VanEck’s Bold Prediction: Ethereum to Hit $22,000 by 2030

The American investment management firm VanEck has released a striking prediction for Ethereum, forecasting its price to surge to $22,000 by 2030.

This projection is driven by Ethereum’s increasing role in digital banking, artificial intelligence (AI), and blockchain technology. According to VanEck’s analysis, Ethereum’s potential market could reach a staggering $15 trillion total addressable market (TAM) by 2030.

This optimistic outlook comes on the heels of the U.S. Securities and Exchange Commission (SEC) approving Spot ETH Exchange Traded Funds (ETFs), which has significantly boosted investor interest. VanEck’s forecast is based on an expected $66 billion in free cash flows for Ethereum by 2030, assuming a 33x price multiple.

Ethereum’s current trading price stands at $3,843, having increased by 0.72% in the last 24 hours. ETF inflows and the upcoming U.S. Non-Farm Payrolls report on June 7 are expected to further influence Ethereum’s price movement.

Ethereum’s Ascendancy in the Digital Economy

Ethereum has firmly established itself as a pivotal player in the digital economy, boasting 20 million monthly active users. Over the past year, the platform has settled $4 trillion in transactions and facilitated $5.5 trillion in stablecoin transfers. Ethereum’s ecosystem currently holds $91.2 billion in stablecoins, $6.7 billion in tokenized off-chain assets, and $308 billion in virtual currency.

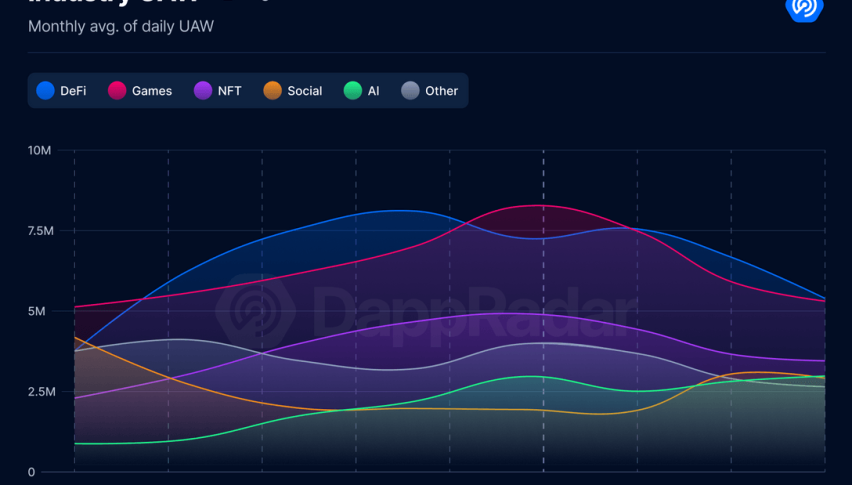

VanEck’s analysis highlights Ethereum’s disruptive potential across various sectors, including finance, banking, marketing, infrastructure, and AI. The firm estimates that by 2030, Ethereum could achieve a 7.5% market penetration in banking, 20% in marketing, 10% in infrastructure, and 5% in AI, contributing to the projected $15 trillion TAM.

Unique Value Proposition and Revenue Growth

VanEck identifies Ethereum’s unique value propositions—such as being termed “Digital Oil,” “Programmable Money,” “Yield Bearing Commodity,” and “Internet Reserve Currency”—as key drivers of its growth potential. Over the last year, Ethereum’s revenue has seen significant growth, totaling $3.4 billion. This revenue is bolstered by ETH buybacks and burns, which have permanently removed 0.4% of the supply over six months, benefiting ETH holders.

Ethereum’s user base and revenue growth outperform traditional web2 applications like Etsy and Roblox. On average, Ethereum users generate $172 in annual revenue, comparable to services like Apple Music and Netflix. This robust economic activity increases demand for ETH, benefiting all holders.

Ethereum’s competitive edge is further enhanced by its lower cost structure. While companies like Apple and Google take around 30% of app income, Ethereum’s take rate is currently at 24% and is expected to drop to 5–10% with the adoption of Layer-2 solutions. This efficiency is likely to attract more businesses and users to the platform.

VanEck also predicts that Ethereum will play a crucial role in AI applications by providing essential infrastructure for AI agents. By 2030, the AI sector could contribute $1.2 billion in revenue to Ethereum holders. With finance expected to dominate Ethereum’s revenue stream, the implementation of Layer-2 solutions will enhance scalability, driving future growth.

Conclusion

VanEck’s prediction of Ethereum reaching $22,000 by 2030 is grounded in the platform’s expanding role in various digital sectors and its impressive economic metrics. The firm’s analysis underscores Ethereum’s potential to revolutionize finance, AI, and beyond, setting the stage for significant growth in the coming years.