AI Surge Leads US Stock Market; First Solar Shines Bright

In the US stock market, the Electronic Technology sector continues to dominate, boasting year-to-date (YTD) gains of nearly 60%. This impressive performance is primarily driven by the proliferation of artificial intelligence (AI). Notable beneficiaries of this AI rally include chipmakers Nvidia and Micron Technology, as well as chip designer Arm Holdings. Additionally, optimism surrounding potential interest rate cuts by the Fed has further fuelled this sector’s growth. Despite the latest Fed meeting signaling only one rate cut this year and four more expected next year.

First Solar: A Major Beneficiary of the AI Rally

Apart from chipmakers, First Solar, Inc. has also significantly benefited from the AI surge. This solar technology company designs, manufactures, and sells solar modules that convert sunlight into electricity, a crucial component for powering AI data centers. First Solar, Inc. is now the world’s largest thin-film solar module manufacturer, with production facilities in the United States, India, Malaysia, and Vietnam.

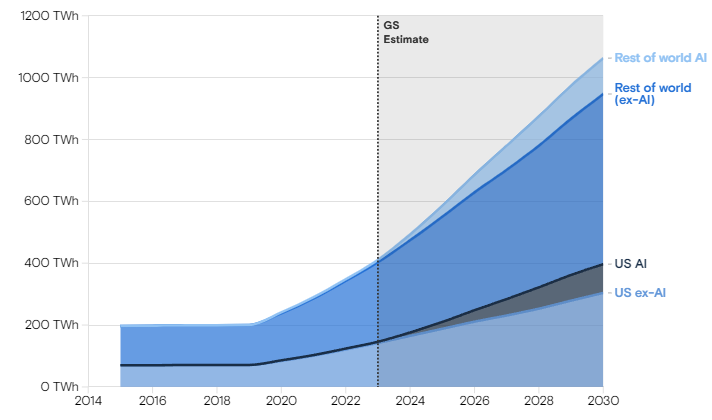

The increasing use of AI is expected to drive a substantial rise in power consumption. According to Goldman Sachs, AI-related data center power consumption is projected to reach 200 terawatt-hours per year between 2023 and 2030. By 2028, AI is anticipated to account for about 19% of data center power demand.

First Solar’s strength lies in its innovative approach to solar energy production. It integrates thin-film Cadmium Telluride (CadTel) photovoltaic (PV) technology, which is generally less costly and offers superior scalability and a higher theoretical efficiency limit. Additionally, recent regulatory shifts away from pricing wars by China’s solar agency have provided a favorable tailwind for First Solar.

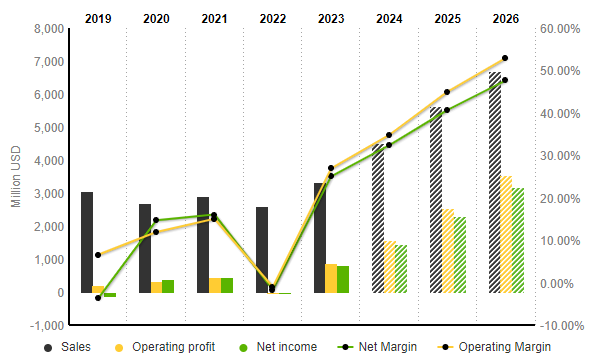

First Solar’s financial performance significantly improved in FY 2023. Sales revenue increased by over 26% year-over-year to $3.32 billion. The company also turned both operating profit and net income from negative to positive, reporting $893 million and $831 million, respectively. Operating margin and net margin stood at 26.90% and 25.03%, compared to -1.04% and -1.69% the previous year. Prospects look promising, with projections by S&P Global Market Intelligence indicating that by 2026, First Solar could reach $6.7 billion in sales revenue and $3.2 billion in net income, with operating and net margins rising to 52.94% and 47.67%, respectively.

Technical Analysis:

#FirstSolar, Weekly

The chart above shows that First Solar’s share price has been in a strong uptrend, breaking the previous ATH of $231.81, now a support level, in mid-May. The stock continued to rise last week, reaching a new ATH of $306.60. The nearest resistance zone to watch is between this point and $301.40 (FE 100.0%). The MACD indicator remains positive, but the stochastic oscillator has formed a dead cross in the overbought zone, suggesting a potential decrease in bullish momentum. A price retrace could test the $231.81 and $235.60 (FE 61.8%) levels, followed by $170 and the dynamic support at the 100-week SMA.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account