German & French PMI Indicate Another Economic Decline Pressuring The DAX

The German DAX declines 0.34% as investors react to the latest Purchasing Managers’ Indexes. The German Services PMI fell from 53.9 to 53.5, below expectations, while the Manufacturing PMI dropped to 43.4, missing analysts’ forecasts by 3.0 points. Investors are particularly concerned about the Manufacturing data, which is below 50.00, indicating a risk of economic contraction.

The Purchasing Managers’ Index (PMI) is important because it serves as a key economic indicator that provides insight into the health of the manufacturing and services sectors. Here are several reasons why the PMI is crucial:

- Economic Health Indicator: The PMI is a reliable gauge of economic activity. A PMI above 50 indicates expansion, while a PMI below 50 indicates contraction. This makes it an essential tool for assessing the overall economic health.

- Early Economic Signal: PMI data is released monthly, providing timely information that can give an early indication of economic trends before other major economic reports are published.

French PMI data also came in lower than expected and below the previous month’s figures, further dampening risk appetite and negatively affecting the stock market. However, this data could prompt a second-rate adjustment in 2024. If US and UK PMI data also decline, it may lead to a broader risk-off sentiment, potentially triggering continued bearish momentum and a more dovish stance than other central banks. The UK PMI data also reads lower than expectations.

The regulator’s governing board confirmed that the decision to cut interest rates earlier this month was made to test the monetary system. Simultaneously, the parameters of the PEPP bond purchase program will remain unchanged until the end of 2024, with the ECB continuing to reduce its portfolio by an average of 7.5 billion euros per month.

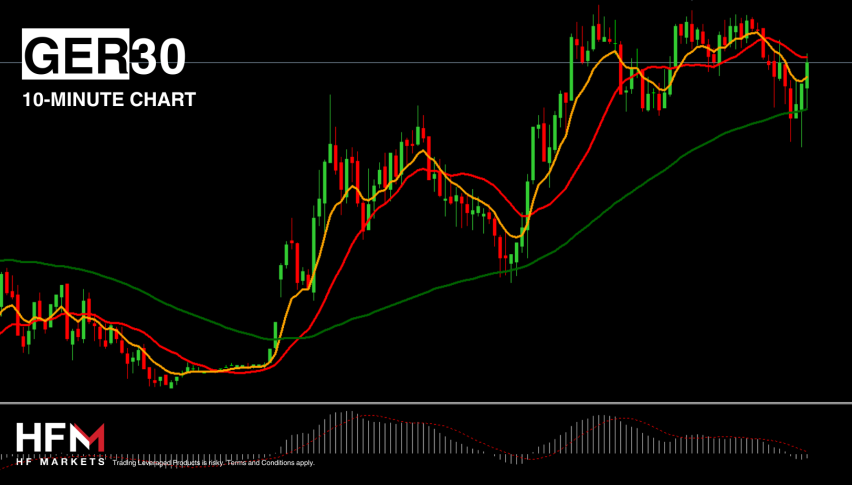

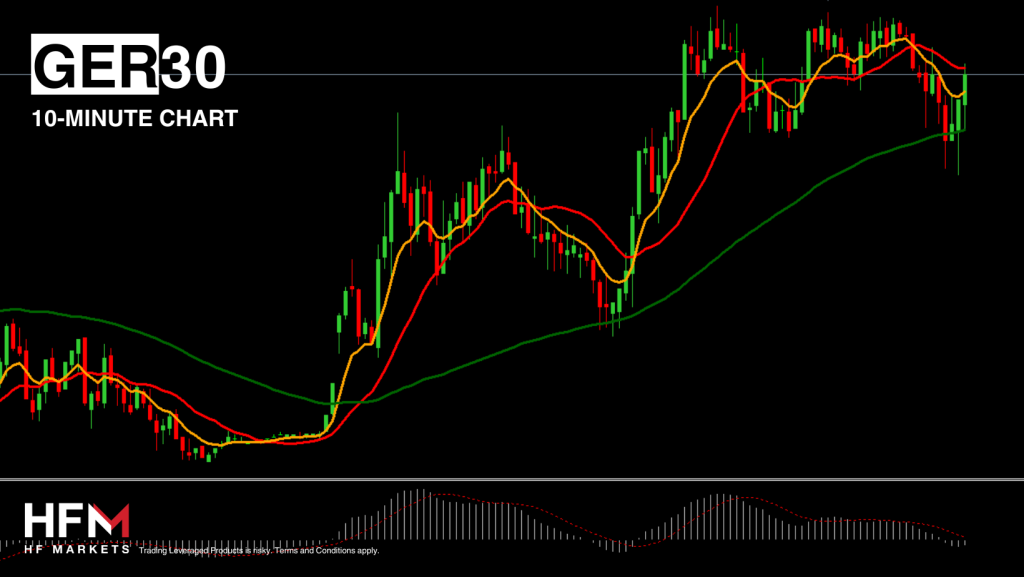

From a technical analysis perspective, the price is trading below the 75-EMA and the 100-Bar SMA, indicating that sellers are controlling the market despite recent impulse waves. The Moving Averages have formed a bearish crossover, and the MACD is below the signal line. If the price falls below 18,210.30, sell signals could potentially intensify. The index has two support levels close to the current price. The first at 18,062.09 and the second at 17,976.12. Indicators point towards a potential decline, but investors should be cautious of these levels. Lastly, technical analysts also note that price action can change as we enter the US Trading Session, and the US PMI is made public.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account