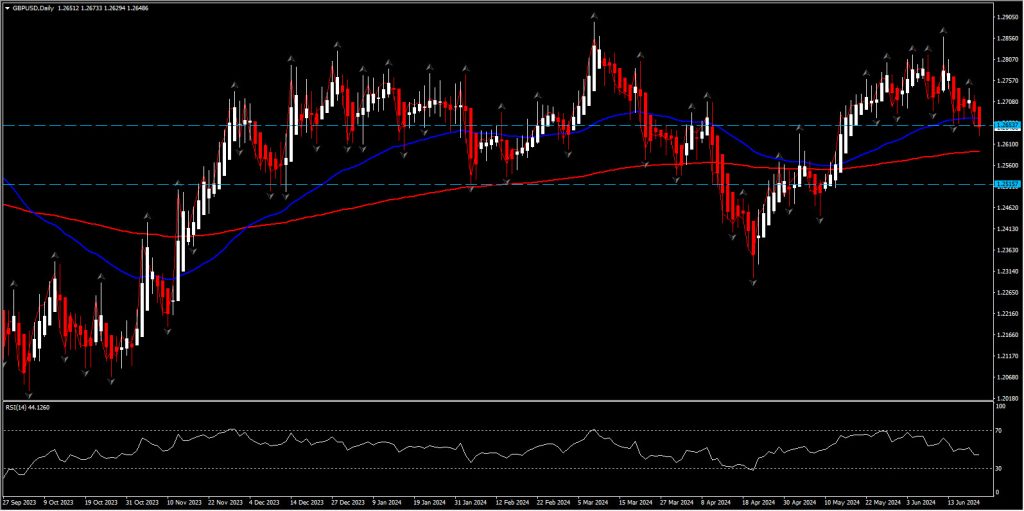

BoE Holds Rates, Signals Future Cut

The Bank of England (BoE) left official policy settings unchanged, with the Monetary Policy Committee (MPC) voting 7-2 to keep the Bank Rate at 5.25%. Members Swati Dhingra and Dave Ramsen continued to advocate for immediate cuts. The minutes revealed a split among the seven members who favored unchanged rates. Some members called for more evidence of diminishing inflation persistence, while others felt the recent data did not significantly alter the economy’s disinflationary trajectory. The statement emphasized that indicators of short-term inflation expectations have moderated and GDP growth appears stronger than expected. Labor market data quality remains a concern, complicating the assessment of labor market activity. Despite these uncertainties, the BoE noted that headline inflation continued to ease, with CPI falling to 2.0% in May. The statement suggested that the restrictive monetary policy stance would remain for an extended period, but the possibility of a rate cut at the next meeting is increasing.

Norges Bank Maintains Policy Rate

Norges Bank maintained its policy rate at 4.5%, indicating that it would likely stay at this level for the rest of the year. The statement pointed out ongoing uncertainty about the economic outlook and projected that inflation would approach 2% by the end of 2027. Governor Ida Wolden Bache mentioned that the policy rate could remain at 4.5% until the end of the year, with gradual reductions thereafter. However, if capacity utilization increases or the krone depreciates, wage and price inflation could stay elevated, possibly necessitating a rate hike. Conversely, if unemployment rises more than expected or price inflation declines rapidly, the policy rate might be lowered sooner than anticipated.

Market Implications

The SNB’s unexpected rate cut and the BoE’s groundwork for a future cut reflect differing approaches to current economic conditions. While the SNB is taking pre-emptive steps to maintain monetary conditions, the BoE is cautiously optimistic about the inflation outlook. Norges Bank’s decision to hold rates steady, with a slight hawkish tilt, indicates a measured approach in response to economic uncertainties. These developments highlight the varied strategies of central banks in navigating economic challenges, with implications for global markets and economic stability.

Stay tuned for more updates as central banks continue to adjust their policies in response to evolving economic conditions.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account