Bitcoin Market Braces for Options Expiration, Bullish Outlook Intact

Bitcoin (BTC) navigates potential volatility today as over $2.2 billion in options contracts for both Bitcoin and Ethereum are set to expire. Analysts remain optimistic about Bitcoin’s long-term prospects despite the short-term uncertainty caused by expiring options.

Options Expiration: A Potential Catalyst for Volatility

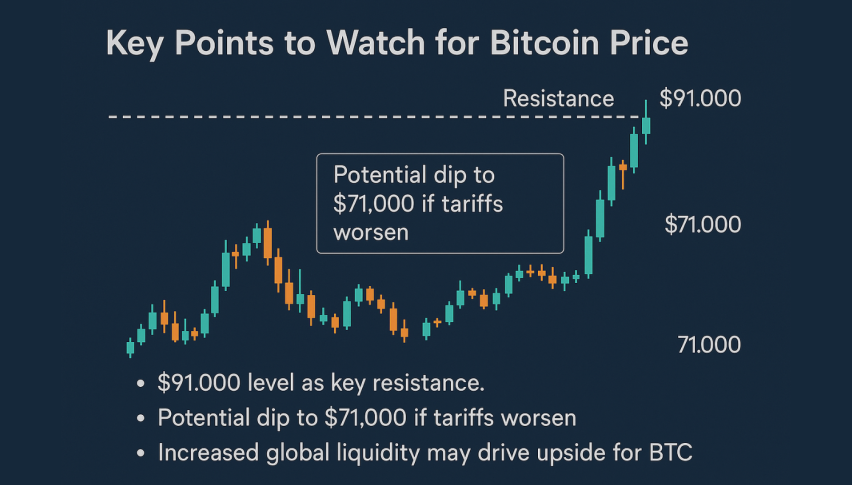

The expiration of roughly $1.24 billion in Bitcoin options contracts could trigger price swings depending on how traders react. Data from Deribit shows a put-to-call ratio of 0.67, indicating a slight prevalence of call options (bullish bets) over put options (bearish bets). Bitcoin’s maximum pain point, the price where the most options contracts expire worthless, sits at $70,000.

Analysts Maintain Bullish Outlook

Despite the options expiration, analysts at Greeks.Live predict positive price action for Bitcoin and Ethereum. They cite the recent interest rate cuts by the Bank of Canada and the European Central Bank, along with rising anticipation for today’s U.S. Non-Farm Payrolls data, as factors fueling optimism.

Bitcoin Buoyed by Record Global Liquidity

Bitcoin’s bullish momentum receives a further boost from record-breaking global liquidity. According to Philip Swift, creator of on-chain data platform LookIntoBitcoin, global liquidity is approaching $100 trillion, a significant factor influencing crypto markets. This aligns with other recent analyses suggesting a potential price increase for Bitcoin.

On-Chain Activity Hints at Institutional Interest

CryptoQuant’s “Weekly Report” highlights a potential surge in institutional investment, mirroring investor behavior observed in 2020 before Bitcoin’s significant price rally. The report reveals large investors adding roughly $1 billion to Bitcoin and increased inflows to U.S. spot Bitcoin ETFs.

Bitcoin Price Pullback: Correction or Opportunity?

Bitcoin recently dipped from a two-month high of $71,713. This correction could present a buying opportunity for some investors. Technical indicators suggest potential support around $69,500.

MicroStrategy Short Sellers Face Waning Confidence

Despite Bitcoin’s recent price correction, short sellers betting against MicroStrategy (MSTR), a Bitcoin intelligence firm, appear to be losing confidence. The short-interest ratio for MSTR stock has significantly decreased, indicating a potential short squeeze.