EURUSD Keeps Holding, Despite the ECB Confirming A June Cut

The EUR to USD rate was on a bullish trend since mid-April and last week's retreat ended with a jump on Friday, despite dovish ECB remarks.

The EUR to USD rate has been on a bullish trend since mid-April and last week’s retreat ended with a jump on Friday, despite dovish ECB remarks. The European Central Bank has made its mind up for a June rate cut, however the Euro has shown remarkable resilience despite everything.

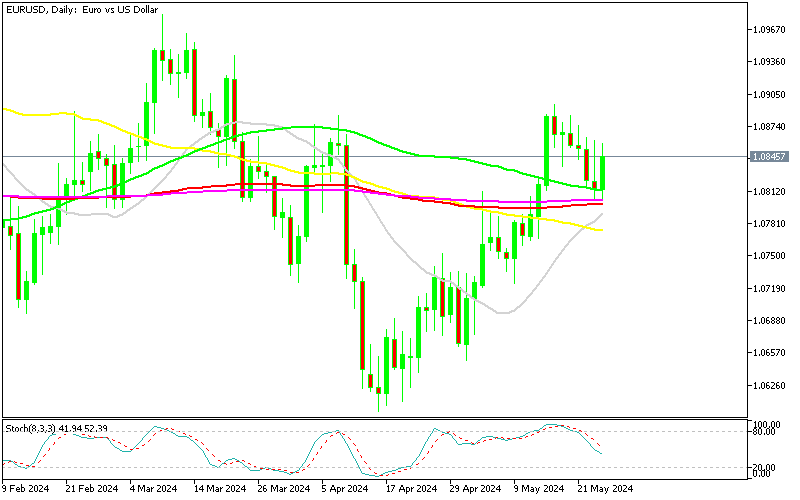

EUR/USD was on a steady bullish trend for several weeks, when it started retreating lower last week. The price fell close to 1.08 but it didn’t quite reach that level, so this zone seems to have turned into support now. The 200 SMA (purple) held as support and on Friday we saw a bounce off that moving average despite the positive US durable goods orders report, so the trend still remains bullish for this forex pair.

EUR/USD Chart Daily – MAs Held As Support

Recent remarks from European Central Bank (ECB) policymakers indicate a growing likelihood of a rate cut in June. Fabio Panetta’s remarks, as a member of the ECB’s Governing Council, provided further confirmation over the weekend, of the widespread consensus among ECB officials regarding the potential for a rate cut in June. His statement underscores the collective sentiment within the central bank regarding the need for additional monetary stimulus to support the Eurozone economy.

The acknowledgment of a “fairly general consensus” among ECB officials regarding the rate cut aligns with recent comments from other policymakers, including Joachim Nagel and Isabel Schnabel, who have also hinted at the likelihood of monetary easing in the upcoming meeting. Panetta’s remarks reinforce the market’s expectations of a rate cut and highlight the ECB’s commitment to addressing economic challenges, particularly concerning inflation dynamics and economic growth prospects in the Eurozone.

ON Friday we had both Joachim Nagel, a known hawk, and Isabel Schnabel, an ECB executive board member, suggest that a rate cut is very probable, although Schnabel emphasized that the final decision will be data-dependent and made at the upcoming Governing Council meeting.

Key Points from ECB Policymakers Nagel and Schnabel

Joachim Nagel:

- Rate Cut Probability: Nagel, traditionally a more hawkish member, conceded that the probability of a June rate cut is increasing.

- German Economy: He noted that the German economy performed better than expected in Q1.

- Wage Developments: While wage growth has been strong, Nagel expects it to flatten out.

Isabel Schnabel:

- Rate Cut Likelihood: Schnabel echoed the sentiment that a June rate cut is likely.

- Data Dependency: She stressed that the decision will be made based on incoming data, specifically if it supports the ECB’s price target sustainably.

- Inflation Persistence: Schnabel highlighted that some inflation elements, particularly in services, remain persistent.

- Caution on Rate Cuts: She advised caution against moving too quickly on rate cuts to avoid potential negative repercussions.

Implications for the ECB Monetary Policy and the Eurozone Economy

Monetary Easing:

- Expected Rate Cut: The remarks from both policymakers suggest a strong leaning towards monetary easing at the June meeting. This would mark a significant shift in the ECB’s policy stance, especially given the hawkish background of figures like Nagel.

- Data-Driven Decision: The emphasis on data indicates that the ECB will closely monitor upcoming economic indicators, particularly inflation and economic activity, before finalizing the rate cut.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account